Does Starbucks Give You More for Your Money Than a Bank Does?

MarketWatch reports that we deposit more money into Starbucks cards than we do into some banks. Let’s see if the Starbucks card is the smarter financial choice.

Where are we putting our money these days? A lot of us are adding value to our Starbucks cards—and that value adds up.

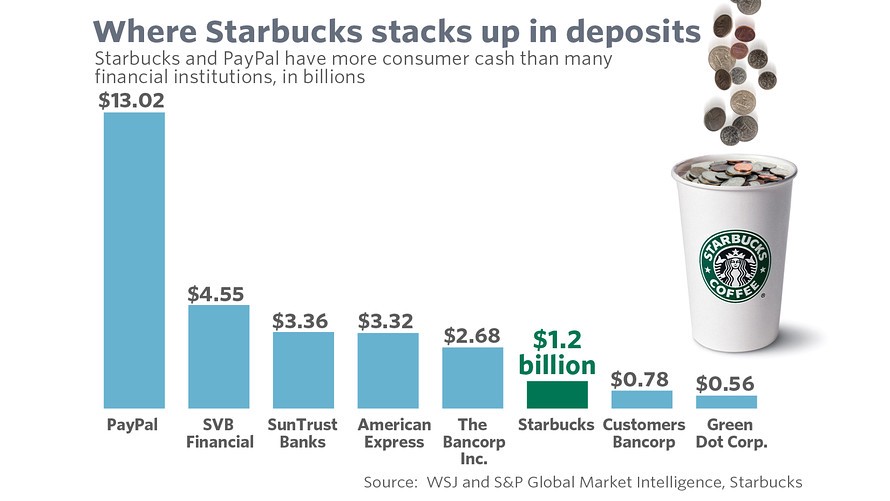

Starbucks has more customer money on cards than many banks have in deposits

MarketWatch reports that “as of the second quarter of fiscal 2016, 41% of Starbucks transactions in the U.S. and Canada were conducted using a Starbucks card (24% of transactions at company-operated retail stores U.S. used the Starbucks mobile app),” and gives us a chart comparing Starbucks card deposits to actual banks:

Now, to be fair, Green Dot Corp. isn’t exactly what I’d call a “bank,” and you might remember Kelly Clay’s article on the month she tried to buy everything with a Green Dot prepaid Visa card:

Prepaid Cards Are Only Loaded With Problems

Also, Customers Bancorp only operates in five states and has literally 20 locations. So yeah, of course Starbucks is going to beat that.

The most interesting data on that chart is the PayPal data, but let’s leave that analysis for another day and ask ourselves one question: does Starbucks give you more for your money than a bank does?

A Starbucks card functions in many ways like a checking account: you deposit money now so you can spend it later—and sure, you can only spend it on Starbucks, but when you do choose to spend your Starbucks card dollars, you earn Star Rewards which can then be redeemed for free Starbucks products. You’re also automatically entitled to free refills and a “free birthday reward.”

I would argue that your Starbucks card pays better than any checking account interest rate out there.

My Capital One 360 checking account, for example, pays 0.20 percent APY for all deposits under $50,000.

The Star Rewards program gives you two stars for every $1 you spend, and you can earn additional stars on special occasions like Double Star Day. Once you hit 300 stars, you become a Gold Level member and you get a free food or drink item after every 125 stars.

So, after spending $150 to hit Gold Level and $62.50 to get your additional 125 stars, you get a free item. Let’s say it would have cost you $4. That’s not exactly analogous to a 1.88 percent interest rate, but it sure beats the 0.4 cents that might have been deposited in your checking account if you’d put that same $212.50 in the bank.

And that’s even before your free refills and birthday reward.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments