Updating My Financial Plan for 2016: This Year, I Want to Know Where My Money’s Going

In May 2015, I committed to getting my finances in shape by paying myself (and my debt, and my taxes) first, and subdividing every freelance check I received as follows:

- 20 percent towards debt repayment

- 20 percent towards taxes

- 10 percent towards savings

- 50 percent towards rent+bills+food (aka “overhead”), professional, and discretionary expenses

This system worked out reasonably well. (Yesterday, I called it “the smartest thing I did financially in 2015.”) But it’s a new year, so I want to update this plan to meet my 2016 financial needs.

As stated in my Best Self in 2016 post, my financial needs and goals are:

- Getting myself debt-free ($8,364.08 to go)

- Getting three months of living expenses in an emergency fund ($1,795.82 to go)

- Putting $5,500 into a Roth IRA ($5,500 to go)

- Covering my $1,800 overhead cost ($1,800 to go, every month)

- Having $1,000 left over every month to spend on discretionary and professional expenses ($1,000 to go, every month)

I’ll need a minimum of $59,317.66 in 2016 income to achieve that goal, which is a number that feels very achievable but is also ridiculously out of my control. Clients adjust their budgets, they change their publication strategies, etc.; and even though part of the responsibility is on me to continuously find new (and higher-paying) clients, there is no way I can say for certain that I will hit this number. The odds are in my favor, but still.

This means that I can’t bank on getting that $1,000 of discretionary/professional income that I want every month. If something gets cut, that gets cut first.

This feels incorrect, because if I want this to be a growth year for me—and I do—I know I have to invest in myself and my business.

But before I figure out how much I can invest, I need to know how much I’m spending on myself and my business. I can definitely go into my bank statements and tell you that I spent $349.33 at Old Navy in Fall/Winter 2015, and I also have a spreadsheet of 2015 tax-deductible expenses, but I don’t have any real concept of how much I spend on myself (clothes, entertainment, friend hangouts, etc.) and how much I spend on my business (workshops, conventions, software, etc.) every month.

Is it close to $1,000? Is it closer to $500? I couldn’t tell you.

Which means that this year, I need to get serious about where my money is going.

At first I thought I would create a brilliant scheme where I put every different type of spending on a different credit card, and then paid each of the credit cards in full from my checking account. That way I’d know for sure how much money I was spending on discretionary vs. business expenses every month. I’d have the credit card statements to prove it!

I actually wrote an entire separate Billfold post on this plan that you will never get to see.

Then I changed my mind.

Despite the lure of the 1.5 percent cash back on my Capital One Visa Platinum card—you know, the credit card I just paid off—I don’t want to do the “use credit responsibly” thing until I have completed the “pay off all my previous credit card debt” thing.

I read Mike Dang’s post about reward cards and I know very well that my cards could give me rewards; I have a Southwest Airlines Rapid Rewards card that used to give me free flights and that I nearly maxed out (it’s got a $0.00 balance now). I could start charging to that card again and paying off the balance every month and maybe scoring a free ticket somewhere.

But I don’t feel like I can trust myself to pay off my credit card balance in full every month because I have never successfully done it. Yes, I’m earning more now and I could probably pull it off. Now is not the time to test that theory.

Instead, I decided to track my spending the more obvious way: through an app. After checking out the available options, I signed up for Level. First because it’s one of the most minimal finance trackers out there (sorry, Mint, but I don’t want to dig through all your features to find the one I need) and second because it’s part of Capital One, like my Capital One 360 bank account and my Capital One Visa Platinum, and I gotta stick with my brand.

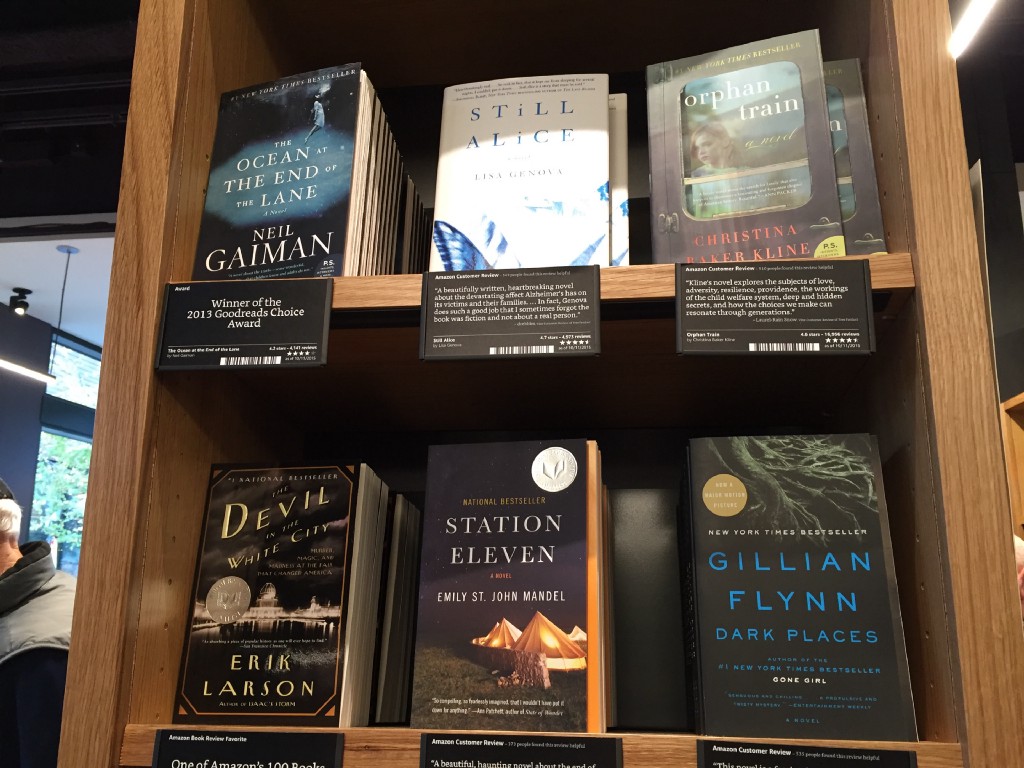

It took me maybe five minutes to set up all of my spending categories and track everything. I now know that, in the past five days, I’ve spent $52 on groceries and $242 on discretionary expenses. The groceries number seems too small (but I’m sure that’ll change), and that discretionary number seems startlingly large. What did I buy? A pair of jeans, some Star Wars IMAX 3D tickets, dinner and drinks, two books…

The discovery that I spent $242 on discretionary stuff in five days is proof that this is exactly what I need to be doing with my money this year. 2015 was all about building my financial house, as it were. 2016 is about cleaning it up, putting things in boxes, and figuring out what things I want to keep.

So, the 2016 Financial Plan, as follows:

- Continue subdividing freelance checks into 20 percent debt, 20 percent taxes, 10 percent savings, and 50 percent left over.

- As I hit each Best Self goal (e.g. debt-free), create a new plan for the money. It would be smart to set up a “holiday” savings account, for example. I’ll probably need a new laptop in a year or two, so I could start an account for that.

- Track spending categories via Level. Get a more detailed understanding of where my money is going. Decide whether I’m happy with where my money is going, or if something needs to be adjusted.

I’ll share my spending category results with you, of course. Look for the first round-up at the beginning of February.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments