Turns Out Women Are Better At Running Hedge Funds

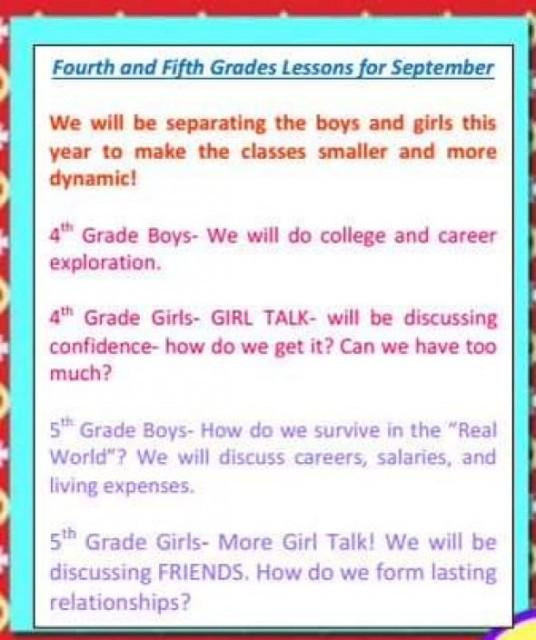

A Texas school got in trouble recently for separating its students by gender to give them different kind of life advice, Slate reports. This screenshot, originally via WPAA, tells the whole story:

4th grade boys get to hear about “college” and “career.” Girls get to hear about “confidence — how do we get it? Can we have too much?”

5th grade boys discuss “careers” (again) as well as “salaries and living expenses.” Girls discuss “FRIENDS. How do we form lasting relationships?”

That’s your shot. Here’s your chaser: it turns out that “women-owned hedge funds outperform male peers.”

women-run funds may find capital-raising more challenging than their male peers. “This finding is rather striking given that the HFRI Women Index shows that women-owned or -managed hedge funds outperform the industry as a whole.”

The authors write that in light of this disconnect, their report seeks to spotlight both women’s successes and their challenges in order to further the dialogue about women in alternatives and to hopefully continue to move the needle.

In fact, it’s not even close:

Women-owned and -managed hedge funds have outperformed both the HFRI and HFRX composites of hedge fund performance nearly every year since 2007, the first year HFR launched diversity indices. Since 2007, the annualised returns of the HFRI Women Index were 5.64 per cent, whereas the HFRI Fund Weighted Composite (”FWC”) Index had an annualised return of 3.75 per cent and the HFRX Global Hedge Fund Index of negative 0.39 per cent. …

Since 2007, the HFRI Women Index had a total return of 59.43 per cent, whereas the HFRI FWC Index had a total return of 36.69 and the HFRX Global Hedge Fund Index had a total return of negative 3.28.

Despite demonstrating not even competence but consistent superiority in this field for almost a decade, women hedge fund managers still have a hard time raising funds.

most respondents said it is more difficult for women-led funds to attract capital, with nearly half citing the stereotype that women are more committed to family and personal responsibilities than to work as a top barrier.

“Every year… respondents have said they believe it’s harder for women-owned or -managed funds to obtain capital than it is for their male-run peers,” said Kelly Easterling, KPMG audit partner and co-author of the report.

Easterling added this could be because funds run by women don’t have the same levels of visibility and investor access funds led by men.

Female-led funds accounted for a small portion of respondents’ portfolios, with 67% of investors allocating 10% or less of their portfolios to them. Nearly 72% of investors blamed the low number of funds managed by women for the low allocation.

Part of what these women are fighting against is the same deeply ingrained nonsense that makes Texas elementary school teachers think that male students should get career advice and female ones should get “girl talk.”

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments