What Would Happen if the Fiduciary Rule Were Revoked?

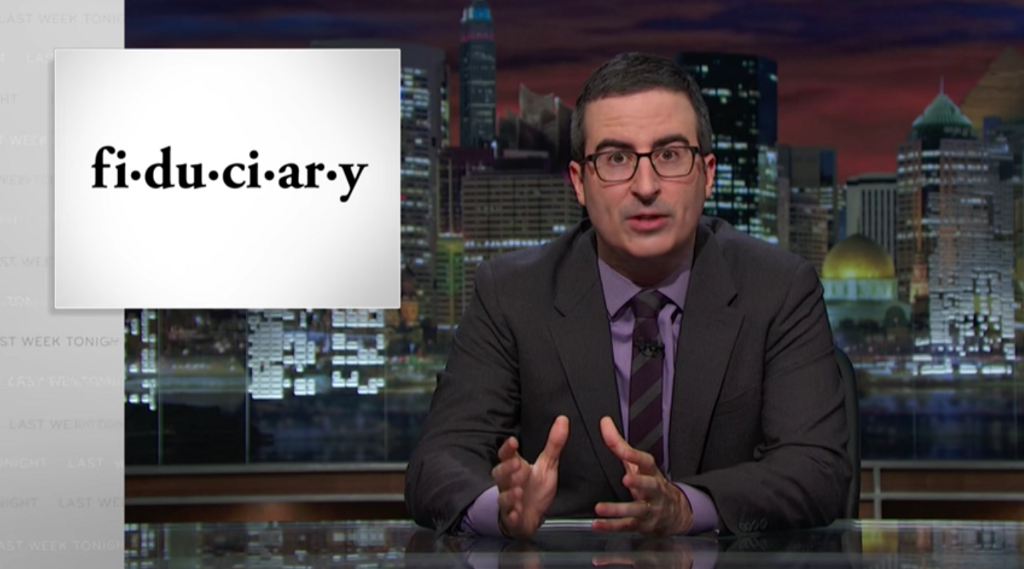

John Oliver did a whole thing on this, remember?

I don’t want to be all politics, all the time, but I couldn’t skip over this story. Call it “the personal finance is political.”

Trump calls for review of long-awaited rule meant to protect retirement savers

President Trump on Friday signed a memorandum asking the Labor Department to review a contentious rule meant to protect retirement savers from receiving poor investment advice. Out of all the regulations that Trump has taken aim at since taking office, this is the one that could impact consumers’ wallet the most, as it directly impacts the advice brokers give to ordinary investors.

The regulation, known as the fiduciary rule, was finalized last year by the Obama administration and requires brokers working with retirement savers to put their clients’ interest ahead of their own. Critics of the regulation said the rule could limit options for investors and raise costs for financial firms.

It might cost more to put retirement savers’ interests ahead of brokers?! How terrible.

If you didn’t get a chance to watch last summer’s Last Week Tonight with John Oliver segment on why fiduciaries are important, here it is again:

The tl;dw? If your financial adviser is not a fiduciary, your adviser might suggest you invest in products that earn high commissions (for the adviser) but aren’t necessarily the best options (for you).

Regardless of what happens with our current fiduciary rule, the NYT’s Ron Lieber offers some good advice:

Fiduciary Rule Is Now in Question. What’s Next for Investors.

First, check the background of anyone who wants to do business with you. Look up their name on the internet and read past the first page of results, way past. Ask where you can find their disciplinary records. Check them yourself on Finra’s BrokerCheck website.

Then, have a conversation. Demand that they take a fiduciary pledge to act in your best interest. Then, ask your investment professional how compensation works. How does money flow from you to them? Is the firm paying them anything extra in exchange for pushing you toward certain investments? What about the company that created the fund or product?

I’m not so sure about the “demand that they take a fiduciary pledge” thing— I mean, people aren’t really going to come in with pledge in hand and say “take this or I walk”—but I always support both background research and communication.

Are you worried about the Trump administration revoking the fiduciary rule? Or are you more like “nobody said investing was risk-free?”

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments