Want to Go In-Depth on Trump and Clinton’s Proposed Tax Plans?

Will they change your life?

This week, John Green gives a detailed explanation of both Hillary Clinton and Donald Trump’s proposed tax plans, as well as how those plans would affect families at different income levels and the country as a whole:

It’s a great video and it makes the differences between Trump and Clinton’s plans really clear, so take the 10 minutes to watch.

[EDIT: if you prefer your info in non-video form, Forbes has a good chart, though its analysis isn’t as in-depth as the 10-minute video.]

There’s a huge problem with Green’s analysis, however, and it’s that it doesn’t discuss ME. Or… most of the people I know. The video focuses on how Trump and Clinton’s tax plans will affect married couples filing jointly with two children and two W-2s, and I’m a single woman with, like, eight 1099s. If you’re a married couple without children, or a single parent, or a freelancer or gig economy worker, you’re left out of this discussion—although Green notes that Trump’s plan will remove personal exemptions, which will probably raise taxes for single parents—and now I’m curious about how these proposed tax plans might affect other groups of people.

Here’s one theory:

Under New Trump Tax Plan, We’ll All Become Freelancers

So Trump’s new, higher 33% income tax rate means that the top income tax on salary income would be 33%, compared to 15% for self-employed folks, including those who work as independent contractors. “You and I would tell our employer that we are now contractors and get an 18% cut in our income tax rate,’’ marveled Len Burman, director of the Urban-Brookings Tax Policy Center and co-author of an analysis of Trump’s earlier tax proposals.

Clinton’s tax plan doesn’t specifically address freelancers, as far as I can tell—I mean, there must be something about them somewhere, but it’s not in any of the talking points—although HillaryClinton.com does mention this:

Hillary Clinton’s plan for a fair tax system

Simplify and cut taxes for small businesses so they can hire and grow. The smallest businesses, with one to five employees, spend 150 hours and $1,100 per employee on federal tax compliance. That’s more than 20 times higher than the average for far larger firms. We’ve got to fix that.

I’m not sure she’s specifically talking about sole proprietors here, but I would love for my taxes to be simplified. (Admittedly, most of what makes my taxes difficult is my own fault, e.g. “having eight or nine 1099s, as well as that one client who hired me for a $200 job and never sent a 1099, and the one time I made $150 doing a commission for a friend who paid via PayPal, etc.”)

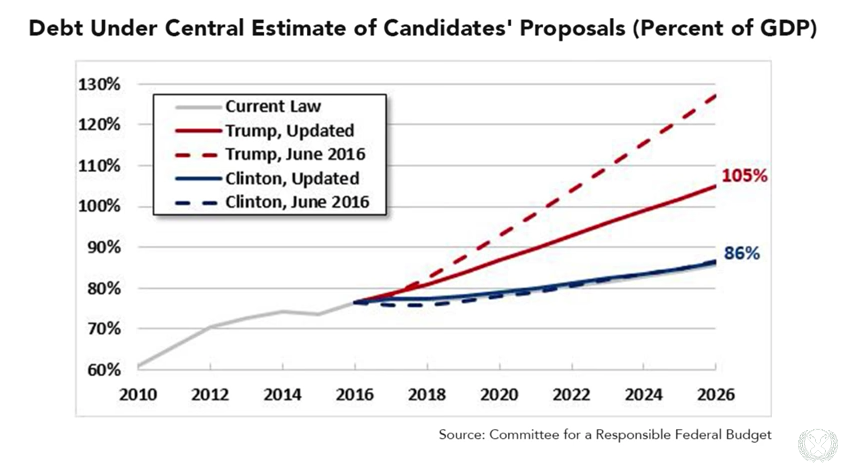

So let’s start there and discuss the merits and drawbacks of Clinton and Trump’s proposed tax plans. We can discuss the potential childcare and caregiver deductions, we can discuss W-2ers vs. 1099ers, or we can just focus on this screenshot from John Green’s video:

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments