Making Extra Student Loan Payments So You Pay Down That Principal

After a long period of unemployment (and a lifetime of aversion to thinking about money stuff), I have somehow landed a job that pays pretty well and am trying to get myself out of the financial hole I was in for a while.

An important part of this is paying off some of my massive amount of debt, most of which is student loans. For a while now I have been paying interest only on my private loans, which obviously needs to stop. Your Sallie Mae “Helping You Pay Less” article was very helpful in alerting me to the barriers that have been put up between me and reducing my private loan principal. So now I will be sending in extra payments by check specifically requesting that they be applied to the principal. Fingers crossed that this works.

On to my question, finally: I have three private loans with roughly equal balances, two of which have an interest rate of about 5% and one that has an interest rate of about 9%. In accordance with your other extremely helpful article regarding the ‘snowball’ and ‘avalanche’ methods, it seems like the best thing to do would be to try to apply any extra payments towards the principal of the 9% interest rate loan before moving on to the other two lower interest loans. So, is this possible and if so, how do I do this? — J.

Since it sounds like J. has it mostly figured out already, I’m posting this question to gauge how many people have difficulties making extra payments on the principal balances of their student loans every month.

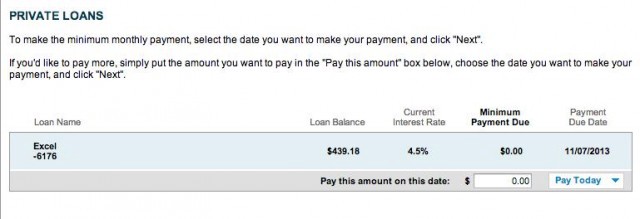

Sallie Mae instructs me that if I’d like to pay more than the monthly minimum payment, all I have to do is enter in more money in the payment field, which I’ve done without ever having a problem:

As for J., it sounds like you are doing everything correctly! I’d definitely make minimum payments on the two student loans with 5% interest and apply extra payments to the student loan with the not inconsequential interest rate of 9% (seriously, that’s like a credit card interest rate!). You should be able to make those payments directly on the site, or send in payments by check requesting that the payment be applied to the principal of the loan with 9% interest (Sallie Mae services three of my student loans — one private loan and two federal loans. Each of the loans has a unique loan name, i.e. Excel-6176, so you should be able to indicate which loan you want the payment to be applied to if you have more than one loan bundled into a single account). If you can’t make the extra payments on the site, I’d definitely call up a customer service rep to get specific instructions. The CFPB has a sample letter you can use to mail to your loan provider with specific instructions, which you can find here.

All the best on getting this paid off, and hope to see you throw some money at your problems in our thread every month!

Photo: Donkey Hotey

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments