Checking In With My Savings Plan: July 2018 Edition

Photo by Michał Grosicki on Unsplash.

In July I received $4,528.17 in freelance income and $207.22 in book royalties, or $4,735.39 total.

Here’s how I divided up the cash:

- $236.77 went to my HSA

- $236.77 went to my traditional IRA

- $527.74 went to federal taxes

- $131.93 went to state taxes

- $284.12 went to my individual brokerage account

- $284.12 went to savings

- That left $3,033.93 for overhead, business, and personal expenses

I was able to stick to my “no more than $400 in unallocated discretionary expenses” budget (I spent $389.52, and that includes the full $100 Days of Summer YMCA membership), but I still ended the month with a lower checking account balance than I had hoped for. Yes, the numbers in my summer budget indicate that I won’t completely refill my $3K checking account balance until the end of September, and yes, I thought I’d get two checks in July that won’t actually arrive until August, but I’m still a little disappointed that my end-of-month checking account balance was only $2,387.88.

(This is where I feel a little uncomfortable telling you that I feel disappointed about a checking account balance that, many people, including Past!Nicole, would be thrilled to have. But, as I mentioned in yesterday’s Billfold LLC post, I’m at a different place financially now — and I know it’s like lifestyle creep for bank accounts, but I still want my one-month checking account buffer.)

I’m also a little disappointed that, thanks to August’s “unusual expenses,” I’m only going to have $61 in unallocated cash to spend this month if I want to stick to my budget and hit my goals. All of my big subscriptions renew in August, including Amazon Prime, and since I didn’t allocate them as part of my summer budget they have to come out of this month’s unallocated $400.

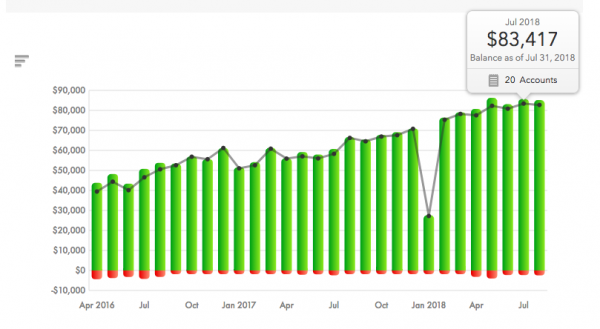

On the plus side, I more than recovered from last month’s drop in net worth. At the end of May, my total net worth was $82,294; at the end of June, it dropped to $80,845 (thanks, stock market!); at the end of July, I was at $83,417.

I have to do some business bank account things first, but I’m curious whether I should start counting The Billfold LLC as part of my net worth. You all suggested it, a few months ago, and I said it was too complicated — but now that I’m the sole business owner, it’s somewhat less complicated. I mean, I still need a clear division between LLC assets and personal assets for IRS purposes, and if I showed you what was in The Billfold LLC’s accounts right now I’d have to clarify it with “but most of that money is already allocated towards taxes and upcoming expenses, we don’t really have $10K just sitting around!”

Still, my small business is technically part of my net worth now (right?) so I should figure out how to track it.

For next month.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments