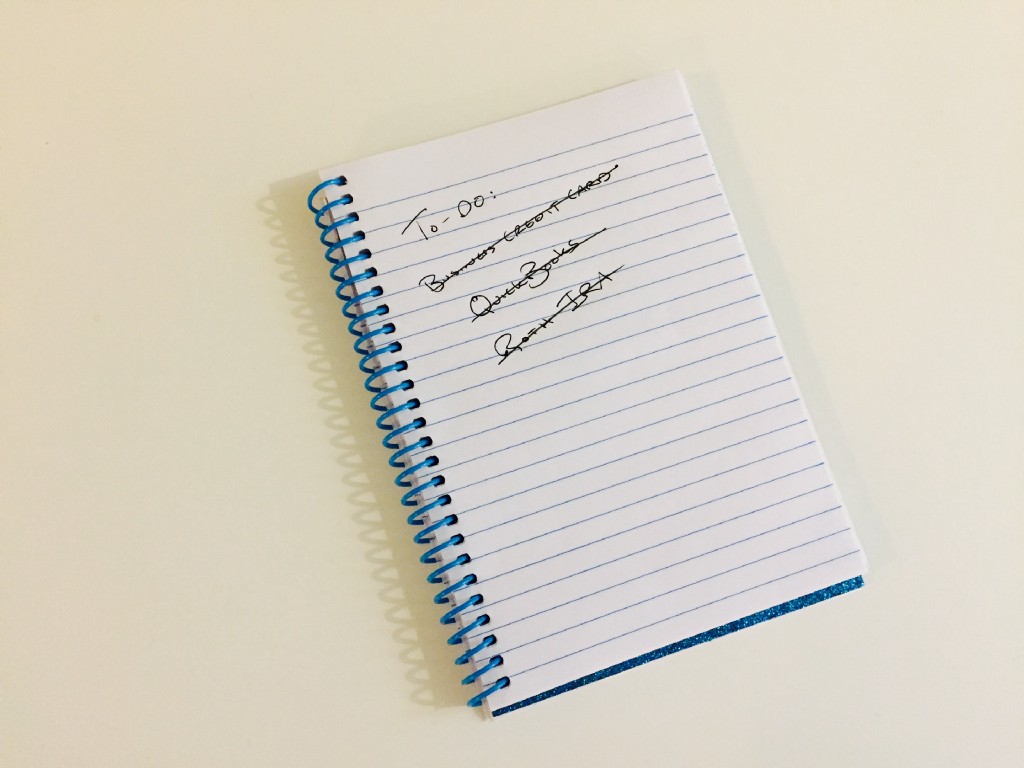

I Have a Roth IRA Now

The whole process took way longer than expected!

So yesterday I completed the last financial thing I wanted to get done before the end of the year: putting $5,500 into a Roth IRA.

(Yes, I know we talked about my being able to invest more than $5,500 in a SEP IRA, and how that might be better in the long term, but I went and read a bunch of IRS stuff and it turns out it’s a smidge more complicated for sole proprietors than it is for small business owners with employees, so I’m putting that on the list of things to discuss with my CPA in 2017. Also, I don’t have more than $5,500 to invest in a retirement account this year.)

I expected to be able to open up Capital One ShareBuilder, dust off the Roth IRA I had open in 2012 (before I took the money out because I needed cash), and put more money into it.

Turns out you can’t do that. First of all, it’s not called ShareBuilder any more, it’s called Capital One Investing. Second of all, when you take all of the money out of a Roth IRA it doesn’t let you put more money in four years later; for whatever reason, I had to start all over.

I also ended up having to call Customer Service before I could open a new Roth IRA, because my Capital One Investing interface had a big red ribbon on it warning me that before I did anything else, I needed to call this number and talk to a guy (who was really nice and helpful) and explain that yes, I had taken all of the money out of my Roth IRA four years ago, and yes, I wanted to start another one.

But finally I had the thing set up and was able to transfer the $5,500 I had saved.

I won’t be able to invest that $5,500 until Thursday.

I wasn’t actively trying to “time the market” at this point, I just wanted to get this task done before I got on a plane to see my family for the holidays, but it is a little frustrating to have come to the end of this process and to learn that it’ll take two days for my money to… um… float around somewhere before I can do anything with it.

Also: all of you who warned me that I wouldn’t actually be able to “buy low” during brief moments of market crisis were right. I wouldn’t have been able to invest on Election Night, first because I would have gotten that banner telling me to call Customer Service.

But it’s done. (Almost done. I still have to put the money in an index fund, and I will.) It looks like Capital One Investing will also let me roll over my 403(b) into a Traditional IRA, which is something I can think about for First Quarter 2017, and slowly-but-surely I will figure out how to invest in my future.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments