How Did My Net Worth Go Up by Nearly $7,000 in One Month?

So last month I dug out the old net worth spreadsheet I kept from 2010–2012 (because my love affair with personal finance goes way back, I should probably buy it pottery or something), and I noted that my net worth, as of July 12, was $54,695.64.

Right now, Mint says my net worth is $61,404.55.

How did it go up by $6,708.91 in less than a month?

Let’s look at what I wrote back in July:

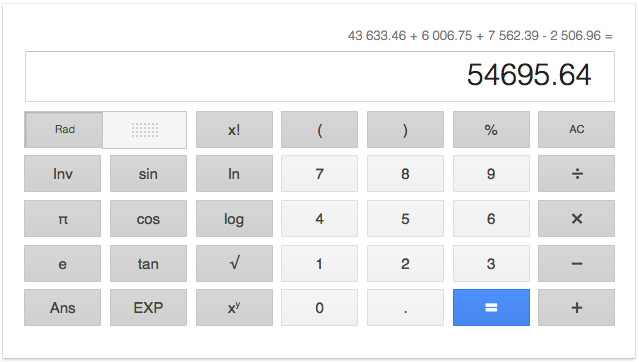

My current net worth, according to Mint, is $54,695.64. This number represents:

$43,633.46 in my TIAA 403(b)

$6,006.75 in my Roth IRA

$7,562.39 in my cash accounts, $924.66 of which technically belongs to my next estimated tax payment

Minus the $2,506.96 on my Chase Ink business credit card that I’m going to pay off within the next week

Here, I’ll do the math:

And here are my current numbers:

My 403(b) has gone up by $803.89, to $44,437.35.

My Roth IRA has gone up by $145.11, to $6,151.86.

My cash accounts have gone up by $5,759.91, to $10,815.34. (Remember that I had to subtract $2,506.96 from my cash accounts in July, to account for my unpaid debt, so the increase was actually from $5,055.43 to $10,815.34. Also, $2,775.61 of that cash belongs to taxes.)

That does in fact add up to a $6,708.91 net worth increase. In a month when I earned $7,400 in freelance checks and paid off $2,506.96 in debt.

The numbers make sense, but it’s hard to fathom them. I guess when you automatically save 15 percent of your income and put 25 percent of your income aside for taxes, your net worth can grow faster than you realize.

Of course, next month I’ll have to pay a few thousand dollars in estimated taxes, which means my net worth will drop again.

But still. I feel surprisingly incentivized to save even more.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments