Why I Quit Using “Plastic Money”

When I was seven years old, my parents divorced. I would say we were probably lower-middle-class at the time, although my second-grade brain thought otherwise. My second-grade self also didn’t realize that my parents would each have less money. Our family went from a two-income household to two homes with a single income apiece.

Times were tight, but it didn’t register with me. I would ask my mom for something and she would tell me we couldn’t afford it. My response? “Just write a check for it.”

I thought as long as you had checks you could buy anything you wanted. It didn’t click with me you had to have money in an account. I figured as long as the bank itself had money we could use it.

That’s a cute thought for an eight-year-old. Rainbows and unicorns and money that grows on trees. But I didn’t grow out of that mindset until very recently—and it’s been a long and bumpy road since. (Really long. Really bumpy.)

Everyone hits a point in life when he/she decides that something needs to change. Mine came when I realized how many purchases I was making with “plastic money.” I’m not talking about my credit card. In fact, according to Bloomberg’s latest figures, average credit card debt is $16,000 and I’m way below at $4,000. Go me!

That doesn’t mean I don’t have plenty of personal debt, though. When I add up three parent student loans, a personal loan for medical bills, car payment, and personal business loans from two family members—and the credit card—I’m up around $42,000.

It wasn’t like I wasn’t trying to pay down my debt. I had a payment schedule for each of the items listed above. But I wasn’t paying as much towards my debt as I wanted. Something was still sucking money away.

It was my debit card.

Yes, debit—not credit—has been my demise. “Plastic money” is so easy to use. Get a Starbucks coffee. Swipe. Impulse-buy a cute new dress at Target. Swipe. Go to Lush to pick up one item and buy three instead. Swipe.

It’s that whole out of sight, out of mind thing. Even though I looked at my bank account daily, it didn’t register until after I got home and realized that once again I would be limping to the end of the month, trying to make it to payday.

I finally got tired of limping.

I cannot take credit for the move I made away from my debit card. I owe the idea to The Minimalists, Joshua Fields Millburn and Ryan Nicodemus. They use cash for as many purchases as possible. And, I decided it was time for me to do the same.

I still use my debit card for online payments, but when it comes to anything I physically buy, I’ve become a cash-only girl. I wish I could say the transition has been easy, but that would be those rainbow and unicorn thoughts again.

Still I’ve changed my online habits completely. I used to cruise Amazon almost daily to see if there were any good deals on running shoes (my current ones are fine) along with any other items I thought I needed. I quit downloading books to my Kindle, another hidden purchase I didn’t realize was adding up. There are some small businesses I like to patronize, and while they have websites where I could easily use my “plastic money,” I’ve opted to go to farmers’ markets where I can pay cash and still support them.

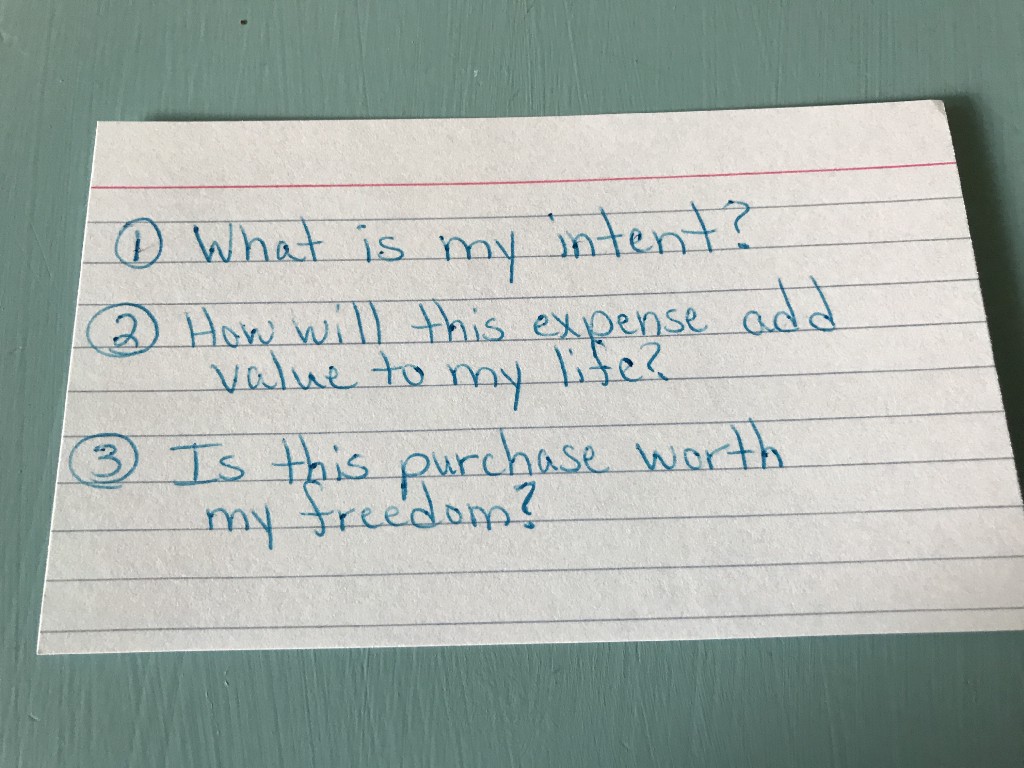

In addition to putting those measures in place to help me be more successful, I have started asking myself three very important questions before I make a purchase.

And when I say I ask myself these questions, it isn’t lip service. They are actually written on a notecard and are placed in my wallet. Before I get out of my car, I read them before going into the store. Seriously.

What is my intent?

This question has been a game changer for me. I ask myself why I’m making this purchase. What need does it fulfill? I’ve become so much more intentional with my buying habits. I write out a list when I go to the grocery store. If it’s not on the list, I don’t buy it. This keeps me from making impulse purchases. If I really need that item, I have to go back on another trip to get it. (Kudos again to The Minimalists for this idea.)

It also makes me think about the cash I have with me. Every time I put an item in the basket at the grocery store, I mentally add up the approximate cost to make sure I have enough cash with me. If I don’t, then some of those items go back on the shelf.

Yes, it would be easy “just this one time” to use my debit card to help out, but we all know how that ends up. Using the card one time makes it then okay to use it the next time, and so on. It’s all or nothing.

How will this expense add value to my life?

I know I sound like a broken record when it comes to The Minimalists, but I believe in giving credit where it’s due. They are big on talking about what adds value to our lives, and answering this question has been a game changer for me.

This question has saved me from frivolous purchases of things I don’t need. I’m working to rid our household of the frivolity. Do I need a purse for each season of the year? Uh, no. I need one purse and that’s it.

I’ve stopped buying the “just in case” items as well. You know, buying an item that’s on sale just in case I might need it later. Instead of filling my home with just-in-case stuff, I only buy items I’m going to use immediately.

When I put gas in my car, I think about how getting me to my destination adds value to my life. It also makes me think about whether or not I need to make that extra trip to the grocery store. Do I need to go to the gym today or can I take a walk in my neighborhood instead to get exercise? I can make a tank of gas go a lot further now that I’m thinking about whether I really need to make the trip.

Is this purchase worth my freedom?

This question shakes me to my core. I’d never considered a $4.00 coffee as something standing between me and freedom.

But, when you’re in debt, those small purchases do keep you from becoming debt free. When I spend $4.00 on a coffee, that’s less money I can put toward debt repayment.

You might respond with, “But you gotta live. Give yourself a break and have a coffee once in awhile.”

And to be honest, I do. But I really make sure it’s worth it and I don’t let it become a domino effect. The big purchases are easy to say no to. Would I like a new pair of running shoes? Yes, but right now they aren’t a necessity. The price tag is enough for me to say, “I’m good with the pair I have.”

The tricky part is the little purchases. They are the ones that sneak up on you, and before you know it you’ve dropped a ton of money unintentionally. One coffee might not seem like a big deal, but if that one coffee turns into four or five during the week, then it’s closer to $20.00. That’s a bigger deal.

I keep reminding myself that each time I tell myself a purchase isn’t worth my freedom, I’m saying yes to moving closer to becoming debt free.

I’ve traded in my debit card for cold, hard cash. I take $100 out and make it my goal to spend only that much during the week. My $100 needs to pay for groceries, gas, and anything else that might pop up (like a nephew’s birthday present).

As the week progresses, I have to make some tough choices. One week, I had $14.00 left and still had three days until the next time I could get more cash. I wanted to go out to lunch with a friend, but I also needed gas in my car. The old me would have swiped the debit card to fill up the gas tank and then gone to lunch. The new me bought the gas and rescheduled lunch for another time.

Making the habit change and the mindset shift have already made a difference. I can’t wait to see how much debt I crush before the end of 2017!

Christine Denker is passionate about writing, consulting, and adding value through simple living and positive vibes. Check out her blog, Everyday Life Uncluttered. You can also follow her on Twitter at @gettoit11.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments