My 2019 Resolutions (and Goals)

My 2019 resolution is the same as my 2018 resolution: to close the bathroom door every time I use the toilet. (The fact that I had to re-make this resolution shows you how successful it was.)

Beyond that, well… I watched this video where John Green explains the difference between resolutions and goals, and most of my hopes for 2019 are, in fact, goals.

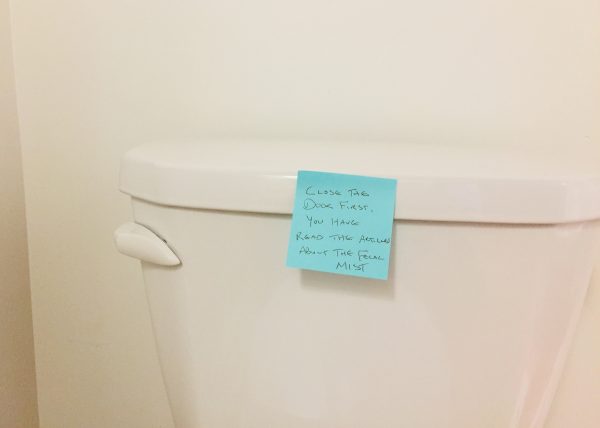

The tl;dw: resolutions tend to be lofty ideals with no action plans; goals are SMART and backed up by measurable benchmarks. I could turn my toilet resolution into a goal if I put a sticky note on my toilet that read “CLOSE THE DOOR FIRST, YOU HAVE READ THE ARTICLES ABOUT THE FECAL MIST” and then, like, kept track of the number of times I did what the sticky note told me, which… well, I just did the sticky note part, but I doubt I’m going to prioritize measuring-and-managing my bathroom door.

Here’s what I want to measure and manage instead.

Increasing my financial runway

Remember how I told you that I had set up my 2019 YNAB budget to reflect my anticipated earnings? In 2018 I earned an average of $5,257 (pretax) every month; in 2019, my YNAB budget gives 5,080 dollars jobs every month. Some dollars get spent right away on rent and food; others get set aside for upcoming expenses like birthdays and Christmas. Since my total budget is slightly less than I anticipate earning, it should all work out. RIGHT?

Well, it might work out, but it won’t increase my financial runway. I don’t know why it took me so long to realize that if I earn ~$5K each month and budget ~$5K each month, I won’t actually grow my income. Nor will I give myself that nice long runway (or thick financial buffer, if you prefer to think of it that way) to protect against loss of income in the future. I won’t even have the choice of saying “I’d like to take five months of financial buffer and turn it into a down payment/round-the-world trip/other expensive thing” because this path will not lead me to five months of financial buffer.

So I have to either spend less or earn more. That’s just Personal Finance 101. I’ve chosen “earn more” because it’s more interesting and might open up additional opportunities for me in the future.

I have a few ideas on how to earn more, but I haven’t put them all into practice yet. That’ll be a First Quarter 2019 project.

Setting up a YNAB category for “stuff I don’t know I want yet”

When I was doing my YearCompass, it struck me that many of the best parts of my year involved buying stuff (I know we’re supposed to not buy stuff or whatever, but I’ll be the first to say that buying stuff can be GREAT), and the stuff that made me the happiest, like my piano, hadn’t initially been part of the budget.

I was able to buy the piano because I had savings, but when you use YNAB, you’re supposed to give all of your savings jobs so you can see how big your financial runway/buffer actually is.

Of course, now that all of my saved-up dollars have jobs, there’s no longer any room in the budget for unplanned-but-delightful purchases — which means I need a new YNAB category called “stuff I don’t know I want yet.” (It’ll pair nicely with “stuff I forgot to budget for.”)

I also need to figure out how much money to add to this category, and which categories I’ll need to subtract money from to compensate. This might be a First Month 2019 project.

Expanding (and consolidating?) my professional work

This is me trying not to write the word brand. But I have been thinking about the work I currently do and the work I might like to be doing in the future, and — gaah, this is so hard to articulate — I want to do more of the work that I do best.

In 2018, I wanted to do more teaching, and I ended up teaching four in-person classes and one online course. I’m a good teacher and I enjoy doing it, but there isn’t a huge amount of money in it and it doesn’t scale.

In 2018, I also took over The Billfold and built its financial runway. I’m good at that, and I’m also good at community-building and helping people have honest conversations about things.

If you combine teaching, making financially-stable projects, community-building, and honest conversations, you get:

Starting another blog

I spent New Year’s Day remaking Nicole Dieker Dot Com. I’ll quote myself:

So it’s twenty-ought-nineteen, in the sense that a lot of us are feeling like we ought to be in a different place right now (we said “happy new year,” and now we have to make it happen), and I’ve started to feel like this ought to be a different kind of blog.

Actually, I thought about creating a whole new blog. Something to pair with The Billfold, but instead of having honest conversations about money, we’d have honest conversations about The Work. By which I mean both the work we do for money and the creative work we’d like to do (and/or are currently doing) with an emphasis on the creative end of things.

Also, how to turn that creative work into work we do for money, because you can’t have a conversation with me for too long before personal finance gets involved.

Unfortunately, The Work was already taken. So was The Candle (because we burn it at both ends?) and The Breath (because it inspires us?) and all of the other catchy “the noun” titles I thought of.

I came very close to starting a blog called The Creative Practice Club, because Dot Club is now a thing, but that sounded like way too corporate. (Although I do, in fact, want this to be a creative practice club. It is a very accurate description of what I hope this space becomes.)

But — because you can’t have a conversation with me for too long before personal finance gets involved — when I looked into how much it might cost to start a new for-real professional blog, with the WordPress Dot Orgs and the fancy Jetpacks and the rest, I asked myself “do I really need to pay $300 to build something brand-new, when I have a perfectly good Nicole Dieker Dot Com already set up and in the budget?”

So here we are.

This is the logical result of “doing more of the work that I do best” and “finding ways to earn more money,” but it was primarily an emotional decision. I am figuring out the next phase of my professional and creative life — am I going to write another novel, where would I like my career to go in the next five years, how can I spend more time doing the work I want to do while also doing the work that makes the $$$ — and I want to make a space for all of us to have conversations about all of that, both in terms of what I want from my work and what you want from yours.

There’ll be one post per weekday, if you want to join me. Today’s post is about that Man Repeller article with Meghan Nesmith and Logan Sachon. It’s also about the difference between the work we want to do and the life we think we’ll have if we do it.

Reconfiguring my time

If you scroll back up and watch that John Green video, you’ll hear him explain that goals require tradeoffs:

Like, for instance, this year I would like to spend more time with my family, which is a nice resolution and seems doable, but the problem is that it will necessarily require me to do less of other things. And that will disappoint people who are involved with, or benefit from, those other things.

Hours are like dollars; you give them certain jobs, and if you overspend in one category, you have to reduce your spending in another category (especially because, unlike dollars, you can’t go out and earn more hours to compensate).

I’ve used what I learned from that Daily Spreadsheet I created last November (the one where I track my sleep, what I eat, when I exercise, whether I play my piano, etc.) to reconfigure my time and give me a little more room for a new blog and a potential new book — I won’t go into the details because this post is long enough, but I completely redid my morning and evening routines — but I’m aware that making the choice to start something new also means spending less time doing something else.

That’s one of the reasons why sticking to New Year’s Resolutions is so hard; saying yes to what you want means saying no to something (or someone).

But that’s just Personal Finance 101.

I’ll share The Billfold’s 2019 goals later this month, when I do my monthly Billfold LLC report. You can probably guess a few of them already, but it’ll be good to write them down.

Also, I successfully closed the door when I got up to use the toilet in the middle of drafting this piece. Maybe resolutions do work after all.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments