How a Woman Who Publicly Tracks Her Net Worth Does Money

Kate Dore is a 31-year-old social media marketing specialist/blogger freelance writer in Nashville. She blogs about personal finance at Cashville Skyline.

So, Kate, tell us a bit about your finances.

I earn around $50K annually with all three of my jobs, own a home in East Nashville, and have no debt except for my mortgage.

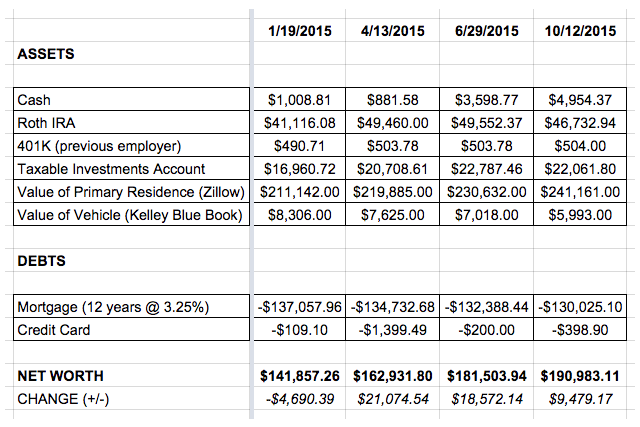

I’ve been tracking my net worth for the past two years on my blog.

While I look at those numbers and both marvel at and absorb the information, tell us: what prompted you to start tracking your net worth, and what was the motivation for making it public?

So I used to be a talent buyer/concert promoter for an independent company based in Nashville. That meant producing shows all over the United States and Canada. It was fun in my early 20s, but it started getting really difficult as I got older. The need to change careers made me realize I needed to stop my out of control spending! I discovered the world of personal finance blogs in early 2013 through a Coursera forum. And I started blogging anonymously at the end of 2013.

I “came out of the blogging closet” at FinCon last year. I had just quit my concert promoter job. I knew making my blog public would probably help with my transition to digital marketing.☺

FinCon! I have heard so much about FinCon. How was that for you? Did it help your career/writing/finances/all of the above?

Absolutely! Nearly all of my freelance writing/social media consulting gigs have come from connections I’ve made in the community. It’s in San Diego next year. You totally should come!

I do enjoy San Diego! At this point I try only to go to conventions where I have a work-related reason to be there, either because I’m a panelist or because I’m getting paid to write about the con.

How do you decide what conventions to attend and which opportunities to go after? I used to try to go after everything, but it got super expensive…

I’m still pretty new to the personal finance blogging/freelance writing world, so FinCon has been my go-to for the past couple of years. And it’s paid for itself both times.

So I’m looking at your net worth, and it looks like you had a pretty significant cash jump between April and July of last year. Your cash went down a little bit at the beginning of the year, but starting in the summer it’s been growing pretty quickly. Can you share what happened?

Sure! After saving about 50 percent of my income for about a year, I quit my concert promoter job last August. I worked a part-time job with Eventbrite from August to December, but it wasn’t enough to cover my bills. So I was living off savings for a while.

Basically, I depleted a bunch of my emergency fund.

When you were planning the career shift, did you have a sort of “risk tolerance level?” Like, a point at which you’d have to say “okay, this isn’t working, time to try something else?”

Or did you decide to go for broke, literally?

Haha.

Honestly, I was incredibly burnt out. And I knew that quitting my job and taking a few months off to recharge was inevitable. Starting the blog was a way to hold myself accountable financially and work on some digital marketing skills.

It was definitely a risky move to quit without something lined up. But my body was exhausted from 5 years on the road. And I knew taking a few months off would help me perform better in my next gig.

And it has, yes?

Absolutely! I’m now a full-time social media marketing specialist for an awesome company. And I have plenty of time for my side projects.

So what advice do you have for Billfolders who might feel like they’re burning out in their own jobs? Do you agree with jendziura that sometimes quitting is the best thing you can do? Should everybody have an emergency fund first?

I think saving up as much money as possible is a smart move! I wanted to have at least six months of expenses. And, yes, I agree with Jen. I needed the time to recharge and think about my next move.

So switching back to you publicly sharing your net worth: When I started publicly sharing my income, I found that I wanted to make that number bigger every time I shared it, and so it incentivized me to hustle for more jobs. Did you have a similar reaction when you started sharing your net worth?

Definitely! I’ve definitely been motivated to step up my side hustles and keep increasing my net worth. I want to show people that it’s possible to establish financial stability even if you’re not a high earner. And I love reading your income reports, by the way!

Just a few more questions for our readers: What do you feel like you do well, financially, and what do you wish you could do better?

I save a large portion of my income. But I struggle with my food budget every single month! I budget $300 and end up spending $500-$600.

Everyone I’ve talked to recently says they wish they could spend less on food! It makes me wonder if the problem isn’t with us, individually… it’s with FOOD. (And probably working hours and less time to cook from scratch and grocery shop and so on.)

Very true! I’ve realized paying for convenience is often worth it.

How much of your saving and spending habits came from your childhood? Were you always a saver? Did your family model saving?

Except for a few years in my 20s, I’ve always been a saver. I worked in a lot of restaurants growing up. And tried to save as much as I could. My parents live a pretty frugal lifestyle. So I know I’ve picked that up from them!

And lastly: We discussed career advice above, but what financial advice, if any, do you have for Billfold readers?

I hear a lot of complaints from friends about living paycheck-to-paycheck. I know how difficult it is with stagnating wages and super expensive rent. But that’s where a side hustle can be really beneficial. There really are endless ways to earn extra money.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments