Everything I Needed to Know About Money I Did Not Learn in Kindergarten

What did you learn about money as a child? Although I never received any formal financial education, I remember a few lessons that trickled down to me from my parents or other authority figures:

+ Don’t take any wooden nickels. My father was fond of saying this to me when I left the house. It works as literal advice, of course, but it primarily means, Don’t get cheated by some slickster, like a so-called banker with a sob story on the Upper West Side.

+ Prioritize buying nice essentials that will last. Over the course of my entire childhood, I remember our getting one new couch and … that might be it? Most of the furniture — which was lovely as well as sturdy, for the most part, our awful kitchen table excepted — predated me, and it might outlast me yet: my mom still has it around. I read something once as an adult that it’s a good idea to buy one nice piece of furniture a year, and if you embrace that wisdom, apparently the time to buy furniture is January (also a good time for linens, suits, and video games!).

+ Feed the meter even if no one’s looking. If you can’t be sure whether or not you need to put in the $.50, err on the side of putting in the quarters. Make following the rules, and being safe rather than sorry, a habit, and it will become much easier to do.

+ Pay your traffic tickets. Twice in one short span of time, two members of my family were formally detained by police officers for non-payment of one particular speeding ticket. To protect their reputations, I won’t say who they were, except that one of them had a gray beard and was led away from a crossword puzzle in handcuffs. The other member of my family arrested for the same ticket got the full monty: shackles, fingerprints, a mugshot. Render unto Caesar, guys, or Caesar comes after you, guns blazing. Trust.

+ Always leave the house with cash. Don’t rely on being able to find an ATM when you need one, or on the generosity / patience of your friends. In emergencies, be able to help yourself as much as possible.

+ Invest in AAA. This came in handy numerous times, including one afternoon when my brothers and I were driving home from school in the minivan and the minivan suddenly decided it maybe didn’t want to be a minivan anymore, maybe it was always meant to be a boulder, and it made this realization while we were on I-495 during rush hour. Whoever was driving managed to guide the recalcitrant vehicle gently to the shoulder without anyone dying or hitting us so that we could flag down a stranger and call AAA for help.

+ Cook. We had breakfast and dinner together as a family every weekday, which is kind of insane now that I think about it, but nice. We weren’t allowed to watch “the Simpsons” while we ate, either. We had to talk to each other. So we mostly quoted “the Simpsons” while the parents sighed and zoned out.

In the morning, my dad made us eggs, because he believed in that Protein in the Morning thing, and in the evening, my mom often made us salmon, because she believed in that Fish is Brain Food thing and also the thing about how Family Dinners Keep Kids From Becoming Delinquents. We graduated high school and went to college, so maybe the magic worked? Also making food at home saves money and when you see cooking done every day as a child it reminds you that it is a possible thing people do.

+ Even at work, be ethical. My dad kept the Book of Isaiah on his desk at the office to remind himself who he was working for. Or so he said. Maybe it functioned as good bathroom reading.

+ Be generous when possible. My mom often allowed me to bring a friend with us on family vacations, so that it wouldn’t just be my brothers fighting over video games and me in the corner reading a book. Though I was very appreciative, it never occurred to me then how much extra expense and annoyance this occasioned, and she never mentioned it, either. She was a gracious host to all of my friends and in her honor I still press food and drink on anyone who comes through the door. Also, one time, my dad secretly picked up the tab for a group of old ladies at the deli where he was a regular. I only found out at his funeral. They never found out at all.

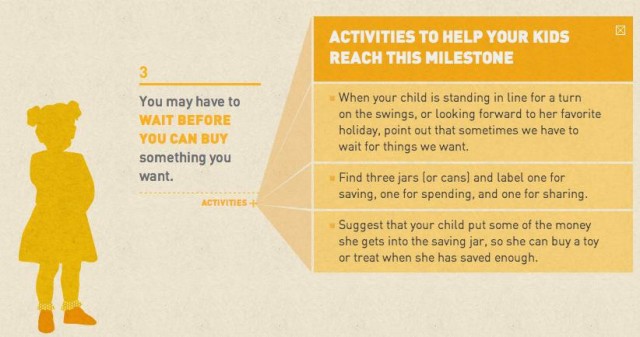

This train of thought has been inspired by an interesting site someone pointed me to called Money As You Grow, which advises starting to teach the basics of financial literacy in age appropriate ways to children 3–5 years old and all the way through their teens. Although I’m grateful for what I did learn, I could definitely have used some of these basic lessons back then too.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments