Checking In With My Savings Plan: May 2018 Edition

Photo by Michał Grosicki on Unsplash.

In May I received $4,421.57 in freelance income and $151.22 in book royalties, or $4,578.79 total.

Here’s how I divided up the cash:

- $228.94 went to my HSA

- $228.94 went to my traditional IRA

- $499.87 went to federal taxes

- $124.97 went to state taxes

- $274.73 went to my individual brokerage account

- $274.73 went to savings

- That left $2,946.62 for overhead, business, and personal expenses

I was expecting to get a little more cash in May than I actually received, but whatever I don’t get in May I’ll get in June, so it’ll all work out.

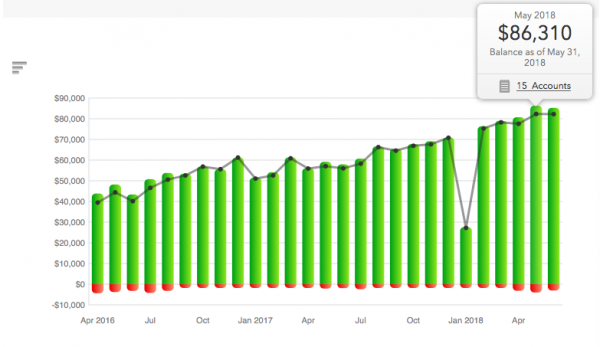

Now let’s look at the more interesting number: how my net worth has grown in the past month, and whether I’ll hit $100K by the end of the year.

Mint says my net worth increased by $5,560 between April and May, and even though I lost $1,030 of net worth in the past five days thanks to all those rent, health insurance, and credit card payments, I’m still up by $4K somehow. I only put $1,474.95 into my savings/taxes/investment accounts this month, and we already know that I haven’t seen a lot of market growth on my investment accounts, so where did that extra $2,500 come from? I bet it’s the $2,518.62 in my checking account that’s earmarked for a mid-month credit card payment. (Mint shows you your debts — they’re the red marks at the bottom of the graph — but doesn’t subtract them from your net worth.)

[Editor’s note: As Billfolder cryptolect noted, Mint does show you your net worth minus debts… if you hover over the tiny black dot on your net worth graph.]

But even if my actual net worth only increased by $1,500 between April and May, it’s still… wait for it… worth it.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments