I Keep Trying to Roll Over My 403(b) and Things Keep Getting In the Way

This is a surprisingly complicated process.

Here is the latest update in my adventures in rolling over my 403(b) into a traditional (rollover) IRA:

I haven’t done it.

This isn’t for lack of trying. I have tried! I have done many things!

First, I opened a traditional (rollover) IRA through Capital One Investing. But I screwed things up by listing myself as “employed” and my employer as “self,” when they really wanted me to list myself as “self-employed.”

That problem was easy enough to fix, but then I had to wait three business days for them to confirm the change to my account profile.

Which, again, no big deal. I waited, and my IRA is now set up and ready to receive rollover funds.

Then I started the process with TIAA. They informed me, through a series of menus and pop-ups and linked PDFs, that I could definitely do a rollover, but I should also consider my “alternative options for receiving income” as well as all of the tax implications, and I carefully read through all of that stuff, including the PDF that was trying to sell me on annuities. (Nope.)

Finally, I got to the part of the website where I could do the rollover. Should be easy, right? Type, click, select the direct rollover option and not the one that you have to manage yourself within 60 days, DONE.

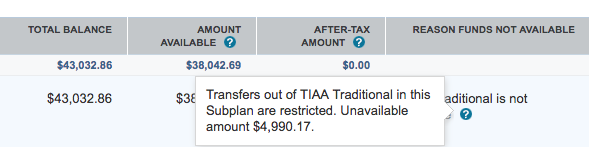

Except TIAA told me that not all of my 403(b) was eligible to be rolled over. I would have to keep nearly $5K of my funds in something called “TIAA Traditional.”

So it was time to go learn what that was. Apparently, it’s an annuity.

How Does the TIAA Traditional Annuity Work? | TIAA

TIAA Traditional is a guaranteed annuity issued by Teachers Insurance and Annuity Association of America (TIAA) that is designed to be a core component of a diversified retirement savings portfolio. It has helped prepare millions of people like you with a solid foundation for retirement.

I have a vague sense that annuities are bad, and I think I picked that idea up from that Last Week Tonight segment about fiduciaries:

Yeah, John Oliver shares a Suze Orman clip where she suggests that annuities are often better for financial advisers than they are for you, so I wasn’t making that up. We’ve also discussed annuities on The Billfold:

5 Times You Don’t Need a Financial Advisor and 2 When You Actually Might

There are a bunch of insurance agents in the world who are also licensed to sell investment products. Many of them will try to sell you whole life insurance, annuities, and other vaguely investment-like products, touting a variety of different benefits they could potentially have. This almost certainly will not be a good idea.

Why is it a bad idea?

[…] most investment-like products offered by insurers aren’t nearly as cost-effective or flexible as simply investing your money directly.

Yes. Investing my money directly. The very thing I am trying to do here.

So now I have to figure out if I can get my $5K out of TIAA Traditional. I’m also very curious how many fees I’m paying on TIAA Traditional, which is a piece of information that TIAA is not very interested in showing me—I can see expense ratios for my other investments, such as CREF Equity Index R1, by hovering over them, but when I hover over TIAA Traditional, I get the message “Investment preview is not currently available. Please click the investment name for more information.”

I clicked the investment name. I kept clicking. I read even more PDFs. Then I gave up and Googled “TIAA Traditional expense ratio.” That got me to a PDF titled “Frequently asked questions about TIAA Traditional Annuity,” and this information:

TIAA Traditional is not an investment for purposes of federal securities laws; it is a guaranteed insurance contract. Therefore, unlike a variable annuity or mutual fund, TIAA Traditional does not include an identifiable “expense ratio” or “fee” like you might see published for a mutual fund or a variable annuity.

[…]

TIAA receives income from the investments in its general account and pays guaranteed interest and any additional interest to participants. The difference is referred to as “spread” and this is what TIAA has available to cover the expenses and risks described above.

Okay. That’s both useful and useless information.

Also, I discovered that many of my 403(b) investments, such as the CREF Equity Index R1 investment referenced earlier, are actually variable annuities. Good to know. (Suddenly, that PDF trying to sell me on annuities makes a lot more sense.)

I think I’m at the point where I actually have to call a TIAA representative. I want my money out of these high-cost annuities and into a low-cost index fund, and I may have to brave a phone call that will no doubt include a sales pitch to do it.

[UPDATE: It turns out there’s a lot I don’t know about TIAA, annuities, and 403(b)s. I’ll have more information for you next week. Let’s all learn together!]

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments