Buying Life Insurance For My Father

It was pretty stressful.

Life insurance seemed to be an abstract concept with which I was only familiar with thanks to TV commercials and I would have been more than happy to keep it that way. That all changed when my father — healthy as a self-employed and aging man with diabetes can be — started displaying symptoms of age that worried me.

We both have some alternative life insurance — I forbid my parents from ever dying and my dad accrues all his “wealth” and leaves it to us in a will. Those facts did not help me sleep at night. I get certain obsessions fueled by anxiety and neurosis that will not allow me to function until dealt with, no matter how ridiculous. My father, having had enough experience in dealing with my crazed determination, was kind enough to provide me his legal consent and some signatures and cleared out of my way as I ventured into the world of purchasing some good old fashioned American life-insurance.

My first order of business: Find a realistic policy. I’m not trying to go broke by blowing my peanuts of a budget on the hope that I will be rewarded with fortune during a tragic event. I want something to make sure that my mother, sister and I will have a safety net to cover funeral and moving expenses. Since we live in The United States but are originally from Lebanon, it is most likely that we will hold his funeral there. The funearl costs will be ridiculous. As if calculating the aftermath of my father’s death wasn’t bad enough, after much research, the total came to $19,200.00.

Odds are, my mother is going to want to move back home. Realistically it won’t be terribly expensive for her to move back. We own a home and have enough family and friends there to provide her a few months of support before she gets back on her feet, but having read A Series of Unfortunate Events, I know it’s better to be prepared. Having these costs in mind, I was able to determine just how big of a policy I was looking for.

Once I had the basic costs figured out, I assumed the hard part was over. Two seconds into my venture, I realized my vocabulary needed to be slightly widened as I had no clue what a “premium” was and the difference between “term” life insurance and “permanent” life insurance. After some thorough Googling, I gathered enough courage to begin shopping around and looking at quotes. I will admit, I cried a little bit after looking at the monthly costs.

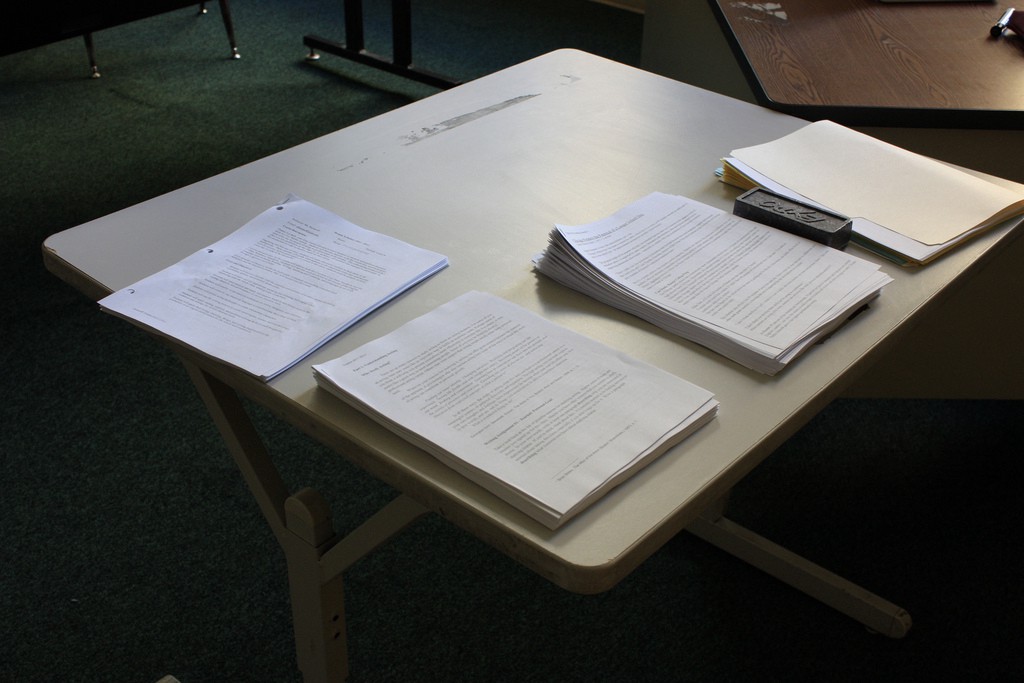

After much contemplation, it was finally time for the real work to begin. I found myself deep in a pile of medical and financial records. I can’t remember if I actually needed his tax information but it was there, taunting me with numbers and words I couldn’t understand. A trying time. Bank statements, bills, poorly placed Starbucks receipts and records of my sister’s school expenses pooled around me in a dimly lit office as I tried to gather the necessary information the insurance company wanted from me.

Eventually the insurance was purchased and my anxiety was relieved. Although I refuse to acknowledge the fact that I will ever need it, I feel better for it .I appreciate knowing that my family will be taken care of.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments