Homemade Mead on a Beer Budget

How we went from destitute to having $20,000 banked in just over a year

On June 1 of last year, our two-week-old son was in the Special Care Nursery. My husband and I were unemployed. We owed 8943 AUD on the mortgage of a vacant seven-acre block, and we owed my dad 4000 AUD for a vehicle we’d bought for the professional beekeeping dream that had died a slow, painful death over the previous year.

Having a Baby When You’re Broke

Meanwhile, the vehicle had died a rather sudden death and taken the money we’d invested in it to the grave.

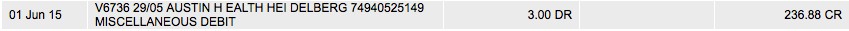

In our savings account, there was a piddling 236.88 AUD, and we didn’t know for how long we were going to have to make that last. We’d put in the paperwork for the Newborn Upfront Payment (a government handout everyone gets for reproducing), but it can take weeks for those payments to arrive. The stress at that point was suffocating.

Fast forward to August 12 this year: we have jobs, a house, and 20,000 AUD in our Fuck Off Fund (FOF).

We’ve gone from having not-so-great and bad debt (a property verging on unsaleable and lemon VW Transporter, respectively), to what we consider acceptable debt: a house we can live in, or could rent out if desperate, and will likely be able to sell for more than the purchase price.

All of this was achieved while only just keeping our heads above Australia’s poverty line.

The secret? Getting some means and then living well below them.

The hunt for an income

We began applying for unemployment benefits for my husband Rohan while our son was in the hospital. I say ‘applying’ but ‘fighting’ is probably more appropriate. The first Centrelink person Rohan spoke to said because of his unusual situation — being stranded interstate with a premature baby in Special Care, which resulted in Rohan losing his sole source of income, a situation complicated by the fact that he’d been a contractor, not an employee — he wasn’t entitled to any payments.

We persisted. Days we spent with our son in the hospital; evenings we dedicated to calling Centrelink and filling out paperwork. Eventually, after weeks, Rohan got Newstart Allowance and, after a kind customer service soul told me I could be eligible for it, I got the Parenting Payment.

At the end of June, our son was strong enough to come home, and we began our search for work in earnest. I’d done small amounts of freelance writing on and off for a while and decided to focus on that because it could be done while caring for a kid full time.

Rohan’s job search involved applying for everything. We live in a small rural town, population approximately 2500, with a scarcity of work opportunities and it’s often a case of “who you know” when it comes to employment here.

After finding some casual work, which he hated, Rohan cold-contacted a local metal fabrication business to see if they had any work available or would consider offering him an apprenticeship. As luck would have it, only the day before they had been talking about taking on another apprentice. Rohan went in the next week for a trial and came home Friday night with an apprenticeship. That was in October last year.

Digging ourselves out of debt

After our son was discharged from hospital, living below our very humble means meant, for a few months, home was a caravan on my dad’s farm.

We spent the end of winter freezing our butts off in a poorly insulated 11 square metres. By the time we got a cot in, there wasn’t much room to move. The bed was way too small for safe co-sleeping with an infant (Rohan and I barely fitted), so on icy nights, one of us stayed awake holding the baby to keep him warm.

During those uncomfortable months in the caravan, we bought the essentials, food and phone credit and not much else, and threw every other cent at our debts. By mid-November last year we had cleared the property mortgage and repaid my dad.

Once we were back in the black and had a stable, albeit small, income, we began to look into buying a house. I did the maths and decided we could afford a 200–250,000 AUD home loan. Being in a rural area where cheap real estate is still a thing, there were plenty of options in that price range.

We asked the banks, to no avail. Then a family member offered to loan us the money. At first, we were very reluctant to accept the offer. But with careful consideration, many discussions, solicitors, and contracts, we went ahead with it. I won’t go into detail here out of respect for the privacy of the other party, but it’s not charity: they get a good return on their investment and, should we be unable to repay the loan, they get the house.

Our means

Once Rohan got the apprenticeship, and I’d picked up some steady freelance work, our weekly earnings looked roughly like this (my income fluctuates a lot, so I’m using a weekly average from the 2015–16 financial year):

- Rohan: $563 (after tax)

- Me: $185 (after expenses)

- Family Tax Benefit (a tax-free government payment that varies depending on income/number of children; you have to earn a lot before you’re ineligible for this one): $154

- Trade Support Loan (an interest-free loan certain apprentices are eligible for, repaid through the taxation system when income reaches a threshold): $166

So, in total we have about $1068 net coming in on average each week.

Our budget

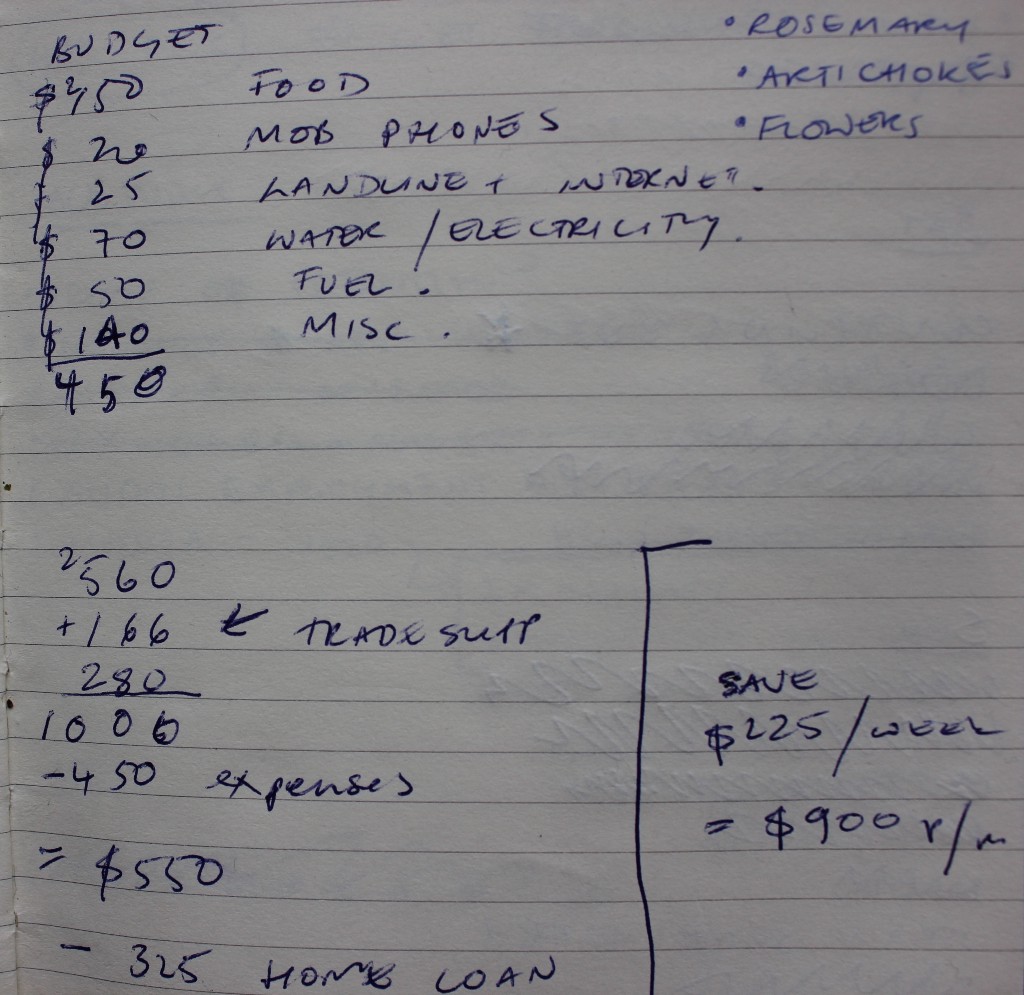

The last time I drew up a budget, just before we purchased our house at the end of last year, it looked like this:

I take care of the money and Rohan takes care of the cooking. Luckily his culinary skills are far better than my financial planning skills.

So, as far as I can make out, this was the weekly budget I planned:

- Food: $150

- Phone credit: $20

- Internet & landline: $25

- Water & electricity: $70

- Petrol: $50

- Misc: $140

Household expenses total: $450

Home loan estimation: $325 (it’s actually $315)

Total earnings estimation: $1000 (so, I was pretty close)

Savings: $225

Drinking homemade mead on a beer budget

If you hadn’t already guessed, my method of budgeting involves barely-legible scribble and very vague adherence. If you’re asking yourself how on Earth this worked, don’t worry, I’ve been asking myself the same question.

The thing is, it has worked.

On February 1 this year, we started our FOF with 1500 AUD with the aim of getting to 10,000 AUD by the end of the year. A touch over six months later, on August 12, it reached 20,000 AUD with a boost from Rohan’s tax return.

It seems we’ve spent less than I’d allowed for in my calculations. As long as we’ve been saving a satisfactory amount, I’ve taken an “if it ain’t broke, don’t fix it” approach to budgeting.

I’ve come to the conclusion that our ability to easily live below our means without strict budgeting or tracking of finances (I couldn’t tell you how much we spent last week) can be attributed to three main factors.

- Our approach to buying inessentials. We rarely make purchases on the spot and often find after a few days the desire to buy an item has faded. All inessentials also have to pass the “how much use will we get out of this” test. If the answer isn’t “a shitload,” it’s a no-buy. Even plants have their usefulness heavily scrutinized before we spend money on them. For example, we chose olives for a screening hedge at the front of the house because they’re low maintenance, attractive, and produce edibles. A plant that ticked only one of these boxes wouldn’t have made the cut.

- Our high threshold for self-deprivation. After some of our past living conditions, hot running water and an indoor toilet are all we need to feel like we’re living in the lap of luxury. Being able to buy pizza on a Friday night once a month is our idea of the high life. For us, a fun weekend is pottering around in the garden or going for a walk in the bush to look for cast deer antlers. We don’t feel like we’re missing out if we can’t buy expensive clothes or eat in restaurants every week or drive a beaten-up old car, which permanently smells like dog.

- Our deep desire for self-reliance. Our pride was gravely injured by having to rely on the government and family for help. We don’t want to wind up in that sort of mess again.

Independence is of great importance to us. We want to be able to take care of ourselves, and we enjoy making what we need from scratch. That goes for everything from meals to cosmetics. Growing our own food is something we’d do even if we won the lottery jackpot tomorrow (not that we’d waste money on tickets) and I still cut my own hair.

We drink homemade mead on our beer budget and the honey it’s made with comes from our beehives.

We also hoard jars. You can never have too many jars.

What’s next?

Rohan will finish the first year of his apprenticeship soon, which will mean a pay rise. My freelance income is slowly and steadily increasing, and while my laissez-faire budgeting style has worked for our personal finances, I do need to take a close look at how I can improve my earning capacity.

We’ll continue to spending in much the same way as we have been even as our income grows. We like how we live, we’re more than comfortable, and I don’t want to fret over tracking expenses. We did enough worrying last year to last us a lifetime.

As for the FOF, we’ll maintain it at 20 grand, and anything above that will be put in a separate account to be dumped on the home loan. Our vacant seven acres is on the market for 65,000 AUD, it could take years to sell, but when it does it’ll be a bonus. That money will go straight to the home loan, too.

We have a 10-litre demijohn of mead brewing in the laundry, and when it’s ready to drink in a month, we’ll have a glass or three to celebrate no longer being a financial disaster area.

Emily Friedel is a freelance writer based in Victoria, Australia, who enjoys eating the odd pizza and not being broke. You can follow her on Twitter via @ej_friedel

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments