Refining My 2019 Money Goals

Over the past two weeks I read two personal finance books (both of which I received for review, and both of which will get full reviews soon) that inspired me to get a lot more specific on my 2019 money goals.

As you might remember, my big goals for 2019 were to:

- Increase my financial runway (aka “increasing the number of months I can go without earning any additional income”)

- Earn more money (so I can increase my financial runway)

- Do more of the work I do best

Admirable goals, right? Who wouldn’t want these goals?

But how do I achieve them?

Well.

I initially tried to fulfill “do more of the work I do best” by starting a new blog with daily posts on the creative practice. While this does play to some of my strengths, plus it’s also immensely personally fulfilling, it does not currently fulfill “earn more money” or “increase my financial runway.”

Still, I love it, so I’m going to keep doing it and see where it leads.

I also went after “earning more money” in the traditional sense, and successfully landed a few more online teaching gigs and am likely going to pick up another freelance client, if our current conversations go well. (I didn’t initially include “freelance writing” in the list of “the work I do best,” partially because I was stuck on this idea that teaching and online-community-building were the things I did really really well. But COME ON, NICOLE, of course freelance writing is one of the things you do best, it is how you have made the majority of your income since 2012. It’s like I’m one of those David Foster Wallace fish that forgot what she was swimming in.)

Which brings me to “increasing my financial runway.”

One of the problems with my current YNAB budget was that it didn’t include any room to extend the runway. I was anticipating earning a little over $5,000 a month (pretax) and I was giving a little over 5,000 dollars jobs every month (including the job of paying taxes).

So, after reading these two books — Grant Sabatier’s Financial Freedom: A Proven Path to All the Money You Will Ever Need and Jesse Mecham’s You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want, both of which are highly recommended and will receive full Billfold Book Reviews SOON — I went back to my YNAB and started making some tough choices.

Or, if you’d rather, reprioritizing my money based on my values and goals.

I set my YNAB budget at exactly $5,000 a month. I could move money between categories if I needed to adjust the budget, and I could spend both that month’s $5K as well as any unspent dollars that were budgeted in previous months, but I could not budget more than $5,000 per month.

Since I anticipate earning more than $5,000 a month based on my current projects and new clients, my extra earnings will go towards increasing the financial runway.

How long might it take to increase my runway by one month? Right now I’m predicting that I’ll earn around $6,500 per month on average, which means it would take three and a third months to increase my runway by one month. (The actual increase might take longer/shorter depending on cash flow.) In a year, I could reasonably expect to increase my runway by around three and a half months while increasing my net worth by around $18,000.

My current financial runway is a month-and-a-half, so by the end of 2019 I might be able to go five months without earning any additional income. Or maybe an expense will come up that’s more important than a five-month financial runway, so it’ll get shortened. Or maybe I’ll earn even more money! We’ll see.

I am both excited by this idea and a little dismayed by how long it takes to save large amounts of money, and I also know that some of you might be thinking “not all of us can just hustle an extra $1,500 a month out of the ground, you lucky privileged duck,” which is exactly how I felt when I read Grant Sabatier’s book (there’s a point where he suggests figuring out how to make an extra $50 every day, at which I actually laughed).

And yes, no doubt privilege and luck and experience all played a part in it (privilege likely played a larger part at the beginning of my freelance career; experience plays a larger part now; luck is constantly required). So… I don’t know. I do believe hustling can help you figure out ways to earn more money, and sometimes it isn’t so much “hustling” as it is “building a career and then getting invited to take on additional work” (which is how I got one of these gigs) but I don’t believe that you can make an extra $50 per day just by setting your mind to it.

It’s tricky. Everything about money is always tricky.

Also, I’d better show you the budget.

Immediate Obligations

Rent: $650

Electric: $60

Water: $45 (updated, see the comments)

Internet: $40

Phone: $23.22

Health Insurance: $442.83

Renter’s Insurance: $18.34

Huel: $139.50

Groceries: $110

Tea: $15

Household goods: $30

Beauty: $15

Haircut: $61.63

Transportation: $60

Fees: $8.25 (the annual fee on my new travel credit card, prorated)

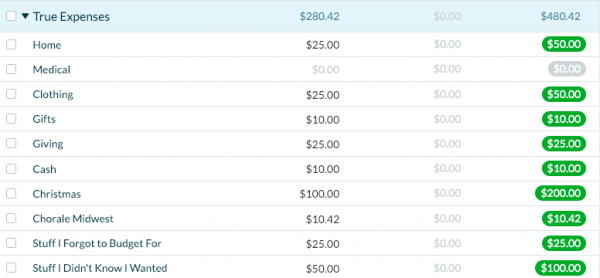

True Expenses

Home: $42.50

Medical: $0 (medical expenses are covered through HSA withdrawals)

Clothing: $42.50

Gifts: $10

Giving: $25

Cash: $10

Christmas: $100 (I’m planning on using travel rewards to cover some of these costs)

Chorale Midwest: $10.42 (annual dues, prorated)

Stuff I Forgot to Budget For: $25

Stuff I Didn’t Know I Wanted: $50

Investments

HSA: $291.67 (to hit the maximum contribution by the end of 2019)

IRA: $500 (ditto)

Brokerage: $300

Subscriptions

YMCA: $35

Amazon Prime: $12

Patreon: $25

YNAB: $7

Tunecore: $6.25

Quality of Life

Vacation: $200 (if big expenses come up that aren’t in the budget and can’t be covered by “stuff I forgot to budget for,” like a new concert dress for the choir I just joined, I’ll either have to pull from vacation or the money I put in my brokerage account, CHOICES CHOICES)

Dining Out: $25

Books: $5

TV: $2 (to rent movies on Amazon, essentially)

Performances: $10 (one performance every two/three months)

Massage: $25 (one massage every three months)

Fun Money: $6.06

Business Expenses

Federal Taxes: $1,000 (yes, taxes will go up as my income goes up, but I’m going to take advantage of the 90 percent rule with 2019’s estimated taxes, i.e. if I pay 90 percent of my tax burden in estimated taxes I won’t get charged a penalty; if I end up paying additional taxes instead of dumping the money into a SEP IRA, I can decrease the financial runway or withdraw from the brokerage account)

State Taxes: $250

Simplecast: $12

WordPress: $25.50

Dreamhost: $1.50 (all these small numbers represent prorated annual subscription fees)

Washington Post: $8.25

Business Travel: $90 (Billfold business travel comes out of the Billfold budget)

Publishing: $100 (this is for the novel I plan to write this year)

Computer/phone replacement: $28.58 (sinking fund)

If you’d like your own YNAB so you can create budgets like this and build your financial runway, Billfold readers can get the first two months of YNAB free.

Otherwise, feel free to share your own budgeting goals, and the tough choices you might be making as you balance various goals and priorities.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments