Checking In With My Savings Plan: November 2017 Edition

In November, I received $4,704.84 in freelance earnings and $214.97 in book royalties, or $4,919.81 total. Here’s what I put in my sub-savings accounts:

Taxes got 25 percent, or $1,229.95.

Savings got 15 percent, or $737.97.

That left $2,951.89 for my checking account—and I spent all of that and then some on this month’s move. (I’ll give you a total “cost of moving” roundup later today.)

In December, I’m going to start putting 30 percent of my gross income into the tax account to cover both federal tax and Iowa state income tax. I need to meet with a CPA ASAP so I can sort out my business tax requirements and decide whether I need to set aside even more for state income tax; that’s on the to-do list for this month.

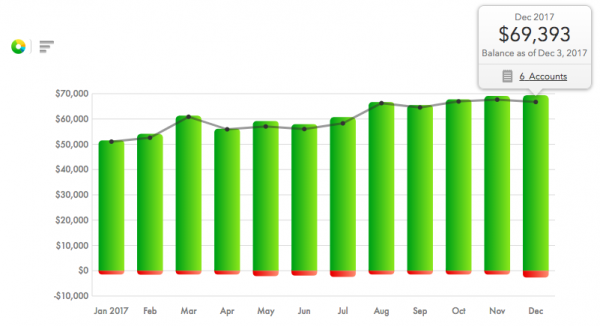

Here’s Mint’s graph of my total net worth:

Even though that line makes it look like it went down, my net worth actually increased by $1,640 this month—and that’s after subtracting the credit card bill I’ll be paying off in a week or so. (That’s a lot of red to pay off, but I’ve been planning for it.)

Yes, if you do the math you will notice that I put $1,880.74 into my sub-savings accounts but my net worth only increased by $1,640, which means I did a lot of spending in November. The value of my investment accounts also dropped by $86 last month, which didn’t help my net worth any.

But that’s just how some months go.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments