An Update on My Investing Project

Photo by Natalie Rhea Riggs on Unsplash.

I haven’t done an investing update in a while, but it’s been nearly half a year since I committed a percentage of my freelance income to buying and holding (along with moving my retirement investments to Vanguard and opening up a HSA). I’ve been following the ups and downs of the market on my iPhone Stocks app, but I haven’t really taken the time to put any of that data into context, so here we go:

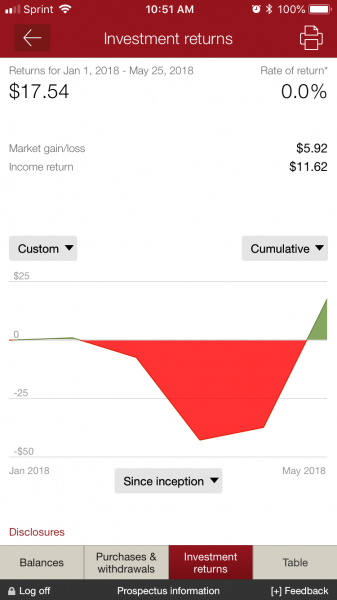

My individual brokerage account has a current balance of $3,336.75. Only $17.54 of that balance comes from investment returns, though — and only $5.92 of that balance comes from market gain/loss. Look, here’s a mildly disappointing visual!

I’m calling this “mildly disappointing” because I still have a little over $3K stockpiled in the account, PUN INTENDED. As far as savings accounts go, well… I was about to say that my individual brokerage account was still outperforming my savings account, but I checked, and I’ve earned $19.26 in interest since the beginning of the year. (Of course, my savings account has twice as much money in it.)

My rollover traditional IRA, which is invested along the same 45 percent domestic stock, 27.5 percent international stock, 27.5 percent bond division as my individual brokerage account (only with Admiral Shares index funds instead of ETFs), has done a little better. My rollover balance was $44,574.70, and my current balance is $45,090.61. I’m not making any new contributions to this account, so that extra $515.90 came from market gain/loss and income returns!

My Roth IRA and my traditional IRA are both invested in lifecycle funds, and I am currently contributing 5 percent of my pretax freelance income to the traditional IRA. Their balances are $6,601.50 and $6,558.30, respectively, and although the Roth gained $46.68, the traditional IRA actually lost $24.62. They’re both invested in the same lifecycle fund, but I transferred the traditional IRA to Vanguard one month after I transferred the Roth IRA. (As much as we like to pretend that market timing doesn’t really have an impact, it totally does.)

My HSA, meanwhile, has a current balance of $288.87, and it’s in that same lifecycle fund. I’ve lost $9.71 to the market, which I am absolutely fine with because a month ago I had more than enough in there to withdraw $869.98 to cover my annual dental appointment, my annual vision appointment, and my new glasses — and that’s the real purpose of the HSA, right? I’d make the “stockpile cash” pun again, except I feel like it wouldn’t get quite as good of a return as it did the first time.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments