My 403(b) Account Automatically Rebalanced. Did It Do a Good Job?

Why do I feel like I don’t know anything about my own investments?

I have a 403(b) account through TIAA-CREF, because I spent 2008–2012 working for a nonprofit. (Current portfolio balance: $39,256.97.)

I became aware, a few years ago, that it was a good idea to rebalance your account every year—and that TIAA-CREF would happily perform an annual automatic rebalance for me.

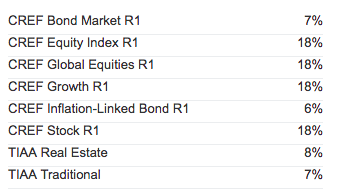

So that just happened. Here are the results of my rebalance:

There’s a lot of information missing from the “we rebalanced your account!” page, including information on my previous account balance and why the balance changed. Did TIAA-CREF put more or less of my money into CREF Bond Market R1? Was there a reason for doing that? Could I… know that reason?

I’m also curious about how many fees I’m paying, and the only way I’ve found to see that information is to tell TIAA-CREF that I want to re-rebalance my account myself, which opens up a page that shows me my current investments and lets me view their expense ratios.

None of my current investments have an expense ratio over 1 percent, which I’ve heard from various sources is the percentage at which you should say “no thanks, too high,” although a few of my investments come pretty close—and according to Helaine Olen and Harold Pollack’s The Index Card: Why Personal Finance Doesn’t Have to Be Complicated, which I read last month, I might still be paying too much in fees.

Here’s an Index Card excerpt they ran on Slate in January:

No, Your Mutual Fund Manager Doesn’t Know How Jellyfish Impact Real Estate in Hong Kong

Let’s look at this simple example. You’re going to choose between putting a one-time $5,000 investment in one of two mutual funds. We’ll call them Strawberry and Orange. The underlying investments will grow at 6 percent annually, and you will leave it there for 30 years. The actively managed fund is Strawberry, and it charges the average fee of 0.89 percent. Orange, the index fund, charges 0.12 percent.

Management fee / Amount in your account 30 years from now

Orange 0.12% / $27,758

Strawberry 0.89% / $22,299

(The slashes in that excerpt are editorial, because Medium wouldn’t let me make a table. You get the idea.)

The point being that the more I try to learn about investing and How To Do It Effectively, the more I realize how little I know, and the more confused I become.

Last week I wrote about whether I should have “bought low” on election night, when the markets crashed to the point where they prevented future sales:

Multiple Billfolders commented that I wouldn’t actually have been able to buy anything, that the markets were closed or that it would have taken a few days for my transactions to process, and so I’m sitting here thinking how little do I really know about this? I mean, this guy was able to buy on election night:

Carl Icahn Says He Bought Stocks During Election Night Dip

So that’s where I am today. My 403(b) rebalanced, but I don’t know what changes were made or whether I’m still paying too much in fees. I have money that I want to invest before the end of the year, but it might be better to do a SEP IRA than a Roth IRA and either way it might take several days for my transactions to process, so checking the market and a few Vanguard picks every morning to see if they’re going up or down is a futile task. Maybe.

Also, I shouldn’t pay for a financial advisor because I don’t have enough money to be worth advising:

5 Times You Don’t Need a Financial Advisor and 2 When You Actually Might

This shouldn’t be so confusing. But it is, which is probably why so many of us avoid investing altogether. Ugh.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments