How to Handle Holiday Gatherings When You’ve Been Laid Off

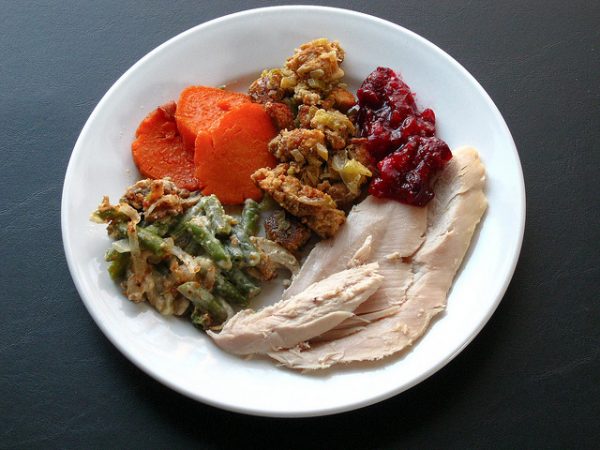

Photo credit: Steve Johnson, CC BY 2.0.

When I found out the week before Thanksgiving that it was finally my turn to be laid off from my company, I had three thoughts:

- How am I going to afford health insurance without a job?

- How do I even find a job after not trying in a decade, and when most of my “network” has been laid off with me?

- Aren’t Thanksgiving travel and family dynamics difficult enough without having to tell everyone I’m unemployed?

Since the holidays are a time to be irrational, I put off resume-writing and application-submitting and instead fixated on the last bullet point. During the eight-hour drive to my family’s hometown I went over all the potential scenarios and scripted responses to each one, with a few jokes ready to go. For the most part, these responses worked.

My aunts and uncles were reassuring and seemed to believe me when I said this was a good thing in the long run. That I knew it would take months to find another job but had no regrets about staying as long as I did. That the flexibility and benefits that allowed me to help out with their kids and my grandparents were great, but there was no opportunity for advancement while working remotely and I was starting to feel like a hermit. (The last part is a lie—I’m not ambitious, loved not having a commute, and worry how I’d manage in an office job the next time I get sick).

Only one cousin from the hyper-competitive side of my family showed up, and it was the nice one who never compared SAT scores or sports trophies when we were kids. We’ve never been close, or ever really talked except for holidays, but she confessed while we washed dishes that her last employer had fired her. Starting fresh at a new job she liked really was the best thing to happen in her career. Honesty and encouragement from this branch of the family tree instead of smug condescension… did not see that coming. We’re maybe friends now? We’ve at least proved we can spend a day together without anyone crying or yelling, unlike our mothers.

There was never a scenario in which my grandmother wouldn’t be anxious and worried, no matter what I said, but at least I tried. She reminded me that I can look for jobs on the internet now, and told me to make sure I get a job with a pension like my grandfather did. So that’s helpful.

What I didn’t expect or prepare for was the way these conversations—however upbeat—made it impossible for me to ignore my new financial reality. Suddenly every decision even vaguely related to money made me freak the fuck out.

I’ve always been frugal, because when you have a chronic illness you never know what your medical costs will be from year to year—you just know there will be a lot of them. My income was finally at a point, though, where I could buy my grandmother a bag of groceries or give my littlest cousins the toy they were asking for without worrying about my credit card statement at the end of the month. I could support my favorite writers by purchasing their latest book (rather than wait until it was available at the library), and when my family split the lunch check I could pay my share like one of the grownups.

This year I went to my family’s Thanksgiving gathering not knowing how many months it might take to find a job that covers the mortgage and health insurance, which means I obsessed over every little expense.

I did buy my grandmother groceries, but I didn’t buy my cousins any toys (and I didn’t buy myself any books). I let my parents pay for lunch but did not accept my aunt’s offer of leftovers from Thanksgiving dinner (she’s not a great cook, so better to not risk the additional cost of food poisoning). I left a tip for the hotel housekeeper when I checked out—there aren’t enough couches for all of us to sleep on, so our family gatherings involve hotels—but used the “Do Not Disturb” sign to avoid housekeeping on the majority of the stay so I could keep the tip small. I took not only the complimentary soap and shampoo, but also the little packets of coffee from the hotel room. This is when I really started worrying about my state of mind and the random budget decisions I was making. “Decisions” is maybe the wrong word for “choices stumbled into through increasing panic,” especially since I’d already determined it was terrible coffee.

It really hit home when we talked about this year’s Christmas gift exchange. While the kids get presents, the grownups make donations to each other’s favorite charities. As the eldest of the youngest generation, I proudly declared myself part of this charity group years ago. This year my relatives asked me what items were on my Christmas list instead of which charity I’ve selected. Not sure what to do about that. On the one hand, my dog would probably appreciate an uninterrupted supply of insulin, and gift cards would be useful. On the other hand, I still have my pride and requesting donations to the local food bank seems more in the spirit of the holiday. So I’ll remain a grown-up and see how far my credit cards get me during this job search. At least I have some complimentary coffee and shampoo to help defray the costs!

Being a grownup also means facing facts and getting serious about this job search after giving myself two weeks “off” to regroup. I went through my denial stage and had my little nervous breakdown about hotel coffee and Grandma’s groceries, and now it is time to get to work. I’ll try finding want ads on that new “internet” thing Grandma mentioned. If financial disaster weren’t motivation enough, I need to make some progress so I have something to tell my family over Christmas dinner.

Anonymous is happy to spill her financial guts on the internet, but would rather her family and potential employers not know about it. She will celebrate Christmas as a grownup, but may have a long wish list for her Easter basket in the spring.

This piece is part of The Billfold’s Holidays and Money series.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments