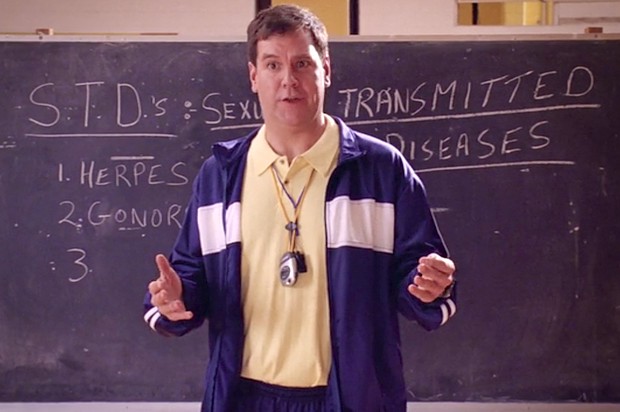

Higher Taxes, Fewer STIs

When Higher Taxes Mean Less Gonorrhea

Governments impose taxes for many reasons: to generate revenue for the state; to discourage frowned-upon behavior; to squeeze every last drop out of those insolent, musical peasants.

All legitimate! But actions can have unintended consequences, even good ones. In one recent case, raising a tax on alcohol seems to have led to a dramatic drop in sexually transmitted infections.

hiking the alcohol sales tax in Maryland helped reduce incidents of gonorrhea. After the state increased its alcohol sales tax rate from 6 to 9 percent in 2011, there was a 24 percent drop in gonorrhea rates over the next 1.5 years — preventing nearly 1,600 gonorrhea cases each year. According to researchers, there was no such drop in gonorrhea in comparable states.

“The observed alcohol tax effects (24 percent decrease in gonorrhea) are similar to effects of condom distribution (23 percent to 30 percent decrease),” the researchers found. “Moreover, condom distribution programs cost, whereas alcohol taxes generate, revenues.”

Correlation, not causation, you say. Well, hike ’em all up, I say, and let’s see. Hike up the alcohol taxes higher than hemlines in lots of places and observe whether the finding holds. As the Vox piece goes on to address in detail, a higher price for liquor seems to lead to less drinking, less violence, fewer crimes, longer lives, and less public vomiting. What do we have to lose?

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments