Checking In With My Savings Plan: November 2018 Edition

In November I received $4,531.81 in freelance income and $15.77 in book royalties, or $4,547.58 total.

I put $412.97 into my HSA, $1,433.74 into my IRA, and $260.60 into both my brokerage and savings accounts. I also set aside $1,174 for federal taxes and $955 for state taxes.

If you’re looking at all of those numbers and thinking “wait, that adds up to $4,496.91, how did you cover basic living expenses,” well… now that I’m using YNAB, I’m thinking about my savings/investment/tax accounts differently. It’s not so much about keeping my budget within my anticipated monthly earnings as it is figuring out what my real expenses are and how to allocate my income appropriately.

Is that confusing? Let me rephrase.

Let’s say I told myself I wanted to put $5,500 in my IRA for 2018 (which is, in fact, what I told myself). Pre-YNAB, I was putting a percentage of each freelance paycheck into my IRA, under the theory that this would force me to “pay myself first” while also ensuring I had money left over for all of my daily necessities. But I didn’t want to put more than that designated percentage in my IRA, because what if I needed that money for something else? In the future?

With YNAB, I can assign money to those anticipated future expenses right now. I’m already saving for the laptop I’ll need in (assumedly) three years. I’m putting money towards two vacations, one business trip, and 2019 holiday travel. I’m saving for the clothes I’ll buy in the spring, and I’ve got money set aside for “stuff I forgot to budget for.”

Which means I can look at the way my money is allocated, check in on my financial runway (which shows me how many months I can maintain this allocation with my current income and savings), and tell myself to go ahead and max out my HSA and IRA now, and while I’m at it, pay the remainder of my 2018 estimated taxes. Why not? The money is already there, and I’m going to have to pay it someday, so let’s just DO IT.

If I have an unexpected medical emergency, I have cash in my HSA. If I have some other kind of emergency or unexpected financial need, I’ll do like many of us do and cancel or cut back on a vacation, spend less on clothes, temporarily stop saving for the laptop, etc. etc. etc.

I also thought ahead and made sure that my total monthly allocations did not exceed $5,000 (my average pretax monthly income). If I can keep the monthly budget under $5K, I won’t find myself spending more than I’m earning — and if my average freelance income drops, I can adjust.

Anyway. I know I’ve been going on and on about how YNAB is amazing, and that’s not just because Billfolders can get two months of YNAB for free if they use this signup link. (Oh hey, look how I casually dropped that in there.) YNAB has changed the way I look at my savings accounts, and it’s going to change the way I save in 2019. Instead of doing percentages, I’ve tallied up the amount I want to put into my IRA/HSA/brokerage accounts for the entire year, divided it by 12, and dropped that number into my YNAB budget. I’m also going to be the person who uses TaxAct to figure out her actual 2018 taxes on, like, January 2, and then I’ll divide that number by 12 and drop it into YNAB as well. (I have a placeholder number in there right now, based on my estimated 2018 taxes, but getting the actual number will help me be a little more accurate.)

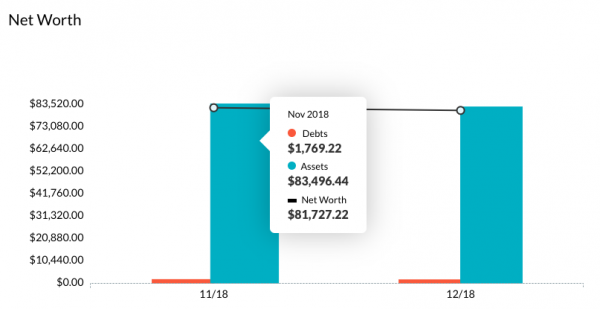

Now that I’ve explained all of that, let’s take a look at my November net worth:

“Debts” represents the outstanding balance on my credit card. I pay the statement balance every month in full.

Last month’s net worth was $80,464.68, so it looks like I added another $1,262.54. I won’t hit six figures by the end of 2018, but I’ll keep working towards that goal.

Photo by Michał Grosicki on Unsplash.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments