I Love Quicken

by Elise Nussbaum

I am a chronicler of minutiae by nature. A few years ago, I started keeping track of every book I read, with the list arranged chronologically, and then rearranged at the end of year in order from best (Vanity Fair) to worst (Water for Elephants). Somewhere among my possessions is a tattered piece of paper with the first names of every guy I’ve ever kissed (this one is purely chronological).

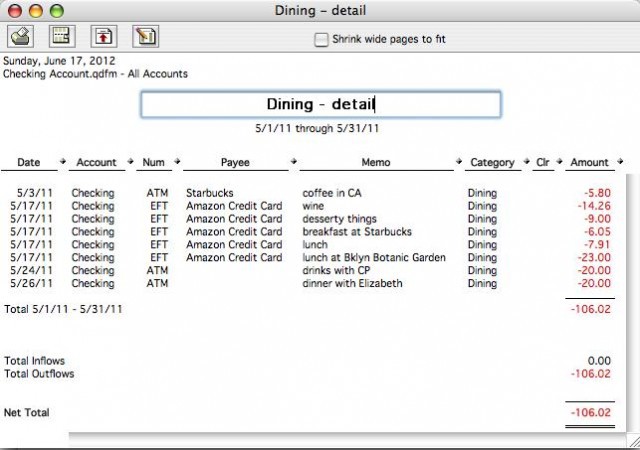

Quicken is perfect for people like me; I like to keep some record of my life, but journaling is time-consuming, labor-intensive and, frankly, embarrassing. I don’t necessarily need to filter and examine every aspect of my life, but I do want to look back and have some idea of what I’ve been up to. The way it works isn’t terribly complicated: You enter your income and expenses into the program, slotting the latter under various preset categories (groceries, clothing, gifts given). You can also include notes that provide a bit more detail (“Cheetos,” “psychedelic dress,” “wooden jigsaw puzzle — Mom’s birthday”). I like to be detailed, except when the charge is from CVS, because I can never remember what the hell I went in there for. I slot it under “grooming,” but it’s a guess.

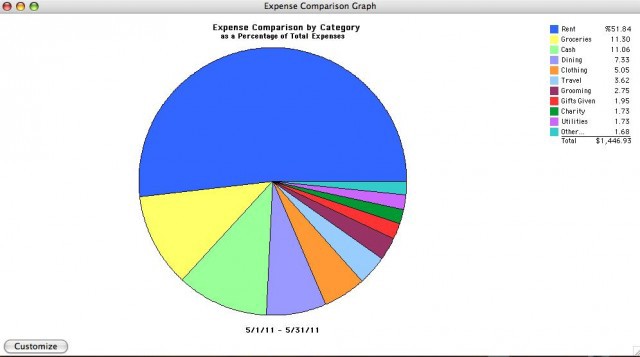

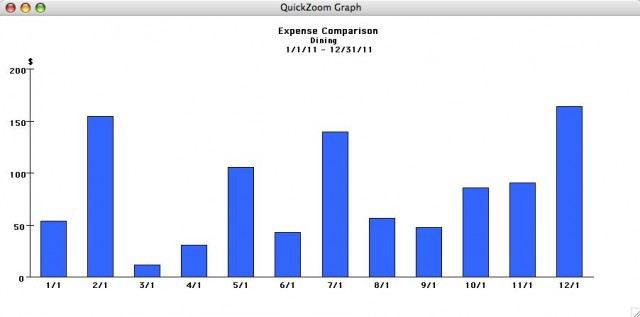

The real magic (magic! my standards are low) comes once you’ve got a few months of expenses totted and jotted, which is when you can pull up all kinds of fancy charts. You can see your net worth rise and fall, you can break down all your spending by category, you can find out exactly how much money you’ve spent since the beginning of time (if the beginning of time coincides with your adoption of Quicken). You can compare income and expenses month by month, to make sure you are living within your means. Which bar is higher? By how much? Did the net worth dot go up or down this month? Try not to obsess.

One of the great things about using Quicken is that it helps me mentally prepare for the possibility of not having a job, should something unfortunate happen. I know exactly how much I spend every month, and how the wants/needs breakdown works out. Turns out, my needs are about $1,500/month, and my wants are a few hundred dollars more than that. (DVDs from Netflix: a want. Gym membership: a need.) So every $1,500 in my savings account is a potentially unemployed month in relative, albeit anxious, comfort.

Even if you use Quicken, as I (mostly) do, for purposes of posterity, rather than financial discipline, your habits will probably change. I used to wait until December to make my IRA contribution for the year, but then I started to get itchy when I saw my net worth appear to drop by thousands of dollars in one month. (Theoretically, I could link my IRA account to Quicken, but there are several reasons why I don’t do that.) So now I spread it out over several months, putting a little money in my savings account to keep the numbers up. I now pay for everything with my credit card to make it easier to track (plus, rewards points), except when it’s something I’m slightly ashamed to be indulging in, e.g. excessive amounts of candy or lunch out for the fourth day in a row when I should be packing it. I give myself a little bit of cash for indulgences and most cash purchases go straight down the memory hole.

I know a lot of Billfold readers use Mint, but I’m not a superfan of the “set it and forget it” interface. Quicken asks you to confront, or at least remember, where the money went. Quicken asks something of you, a bit of attention, while Mint casually chugs away, plugging in numbers as you go on benders or sprees or forget about it entirely. Quicken is something you do, while Mint is something that’s done for you.

There are lots of things I mean to make lists of — dinners I want to make again, million-dollar ideas that come to me in the middle of the night, my friends’ blogs — but for the time being, Quicken scratches the itch.

Nota Bene: The software I use came with my laptop in 2005 (I’m not buying a new one until I really need it!), so the details might be a little out of date. If your version does new and different stuff, hooray! Explore and report back.

Elise Nussbaum lives in Jersey City with a husband and a cat. She is currently blogging her closet at dressopotamia.blogspot.com.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments