Talking to Adventure Cartoonist Lucy Bellwood About Income Tracking

Photo credit: Lucy Bellwood, as shared on her Patreon. Used with permission.

I met Lucy Bellwood last year at Alaska Robotics’ Mini-Con and Comics Camp in Juneau, although I’d been a fan of her work long before that. Much of her art is based around the history of tall ships—think whaling ships, or pirate ships—but she’s also drawn comics about social dance, the Grand Canyon, and more.

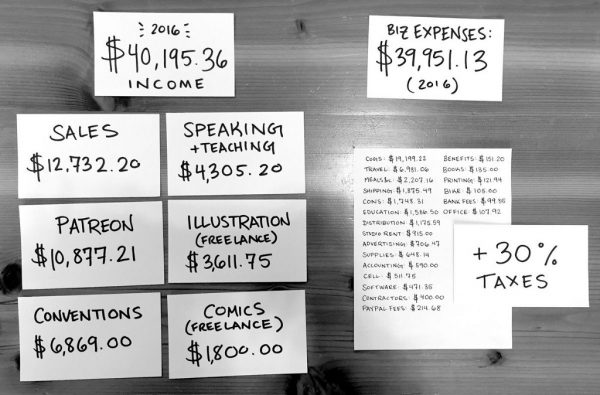

When I began supporting Bellwood’s Patreon, I noticed that she was both publicly sharing her income online and creating these visually compelling representations of her income and expenses, as shown above.

So I asked her if she’d be interested in talking about income tracking and freelancing for The Billfold, and the following is a lightly edited version of our conversation.

ND: How long have you been publicly tracking your income, and what prompted you to start?

LB: This is actually the first year I’ve released all my numbers publicly online. I try to be forthcoming about my financial circumstances when, say, I’m talking to students or aspiring creators, but I’d never actually been able to sit down and list every expense in an organized way. I think a lot of that came from worrying that I needed to have a bulletproof system of organization before I felt comfortable sharing numbers. I worried that people would tell me I was obviously doing it wrong and that there were glaring errors that I hadn’t noticed. But after five years of using a tracking program and keeping tabs on how things change year-to-year and working with an accountant, I realized that I’ve got a pretty decent notion of how things look, and that can be helpful to tons of people.

I’ve been thinking a lot about financial transparency for the last couple years, and the talk I gave in 2016 [at XOXO Festival] that kicked it all off wasn’t long enough for me to go into hard numbers. Doing a post with all the data felt like a really natural extension of that impulse.

My first recollection of tracking money was actually way back when I got a tiny accounting book from my mum for keeping tabs on saving my pocket money. I got really hooked on entering income and spending figures week to week.

I had a bank passbook as a child (remember bank passbooks?) and I also had a piggy bank, and I remember there being this disconnect between money in the piggy bank which I could spend — although it was only ever a handful of quarters so I couldn’t buy much — and money in the bank, which just sat there waiting for the future.

Did you have more spendable income when you were young? Were you buying more things than the occasional Laffy Taffy at the community pool?

My parents (also both freelance creatives who hadn’t been the best with money and wanted to give me a leg up) gave me a weekly allowance of $2, but also a 10 percent weekly interest rate on everything I saved in this little red metal safe. (I have very vivid memories of that safe.)

So I actually wasn’t spending a lot of money on things when I was young — I got far more obsessed with saving up. Eventually they had to call it quits on the weekly interest because I was saving a lot and over time, as you can imagine, 10 percent a week really adds up. I felt deeply insulted when I found out that actual, real-world interest rates in banks were more like 2 percent annually.

Mostly I took those savings and was able to spend them on travel opportunities when I got older. I financed my own high school study abroad session in Greece, and took the rest with me for my gap year before college.

It was really valuable to me to have that kind of independence.

That is amazing. I love it, and I love that your parents eventually figured out that 10 percent interest every week was too high!

Haha, I think they didn’t expect me to get so into saving.

I remember going to the bank with my mum as a I kid and asking how much we had in our account. I think she said “$2,000” and I flipped out because I thought it was like Monopoly — you get all the money you get for a lifetime at the start and then have to meter it out over time.

And she explained that as freelancers there’s always money coming in and going out in bits and bobs, and that it works out all right in the end.

Which calmed me down at the time, but I think about that conversation a lot.

I absolutely agree with you on the bits and bobs thing, and I’m still hoping it’ll work out all right in the end (it has so far).

Does tracking your income make you more or less anxious about your finances? In my case it… depends on the day.

Haha, boy that’s real.

It actually makes me feel way more secure than an ethereal, invisible bank balance I’m afraid to look at directly.

I think having a tracking system gives me a sense of control, and that’s an instant soothing thing. When I was a kid, I could see my income growing from a very small place. $2 a week wasn’t a lot, but if I waited it out that number grew and grew. It was predictable.

Freelance income is… not like that.

BUT! Mapping it out can still help me see where I need to be earning or saving more.

I want to ask you more about the earning/saving thing, but first: some freelance income is predictable, at least within a range. Right? Your Patreon may go up or down by a few dollars, but you still know roughly what you’re bringing in per month and can assume that will continue into the near future. I’ve got a handful of clients I know I’ll be completing work for every month, so I can assume I’ll bring in X dollars every month.

What percentage of your income is reasonably predictable vs. wildly unpredictable?

Ooh, that’s been changing a lot in the last year! It’s been really incredible for me. Patreon tipped over from being a nice bonus to actually paying my foundational living expenses, so I have something that feels like a regular paycheck for the first time in my freelance career. Before that I didn’t have dependable monthly clients, really, so I was pretty reliant on cobbling together income from selling stuff online, doing freelance illustration, and getting comics into various outlets. Granted, I still get my income from about eight different sources, but the other valuable aspect of tracking numbers over time is that I’m starting to see patterns of how much comes in each month on average, and that’s really changing the way I think about it.

It takes my brain a long time to catch up to the idea that my income is actually going up over time (at least so far — no guarantees, right?). I was surprised to find that I was bringing in more than $1,o00 a month, after kind of deciding in the past that $1K was where my fixed monthly income was.

Seeing that I can reliably bring in more like $2–$4K a month these days means I’m trying to better focus my efforts, rather than flailing around scraping pocket change from many, many sources.

So to answer the actual question, percentage-wise:

Patreon now makes up about a third of my total income. The other biggest income bracket is sales (books, prints, minicomics, etc.) both in my online shop and at conventions, but those numbers are more variable because I won’t always do the same kind of business at a show and it can depend a great deal on what I’m releasing in a given year.

And again, that’s really different this year because I’ve got my first proper book out [Baggywrinkles: A Lubber’s Guide to Life at Sea], so I’m starting to see how having a full-price item (rather than a cheap mini) can make a big difference in stability of income.

You self-published Baggywrinkles, yes? (We could have a whole ‘nother conversation about that.) Some people would be, like, “self publishing is like throwing money in a hole,” but because you’ve already put in the work of building skills/craft/audience, it’s an investment for you. And it’s earning.

Ohhh golly yeah that’s a big conversation, and we talked about a lot of this in our podcast chat [on Patreon], but I understand that idea that investing in book stock isn’t necessarily the most cutthroat way to do business.

Even More Money Talk! (with Nicole Dieker) | Lucy Bellwood on Patreon

But I love books, and I love having control over how my books look and feel, and if you can get proper distribution and do the legwork to promote your book independently (which takes three seconds to type but months of brain-breaking labor to do) it can actually become a tidy source of renewable income. It is earning for me (at least so far, this year), and I think more than that it’s lending my work a degree of credence that it didn’t previously have.

Kids run up to my table now because there’s an object they see and understand that looks like it’s made for them.

Also because ships are rad.

FACT.

Okay, so now I want to ask the question about how you know when it’s time to earn more and/or save more. Freelancing is like any other job, where you basically work all the “standard work hours” and maybe a few more, and yet sometimes you say “okay, I need to start hustling for even more work.” How do you know when to do that?

This was big on my mind last year. I’ve usually been able to get by on whatever’s coming in, but I’d begun thinking about what might change if I set myself a monthly income goal rather than just going with the flow and seeing what happened. I think my equivalent of saying “TIME TO HUSTLE” is drawing these little “Where’s the money, Bellwood?” diagrams about once every three months. When I’m feeling stressed about money not coming in, I write out all the outstanding invoices, jobs on the horizon, and dependable monthly income streams on a single page. It helps me feel a little more stable because at least I know there’s something coming in the future.

And, of course, if I write out all those jobs and there’s still a deficit, then it’s time to work more.

But I feel very fortunate in that I haven’t had to do a lot of general solicitation for work. Things keep coming my way. It’s the product of hard work, of course, but it can feel very organic at times.

It actually feels kind of shameful to talk about, because I know a lot of people who are soliciting for jobs constantly, and doing work at a very high level — it’s not a skill thing. A lot of it has to do with social webs and communities. I spend a lot of energy being personable and making connections with people, and while I don’t do it because it will get me work, there’s no denying that every freelance gig I’ve had has come through a friend or a mutual contact or whatever.

That’s why I always try to connect friends of mine with new clients in my networks — it’s that paying it forward feeling.

Well, I’m going to pay it forward by sharing all of the great ways Billfolders can learn more about your work:

Eyy! Masterful segue.

Last question, the one I always ask: what advice do you have for Billfold readers?

Here’s something my friend Lillian [Karabaic, of Oh My Dollar!] and I discussed recently, that’s stuck in my mind and started to have a big impact on how I think about income: Money is a tool, and using it reflects a certain system of values.

When I think about what I value (independence, making connections, learning new things, exploring, creating), I feel less guilty about putting money into travel or education, or even self-publishing. Things that we’re societally taught not to value, that can feel wasteful or frivolous, can be recast as accurate reflections of what we consider to be important as individuals.

Writing out the things that I really value, then finding ways to make my income work for those concepts, has felt like a huge relief lately.

I think it’s a great exercise for anyone to go through.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments