Checking In With My Savings Plan: August 2018 Edition

Photo by Michał Grosicki on Unsplash.

In August I received $6,016.19 in freelance income and $102.54 in book royalties, or $6,118.73 total.

Here’s how I divided up the cash:

- $305.94 went to my HSA

- $305.94 went to my traditional IRA

- $780.90 went to federal taxes

- $195.22 went to state taxes

- $367.12 went to my individual brokerage account

- $367.12 went to savings

- That left $3,796.49 for overhead, business, and personal expenses

I ended the month well over my $3K checking account buffer (you might remember that I checked in at $4,318.63) and I’m pretty sure I’ll be able to maintain that buffer this month as well. I’m currently in the middle of a few great freelance gigs and have both higher-than-usual earnings and better-than-usual cash flow.

In addition to the piano, a bill that’s currently on my credit card and will be paid in full on Monday, I also made another large purchase at the very end of August: a new MacBook Air, which cost $1,495.86 including a three-year AppleCare subscription. (AppleCare turned out to be very useful when my current MacBook Air’s battery died — which, believe it or not, happened two years ago.)

I bought the new MacBook Air because my five-year-old MacBook Air was starting to overheat, and instead of doing the whole “balance it on four water bottle lids so it can vent and try to make it last for another three months” thing, I told myself that this was the primary tool I used to run my business and I needed a tool that wasn’t constantly whirring or crashing or smelling like smoke. Then I put a new laptop on the business credit card. (The freelancing business card, not The Billfold LLC card — although I could arguably have split it between both. I’ll have to talk to my CPAs about how to track it, tax-deduction-wise.)

So I’ll see how this month’s income/cashflow goes, and then decide whether to pay that credit card bill off in full or pay it off in two or three installments. Business credit card interest, after all, counts as a tax-deductible business expense.

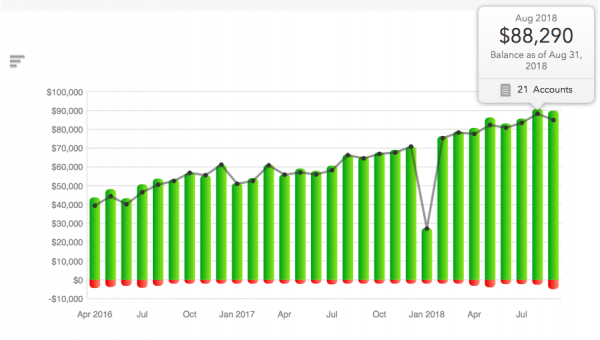

Let’s see how my net worth changed this month:

At the end of July, my net worth was $83,417; at the end of August, it had grown to $88,290, and that’s after you subtract the money currently on my credit cards. I’ll pay around $2K in estimated taxes this month, but even when you pull that money out I’m still on an upward trend and very likely to hit my goal of having a six-figure net worth by the end of the year. (I’m still not including The Billfold LLC’s income or total worth in these calculations; this is just money in my personal bank and investment/retirement accounts.)

I wonder how long it would take me to get to a $300,000 portfolio.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments