The IRS Doesn’t Want You Writing Them $100 Million Checks

“You’re trying to write a $100 million check to the government and they’re treating you like dirt?” he said. “These are your customers. If this was Las Vegas, they’d give you the suite and a bottle of champagne for free.”

That’s Grover Norquist, commenting on the news that the IRS will stop accepting checks of $100 million or more starting next year because most commercial banks can’t cash checks that large.

The IRS says that nearly 90 percent of individuals file their taxes electronically — including me! I had scheduled my estimated tax payment (due tomorrow!) last month, so I woke up this morning to a bank alert notifying me that they had deducted a bunch of money from my bank account. All that money was gone, but I felt relieved more than anything; better to pay a chunk of my taxes now than get surprised with a big bill come next April!

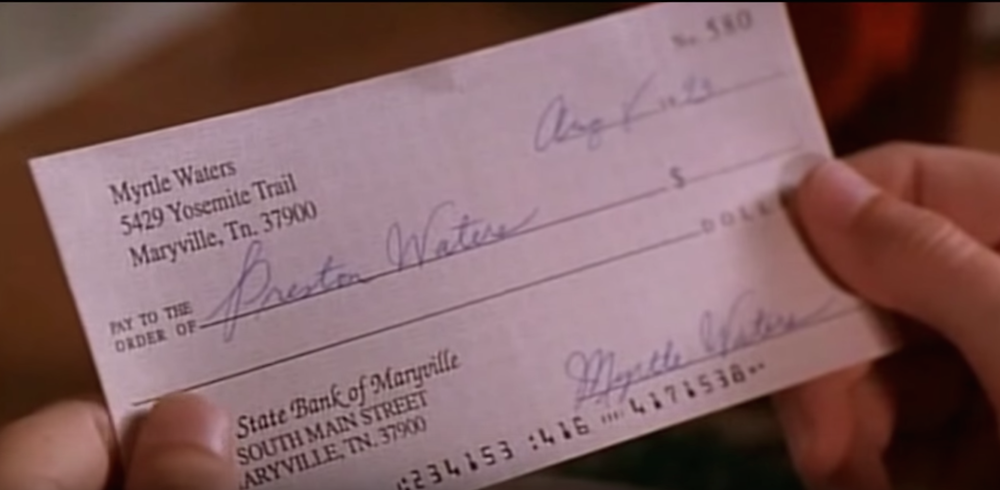

But back to these mysterious ultra-rich people sending $100 million checks to the IRS. Why checks? What benefit is there to writing a check vs. filing electronically? Does anyone here have the answer?

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments