My Spreadsheet Summer

by Lily Altavena

I’m a news producer with a modest salary. I pay my rent on time and don’t borrow from my parents, but occasionally spend way too much on shit I don’t need like DVD players (what is this, 2002?) and fancy, artisanal groceries (lavender ice cream, you were kind of gross). I fall squarely in the middle on the scale of financial responsibility.

At 23, I’m a lot better off than many of my peers — a year out of college, I have no student loan debt and have been steadily employed since graduation. A lot of my friends are currently struggling with their first loan payments. I know that I’m lucky and privileged, but I’ve recently found myself in perpetual credit card debt. It’s not a lot, but it’s a couple hundred dollars on my Visa that just won’t go away.

It started accumulating in February, when I moved from Brooklyn to Dallas, Texas. The rent in Dallas is cheaper! Food here is cheaper (and the grocery stores, oh the grocery stores with their wide aisles)! Everything is cheaper!

Moving, however, is not cheap. You have to pay for car insurance, moving boxes, cheap IKEA furniture, all kinds of deposits, and so on. It all adds up. And every time I pay off my card, I find myself short a few weeks later. All of a sudden, I’m $300 in the hole on that goddamn Visa again. I don’t even know how it happens.

Okay, I do know: Trader Joe’s happened. Drunk brunch happened. H&M happened (and yet I still don’t have a kitchen table). I always pay it off in time so that I don’t accumulate interest, but every month like clockwork, the negative balance reappears.

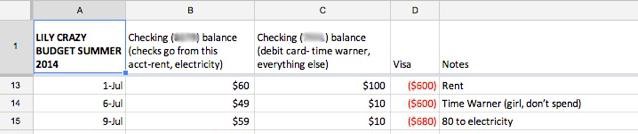

I’ve never really put myself on a budget before, which I find kind of shameful. Fed up with constantly being a couple hundred dollars behind on my Visa, I’ve decided to do something about it. I set up a spreadsheet, planning my budget over the next few months and will be obsessively tracking my progress. I’ve got a pretty simple set-up: one column for the date, one for the balance of each of my bank accounts, one for my Visa, and one for notes. It looks like this:

I’ve planned out what I’ll theoretically spend for the next few months, accounting for everything from gas to groceries and even birthday presents. If I stick to it, I’ll be out of credit card debt by August 15th — that’s three paydays and one long summer from now.

Success is hit and miss. Just today, I ended up at the mall. I stuck to sales, but still bought more than I was supposed to, purchasing a knock-off George Foreman grill that I really didn’t need. It was on sale — but wasn’t in the budget. Does my meat really need to be grilled, lean and mean style? I also went $20 over at the bar last weekend, because, as it turns out, vodka doesn’t really care about your budget. There have been little victories, too: I pay a lot of attention to what I put in my grocery cart, making sure to stick to my goal of $40. I bring lunch to work. I keep the electricity and AC use to a minimum, even if it means sitting in the dark in a warm apartment.

I’m not used to budgeting for myself, which is what got me into this Visa mess in the first place. In college, I paid for a lot of my expenses, but not nearly as many as I do now. I’m not used to all these bills popping up every month. I spent indiscriminately because there was much less for me to worry about. My bank account is telling me I can’t do that anymore. And I’m listening.

Lily Altavena is a TV news producer and freelance writer based in Dallas. Follow her on Twitter: @lilyalta.

Photo: John Tornow

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments