Even More Thoughts on Investing

Is it better to invest in the market, or in myself?

I know this sounds too unbelievable to be true, but I literally woke up this morning—a few minutes before my alarm—thinking “BUT NICOLE, $500 times 12 months is $6,000, so the majority of that investment you were describing yesterday will be your own contribution.”

I’ll back up.

Yesterday, I outlined how much a proposed investment could grow over the course of a year:

More Thoughts on Investing: What Is My Goal?

If I invest $3,000 to start, add $500 every month, and get a 7 percent return, I’ll have $9,630 at the end of the year according to Dave Ramsey’s investment calculator. Which is way better than keeping cash in a savings account, but it’s not down payment money. It’d take, like, five years of consistent investing and a 7 percent return to get that much money.

And yes, as I seem to have discovered while sleeping, $9,000 of that $9,630 will be my own contribution. The return on my investment, over the course of my first year, would be $630.

Which feels… well, it feels like if I wanted to earn an extra $630 in a year, I could hustle for it and not have to deal with the risk of an investment.

Obviously the magic of investing is what happens long-term, not what happens in the first year, so I dropped some more numbers into Dave Ramsey’s investment calculator (which I chose because it was the first Google search result for “investment calculator,” natch) and discovered that, should I continue with this plan of investing $3,000 and then adding $500 every month, I might have $41,127.41 at the end of five years if I got a 7 percent return every year.

$33,000 of which would be my own hard-earned money.

I also know we’re kinda supposed to estimate a 6 percent return, not a 7 percent return, so… in that case I’d have $39,866.58 after five years, and the first $33K would still be my own money. I’d only earn $6,866.58 in returns.

Which, again, is better than nothing. Certainly better than savings account interest. But for the first two years of investing I’ll earn less than $1,000 in returns per year, and for the second two years I’ll earn less than $2,000 in returns per year, and I’m still kind of thinking “well, if I wanted to earn an extra $1,000 or $2,000 every year, I could do a little more freelance work, which would probably boost my career and help me earn even more money over time. Plus, I wouldn’t be at risk of losing money if the market dropped.”

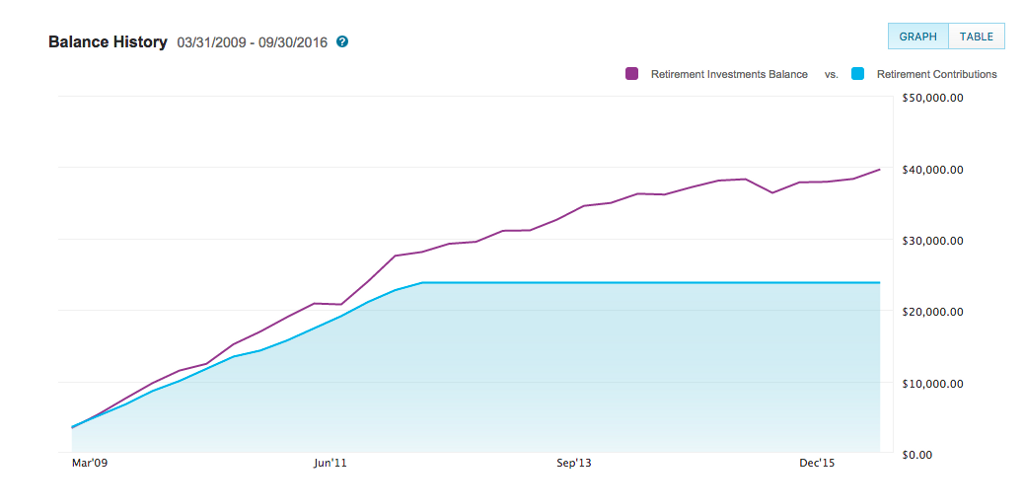

How much money might I lose, over five years? I can’t predict the future, but I can look at the past, thanks to the 403(b) I opened when I worked for a non-profit.

This seems to be a clear argument for the power of investments, even when you’re no longer making contributions to the account. TIAA-Cref tells me that my five-year rate of return has been 9.4 percent, which is no doubt because we had a couple of really good years in there (in 2013, my rate of return was 17 percent).

It’s also worth noting that I started this job in 2008—that is, right as the stock market was imploding—and would have opened the retirement account shortly afterwards. I bought low without realizing it, and got lucky.

Hmm. I was totally ready to conclude this with “maybe I would be better off investing in myself,” but that’s not what the numbers are showing me.

Let’s see what I wake up thinking about tomorrow.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments