Checking In With My Savings Plan: October 2018 Edition

In October I received $7,174.50 in freelance income and $162.44 in book royalties, or $7,336.94 total.

Here’s how I divided up the cash:

- $366.85 went to my HSA

- $366.85 went to my traditional IRA

- $1,027.04 went to federal taxes

- $256.76 went to state taxes

- $440.22 went to my individual brokerage account

- $440.22 went to savings, plus the extra $748.70 I added at the end of the month because my checking account balance turned out to be $3,748.70 (and I only needed a $3K buffer)

- That left $3,690.32 for overhead, business, and personal expenses

I also spent about an hour this morning setting up my YNAB account for You November a Budget. Although most of YNAB is really easy to figure out, I still have a lot of questions, like “how do I prorate my Amazon Prime membership over the next year” and “how do I even do estimated taxes with this system” — so I gotta spend some more time with the YNAB Help Guide at some point.

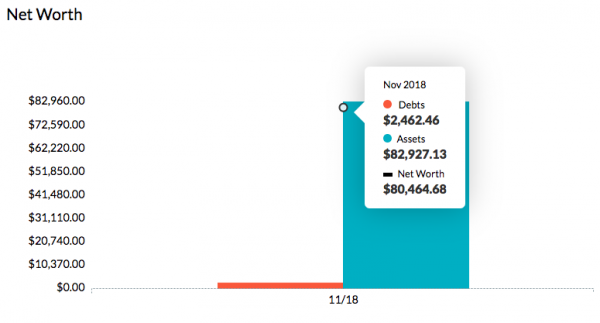

However, I do have the one piece of information I wanted to share with you today, and that’s my updated net worth, YNAB-style:

Those debts are my credit card bills that’ll get paid next week (since I run nearly all of my spending through credit cards to get THE POINTS).

It looks like my net worth has dropped a lot since the beginning of October — I went from $86,232 on Mint to $80,465 on YNAB — and I was all WAIT THAT IS NOT POSSIBLE until I went back into Mint and realized it had been counting one of my investing accounts twice. Because WHO KNOWS WHY.

But fine, we can start over from here. My current net worth is $80,465, and I will be very very unlikely to hit six figures by the end of 2018, but at least I have a more accurate number to work from.

Also, I am very excited to learn more about YNAB and start setting some long-term financial goals — and updating the way I structure this monthly column to reflect them.

Photo by Michał Grosicki on Unsplash.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments