Lying About Money Can Be Worse Than Cheating, and Other Relationship News

Since I am not currently in a relationship, I’m going to have to turn to the Google News tab to learn how today’s couples are handling their finances.

Not well, as it turns out. At least not according to the types of stories that are currently ranking highly on Google News.

Let’s take a look:

Bustle: “Is Lying To Your Partner About Finances Bad? One-Third Of Americans Say It’s Worse Than Cheating”

For once, the headline answers its own question—no, most people don’t think lying about money is worse than cheating—but I read the article anyway.

How important is it to you that your partner or spouse is honest with you when it comes to money? Is it more important to you than fidelity? While that might seem extreme, it turns out that over 32 percent of Americans feel that their partners being dishonest about finances would be worse than cheating.

I can see the logic here. In one case, you have to deal with dishonesty and the decision to either end the relationship or rebuild trust; in the other case, you have all of that plus a financial loss.

(I guess one partner could be lying about having more money, but they’re usually lying about having less, or overspending, or having more debt, or something like that. They could also be lying about the money they’re spending on the person with whom they’re cheating!)

Despite the fact that honesty about finances is so important to one-third of Americans, it turns out that there are a lot of people who aren’t being honest with their spouse or partner about money. Ten percent of people surveyed reported having a secret credit card or bank account that they used to spend money without their partner knowing, and more than 37 percent of people withheld information from a spouse or partner about spending on discretionary items such as apparel, accessories, electronics, and entertainment.

I’m assuming these are people who have separate bank accounts, because it’s hard to lie about how much that outfit or video game system cost when your bank keeps an online tally of everything.

And, on the subject of sharing money between separate bank accounts:

Forbes: “Could Venmo Hurt Your Relationships? Yup, Says Expert On Social Status. Here’s Why”

This is my second favorite headline of the day—I love the casual “yup”—and please note that it also answers its own question and then immediately promises a new answer to a new question. Tell us why, Forbes!

[Social status expert Cameron Anderson] says that while social media has become a key component of how many people manage their status among friends and peers, the difference with sites like Venmo is that they allow people to emphasize transactional aspects in relationships. And that, he says, is likely to erode them.

Venmo allows your social network to see your transactions in real time; someone paid a friend for their share of a bar tab, someone else paid their rent, someone else donated to a charity. The problem? People might engage in performative spending to increase their social status.

“If Venmo allows you to ‘show off’ all your activities in the same way that Facebook or Instagram does, then that it could be one new way to enhance your status,” [Anderson] said. “For example being very active, socially connected, philanthropic — these are all behaviors that are socially valued and therefore can boost someone’s status in the eyes of others.”

To be fair, you don’t have to be on Venmo to feel pressured to perform spending. Twitter and Facebook also constantly urge people to pay attention to causes and donate accordingly—and when I donate, I feel like I need to share that information publicly, so the world will know I care.

But this type of behavior has been around forever, right? Before there was social media, people carried tote bags or displayed bumper stickers to show their financial allegiance to various non-profits. Venmo may escalate this type of performative spending, but it certainly didn’t invent it.

Also, that article wasn’t really about relationships and money. Let’s try one more:

Time: “This One Simple Tool Could Save Your Relationship”

What is it, Time? Is it… wait, it’s the Nash Bargaining Problem? Seriously?

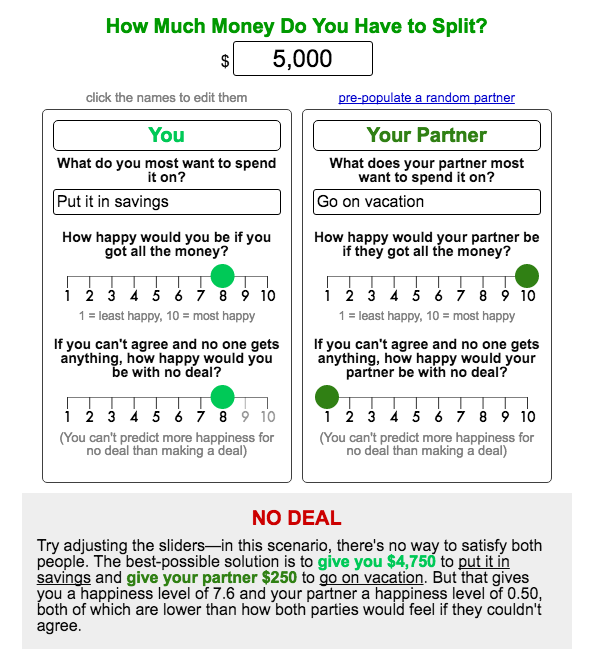

Nash’s formula is one of many noted by Wellesley College mathematics professor Oscar Fernandez in his recent book The Calculus of Happiness, which surveys a wide variety of ways that mathematics can be used to improve decision making and general well-being. The way it works is simple: Whenever two people are deciding how to divvy up a shared resource, they each just have to rate how happy they would be if they got all of it, on a scale of 1 to 10, as well as how happy they would be if they can’t reach an agreement and have to give up without either person getting anything.

The way it works is simple, as long as you aren’t in a relationship with somebody who is trying to manipulate the game. Also, Time includes an interactive Bargaining Problem interface, and I put in numbers at random and was told “there’s no way to satisfy both people.”

If you’ve ever used the Nash Bargaining Problem to solve a relationship dispute, let us know!

This story is part of The Billfold’s Money and Relationships series.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments