Don’t Lie To Yourself About When You’re Spending Money

Why I’ve got to stop pretending that those big purchases don’t count in my budget right now.

I have a terrible habit: I’m a planner, and I buy things far in advance, but when I’m tracking my budget in Mint, I date them for the month when they’re happening, or even mark them as “special occasion,” so they don’t show up in my budget at all. Visiting my brother in San Francisco in December 2014 was totally a “special occasion,” right? So clearly it didn’t count!

Let’s look at a chronological list of things I’ve already planned and purchased for 2016, what I paid for those things, and when I paid for them.

- Baseball season, which starts for me on April 4. MLB.tv subscription, only $110 this year thanks to a class-action lawsuit! Hit my card on March 2.

- Visiting my parents for the Passover seders, April 15–17. Round-trip Amtrak tickets from NYC to DC, $98. Purchased on January 14.

- Visiting my friends Samantha and George in Chicago, May 5–8. Round-trip flight on Delta that allows me to fly out Thursday after work and leave after brunch on Sunday, $332.20. Purchased on March 5.

- Thanksgiving at home, November 22–26. Train after work on Tuesday paid for with Amtrak rewards points, and Saturday night train back to NYC, $59. Purchased February 23.

- Hamilton (again) with one of my best friends from college, December 7. $179 each for a rear mezzanine seat, including fees, the most either of us has ever spent on a theater ticket. Purchased January 26.

That’s $668.20, for those who weren’t adding it in their head as they read.

There’s nothing inherently wrong with me spending $668 on these things. It’s travel, and theater, and other things that make me happy. These are things that my former therapist would approve me spending money on. And being the kind of person who plans way in advance got me amazing deals on those Amtrak tickets for holiday weekends.

Here’s the problem: I don’t necessarily have the money in the bank for these things. The credit card billing cycle with the Hamilton tickets? I had to raid my savings account to pay my bill, and I’m not able to pay myself back any time soon.

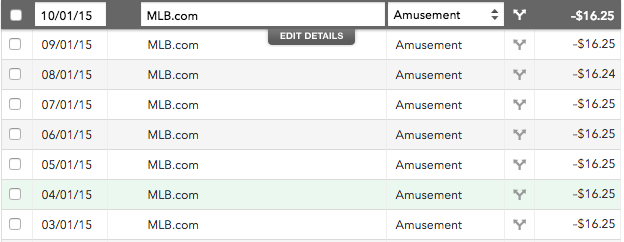

I’ve had this habit of not counting special occasion purchases in my regular budget, or shifting the dates on those purchases, for as long as I’ve been using Mint. Pricey theater tickets, plane tickets, that kind of thing often just doesn’t get counted at all. And things like my MLB.tv subscription and my CSA often get broken out over all the months I’ll be using those things, even though I need to pay for them up front.

After raiding my savings account last month to cover Hamilton tickets and Passover travel, I’m probably going to need to do the same this month to cover my Chicago ticket and my baseball fandom (go Nats!). I’m going to use my special travel savings account to cover the plane ticket, but this is all a big setback in getting my emergency fund back to where it should be following a five-month stretch of unemployment last year.

So here’s the plan: No more doing this! Every dollar I spend needs to show up in Mint. It’s okay if I want to pay for something from savings, as I’ll do with the plane ticket, but I can’t just pretend the money just … disappeared.

And I’ve already taken the first step toward more responsible budgeting! I’m going to make my very first trip to Wrigley Field while I’m in Chicago — a Friday day game against my Nationals. But I don’t have the money to pay for the ticket right this moment, and I won’t for another paycheck or two. So I’m waiting, and maybe I’ll decide I can only afford the bleachers, but that’s okay. When I buy that ticket, I’ll know that it fits in my budget, and sometimes that’s got to come before my desire to have things planned. I’m still going to make it to Wrigley — but I won’t need to raid my savings to make it happen.

Rachel Goldfarb is a writer, editor, social media strategist, and activist in New York City. Follow her on Twitter @RachelG8489.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments