Checking In With My Net Worth and Monthly Spending: February 2019

It’s time for another monthly financial check-in! Let’s start with a look at my net worth.

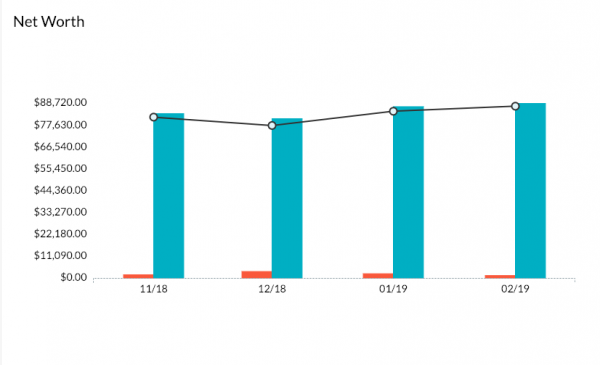

According to YNAB, my total net worth has increased by $5,538.47, or 6.8%, since I started using the budgeting tool in November. (If you want your own YNAB, use this link to get two months free!)

Currently, I have $88,649.83 in assets and $1,384.14 in debts — all credit card debt, but I pay my statement balances in full every month — for a total net worth of $87,265.69.

I owe at least some of that net worth to the stock market’s recent rebound, and the rest comes from the typical combination of a) earning more money, b) spending less than I earn, and c) prioritizing investments.

Which means it’s time to look at exactly how much I spent in January 2019! You might remember that I put myself on a fairly strict YNAB budget this year, and have allocated myself $5,000 per month for all my necessary transactions, including business expenses and taxes. I anticipate earning more than $5,000 each month, which means that any extra earnings will go towards increasing my financial runway — that is, increasing the amount of time that I can live on the money I’ve already earned.

Here’s everything I spent money on in January:

Immediate Obligations

Rent: $650

Electric: $50.82

Water: $86.47 (remember my water bill covers two months of usage)

Internet: $80 (this is usually $40, but I got billed for both January and February this month)

Phone: $22.90

Health insurance: $885.66 (this is usually $442.83, but I got billed for both January and February this month — did anyone else get a bunch of February bills that came in early?)

Renter’s insurance: $18.34

Huel: $139.50

Groceries: $201.45 (I bought February’s groceries at the end of January because I knew the polar vortex would shut a bunch of stuff down, so this represents two months’ worth of grocery spending)

Household goods: $155.05 (see above, also wow this feels like a lot of money)

Beauty: $8.12 (a box of hair dye)

Haircut: $61.63 (I decided to eliminate this expense going forward and am now growing out my pixie cut)

Transportation: $55.87

True Expenses

Cash: $10

Chorale: $147.33 (you might remember that I joined a choir in January, so this is dues, jewelry rental, the fancy music folder they suggested we buy, etc. and will not be a recurring monthly expense)

Investments

HSA: $291.67

Traditional IRA: $500

Brokerage Account: $300 (I’m adjusting my budget to put more in my brokerage account going forward, this is why I’m pulling back on things like haircuts and Hulu)

Subscriptions

YMCA: $35 (best $35 I spend each month)

Hulu: $6.39 (I canceled my Hulu account going forward, since I finished watching Adventure Time in January and didn’t need it anymore)

Patreon: $51.50

Quality of Life

Dining Out: $54.01 (I usually budget $25 for this, but bought an extra restaurant meal in January because I had that really nasty cold and thought tom yum soup would help)

TV: $1.06 (one Amazon rental)

Business Expenses

Simplecast: $12

These expenses total $3,824.77, but the remaining $1,175.23 dollars in my January budget all have jobs and will carry forward in my YNAB budget so that they can be spent spent later in the year. This is how I can save up for larger purchases (you might notice I didn’t spend anything on clothing this month, but am likely to do a big clothing shop this spring) and still hit my “no more than $5K/month” goal. In other words: I can spend February’s $5K plus any of the $5K that didn’t get spent in January, and so on.

Also, I didn’t spend any money on taxes this month — I paid my fourth quarter estimated taxes in December, even though they weren’t due until January 15 — but that also comes out of the remaining $1,175.23.

But that’s how much I spent in January, in case you were curious. (Also, I kinda stole this idea from Lillian Karabaic, so go read her January spending roundup and see how our spending habits compare.)

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments