Getting Health Care After Quitting Your First Job

by Marie French

I wasn’t thinking about health insurance when I quit my job. I thought about how much I loved New York, what I loved about journalism and writing, and how I was kicking myself for taking the first job offer I ever got. I was also thinking about whether quitting my first job three months in for a temporary job would ruin my life (hey! I’m young).

I’d acted too quickly by taking a job in NYC that sounded interesting, but was a bit too heavy on database and lead building, and light on meaningful reporting and analysis. When I got a tip from a friend about a temporary reporting job in Missouri that would mean going back to the adrenaline-fueling breaking news and knowledge-junky-feeding analysis pieces, I had to seriously reconsider my options. But once I’d made the decision to uproot my admittedly barely sprouted attachment to what I felt was the greatest city in the world, I had so many money problems to deal with. First there was a car, then a place to live, then the costs of travel.

By the time I got back to Missouri (about eight months after graduating and vowing never to return), I realized I had another problem: What was I going to do now that I had lost my employer-sponsored health insurance plan, moved halfway across the country for a new job and now had to wait 90 days to get on my new employer’s health plan?

Could I do what healthy, young and clueless Americans used to do and just be uninsured? Would I end up paying a penalty on my already bound to be semi-complicated taxes (since I’ll probably have three jobs in three states by the end of 2015)? Should I get this COBRA thing? Do I need to get on the Obamacare site? Can you even buy health insurance for just 90 days?

A more important question: What’s the cheapest option available that won’t leave me paying back money to the government and also ensures I don’t rack up so much medical debt I have to move back in with my parents, or take a job I’m not going to at least mostly enjoy?

Getting insured under a parent’s plan wasn’t going to be an option: If I hadn’t already used my parent’s insurance during that fun period of graduating, being an intern with no benefits and then getting a real job, I could’ve also gone on Tricare Young Adult. Unfortunately, the military’s option for the under-26 crowd locks you out for a year if you cancel coverage.

I was freaking out about being uninsured for the first time in my ever-so-brief 23 years, but it turns out that all of these problems aren’t that difficult to deal with; this whole Obamacare thing actually helps if you’re going to be a nomad millennial who makes some risky career choices.

I swear this is not an endorsement. I have no clue how the heck people dealt with these issues before healthcare.gov and whether or not this is better. Also, it needs to be noted that I probably just would’ve risked going without insurance if I wasn’t worried about paying the penalty. So there’s that.

While the idea that millennials are chronic job hoppers and more likely to move around than the average person is a bit out of proportion, it’s true that younger workers are more likely to switch jobs and also more often view their current gigs as purely temporary.

Plus, about 70 percent of companies have waiting periods of one month or more before benefits kick in, and 23 percent have a three-month waiting period, according to the 2014 Kaiser Family Foundation survey of employers. Either way, your health insurance plan is unlikely going to follow you from one job to another or from one state to another. That’s the world of state-based and employer-sponsored plans.

COBRA

Employers have to offer this when you quit, or are laid off and the plans qualify under Obamacare as minimum coverage. But, as I discovered, you’ll probably be paying way too much for a plan that used to be amazingly affordable when your employer was covering the cost.

Since you pay the full cost of the plan and a two percent administrative fee, COBRA is usually not a great option. I flipped through my paperwork, assuming the premium might be a couple hundred dollars a month. Nope: It was $538.

Thankfully, the handy paperwork, which I then tossed in the corner in disgust, let me know that getting on healthcare.gov and checking out the exchange could make for a better ending to the tale of an uninsured, temporarily-employed 23-year-old.

The not-so-terrible website

Yes, I had to enter the same information more than once and yes, it was a little confusing since my permanent address for all my other financial information is my parent’s place in Virginia instead of the place where I’m renting a single bedroom in Missouri. (My furnishings: I have a $10 Craigslist bookcase — originally from Walmart, I think — a $30 shabby thrift store dresser and a twin mattress on the floor. I also splurged on some 800 thread count sheets. Otherwise it’s cardboard boxes all the way.)

Nevertheless, it wasn’t that big of a challenge to put in my old employer’s info, a phone number for my new employer (they creepily pulled my latest pay info automatically since I recklessly risked the security of my SSN) and the fact that no, for the third time, I was not married.

After about 30 minutes, I had back my answer: Because I’d changed jobs recently and didn’t expect to get coverage at my new employer in my new state right away, I was eligible for a Special Enrollment Period. That was definitely a relief, since I’d rushed to go through the whole process only a couple of days before the so-called deadline to sign up.

Armed with that knowledge, I spent some time browsing through the options. Sure enough, even though I’d overestimated my income so I didn’t qualify for a subsidy, there were way better options than paying through the nose for COBRA coverage.

The prices ranged from $189 for the cheapest bronze plan to $263 for the cheapest gold plan.

Now I just had to figure out the tax penalty and decide if I really needed insurance for the next few weeks.

Winging it

The dreaded tax penalty turned out to be a false alarm. All it took to figure that out was a careful reading of some paperwork, and I realized I really could just go without insurance for up to three months without getting “caught.”

The penalty would only apply if I ended up without insurance for more than three months, which gave me some leeway between losing my employer-based health insurance (January 31) and when the new employer-based insurance is set to kick in (about mid-April).

I also figured out there are some potentially tricky ways to get out of paying a penalty: for example, the hardship exemptions like if you stop paying your utility bill, get a shut-off notice, then resume paying again, or if you claim that you’re unable to pay some medical expenses.

Then, parsing through the documents I’d been sent that, at least with the dreaded COBRA price tag — I could actually forego insurance entirely, get hit by a bus (or experience some other disaster scenario), go to a hospital, buy insurance and backdate the insurance so I could send in any bills I’d paid up front.

That might add up to a hefty sum, considering the premium, but could be worth it. Hopefully I wouldn’t be too rattled by the bus hitting to consider the cost-benefit of that.

If the bus hit me at the beginning of the month and I bought Marketplace insurance before the 15th, then waited ’til next month to go to the hospital… I’d probably die. But hey, besides outlandish emergencies, what’s the problem?

If I’d planned ahead and thought about health insurance before losing it, though, I could’ve gotten uninterrupted coverage through the Marketplace.

Here’s the key part in the notice I got about qualifying for a special enrollment period from the Marketplace:

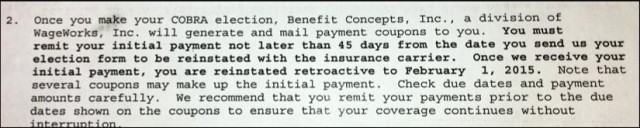

And in the COBRA documents:

Is just going without health insurance and planning to pony up more than $1,000 in premiums if I need to a terrible idea? Maybe. Am I going to do it anyway? Yes.

Marie French reports on state government in Jefferson City, Missouri, for the Associated Press. She’s also written for the St. Louis Post-Dispatch and Bloomberg News. She hopes to soon have health insurance and also stay in one city for more than six months.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments