Planning for an Uncertain 2017

Ron Lieber asks us to consider two questions.

This week, The New York Times’ Ron Lieber asks us to consider our finances in what is very likely to be an uncertain future, and to ask ourselves two questions:

- How much money is enough for our needs?

- Is our current spending aligned with our values, or do we need to make some adjustments?

The idea is that you can combat uncertainty and anxiety by knowing how much—or how little—money is enough, and by focusing your future spending on your values. (Lieber does acknowledge that not all of us are going to earn enough to begin with, and I’ll reiterate that acknowledgement.)

But before you can figure out whether you’re spending according to your values, you have to figure out where your money is going right now:

One Money Question to Rule Them All: How Much Is Enough?

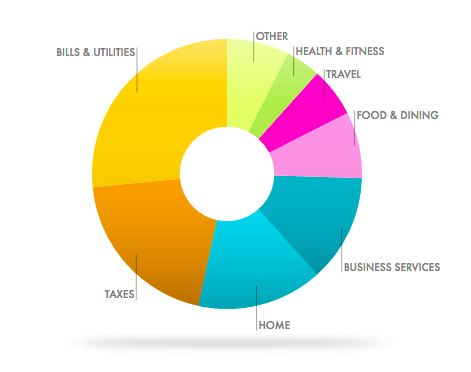

How much do any of us really know about what our spending, saving and giving add up to? Could we draw an accurate pie chart that reflects a year of household outflows?

I couldn’t draw one myself without looking up a bunch of numbers, but I can get Mint to draw one for me:

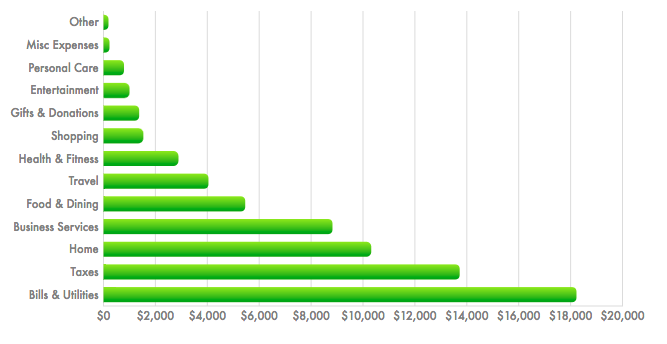

That pie chart is a good start, but it doesn’t really tell me much about my spending. Let’s switch to a bar graph:

The reason “Bills & Utilities” is so high is because, when I set up my Mint account, I tracked credit card and loan repayments as “bills.” (It made sense at the time.) So, if you look at this bar graph as a reflection of my values and/or spending priorities, you get a a really accurate picture of what I value, right now:

- Debt repayment. (I am currently debt free, so this bar will look a lot smaller in 2017.)

- Freelance taxes. (Obviously.)

- Rent. (This bar also includes minor home expenses, but it’s mostly rent.)

- Savings. (Mint doesn’t include savings in its expenses breakdown, but since I put 10 percent of my pre-tax freelance income into savings, it would fit right here.)

- My freelance business. (You have to spend money to make money.)

- Food. (This bar includes both groceries and restaurants, and if you break it down I’m spending about three times as much on groceries as I am on restaurants.)

- Travel. (After food, my next biggest line item is “spending time with the people I love.” This is all personal travel; business travel is under “business.”)

- Health. (The majority of this bar represents health insurance premiums.)

- Shopping. (When you open up this bar and look at the individual transactions, it’s nearly all clothes and books.)

- Gifts and donations. (This bar is nearly equal to what I spend on clothes and books.)

- Entertainment. (Streaming media, concerts, etc.)

- Personal care. (Haircuts and massages.)

- Misc and other.

I’m actually very happy with this breakdown. I put the majority of my earnings towards either basic needs and expenses—rent, food, bills, taxes—or long-term goals like getting out of debt, saving, and growing my business. I love that travel is so high up in the breakdown; I also love that when I open up “shopping,” I see mostly clothes and books. I’m not spending money on stuff I don’t want, and I’m definitely not spending money on stuff I don’t value.

So that’s the answer to Lieber’s second question. What about the first one? How much is enough, for The Year of Our Uncertain Future 2017?

Since I’m no longer making debt repayments, I could take an income hit next year and still cover all of my basic expenses. If I have unexpected new expenses, I’ll have savings to help cover the gap.

Still, I’m really hesitant to name an enough number. My freelancing work has always been about growth; how to make my income higher this month than it was last month. I know that continuous growth is unsustainable and that I should expect income dips and plateaus, but I don’t want to say the enough number because I’m afraid I’ll make it come true. I want to say the number that I really want to earn, which is twice as much as “enough.” It’s “enough plus comfort plus saving for the future.”

So… I want to earn another $80,000 in 2017. That’s enough for me, it’s enough for my future, it’s enough to spend time with the people I love, and it’s enough to support the causes I believe in. To spend even more on those causes. To buy more books. To get a new sofa.

What about you? If you were to compare your spending to your values, would you be on target—and do you have an enough number?

More importantly, does knowing this information make you feel less anxious about our uncertain financial future?

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments