Figuring Out How I’m Going to Pay Myself Back the Costs of This Move

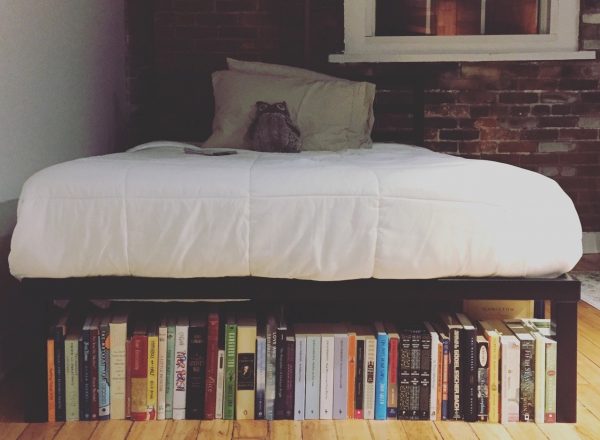

One way to cut back on spending: turn your bed into a bookcase.

So my financial goal for this week—and my Do 1 Thing for yesterday—was to figure out how much of my incoming freelance checks (plus the security deposit/last month’s rent from my former apartment that is currently being mailed to me) should be set aside to refill my $3K checking account buffer.

Essentially, I was trying to figure out how much of my incoming cash was unavailable for spending.

I had sort of thought, in that optimistic, not-very-accurate way that people do, that the $1,350 I’m getting back from my landlord plus the $450 I got for selling my furniture would offset most of the cost of the move.

Except, as we learned on Monday, moving to Cedar Rapids cost me $5,929.10.

This means I spent not only my $3K checking account buffer, but $2,929.10 on top of that.

I feel like all the math I did last night would bore you, so I’m going to summarize the results:

I will not be able to “pay myself back” for the cost of this move. I can’t just spend a little less for the next few months and suddenly have an extra $6K. (If I could do that, I would have already been doing it.)

Realistically, here’s what I can do:

Accept that some of the cost of moving will have to come out of my savings account. I’m going to pull $859.12 out of savings right now and not put any more into savings this month, which—assuming I get all of my freelance checks—will give me $1,831.20 to put towards the credit card bill I need to pay off.

That means I’ll end the year with an even $10K in savings, which is fine. (If I don’t get all of my anticipated checks before the end of the year, this’ll plan move forward into January, but just for the checks I’m expecting in December. I’ll continue to put 15 percent of the checks I’m expecting in January into savings.)

I also need to put $5,500 of that $10K into my Roth IRA, which—if I understand correctly—can happen at any point before April 15, 2018 and still count as a 2017 contribution. (Right?) I’ll put that off until First Quarter 2018 so I don’t draw down my savings too much; after all, that’s also my emergency fund.

Budget December and January’s income to give me $1,500 in the checking account buffer by January 31. A holiday month when you’re simultaneously setting up house is a terrible time to try to cut back on spending; January, on the other hand, should be great for pulling back on discretionary expenses. I have some budgets set up that, if I can stick to them, should give me a $1,500 checking account buffer by January 31.

However, February is probably going to be another low cashflow month, which means I might not get the full $3K buffer set up until end of April. It’ll all depend on how much I earn in Q1 2018.

But—as it always goes with these kinds of things—saving as much as you can is better than saving nothing at all.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments