Heavy Taxes On The Rich? 52% Say Yea

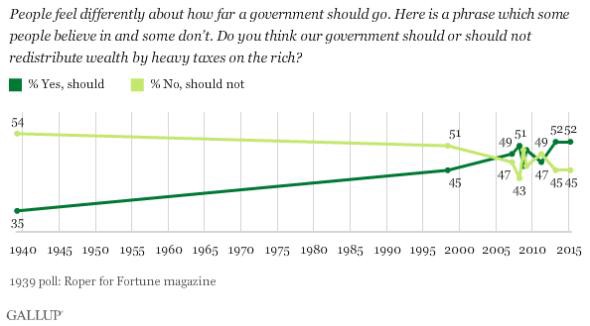

It’s always interesting to see trend lines over time making clear how our views have changed as a society. On the question of whether we, the U.S., should impose “heavy taxes on the rich” in order to “redistribute wealth,” majority opinion has varied considerably since Gallup — or, back then, Fortune magazine — first started polling folks in 1940. Pre- World War II, only 35% of respondents said sure. “Double the taxes. Triple the taxes! Squeeze every last drop …,” as Prince John would put it.

Now we feel rather differently about the rich. 52% to 45%, we think that income inequality is a problem and that, as part of the solution, the rich should pay up.

The wording of the intro is quite stilted: “People feel differently about how far a government should go. Here is a phrase which some people believe in and some don’t.” They’re the experts, of course, but I’m curious why they’ve stuck with something so awkward for so long.

The margin of error on the poll is +/- 4 percentage points, so, yes, it’s possible that less than half the country is really in favor of steep taxes on the affluent.* But Gallup has now reached the same result twice running, and these findings are in line with the outcomes of similar surveys from Pew, which has found that 54 percent of Americans think the government should “raise taxes on the wealthy and corporations to expand programs for the poor,” and that 58 percent say “upper-income Americans pay too little in taxes.”

The politics of this are unsurprising. 75% of Democrats want a government that will use its power to reapportion wealth in a more equitable fashion, along with 50% of Independents and only 29% of Conservatives, as well as 59% of all people aged 18–34. We have a strong sense of fairness, we Millennials, I guess. Will we grow out of it, especially once we accumulate more wealth ourselves? That remains to be seen.

Gallup offers more details — both on the question of whether wealth should be accessible to more people and as to whether the government has a role in making that happen:

the 63% of Americans who say that money and wealth should be more evenly distributed among a larger percentage of the people is almost the same as the 60% who said this in 1984. …

nearly half of Americans (46%) are strong redistributionists — in the sense that they believe the distribution of wealth and income is not fair, and endorse heavy taxes on the rich as a way of redistributing wealth. One in four are in essence free-market advocates — sanguine about the distribution of wealth and income and not supporting heavy taxes on the rich. Another 16% say the income and wealth distribution is not fair, but don’t endorse heavy taxes as a remedy. A small percentage have the somewhat contradictory views of believing that the distribution is fair but favoring heavy taxes on the rich.

So “redistributionists” make up a plurality of this country, outnumbering almost 2:1 the free-market true believer Ayn Rand-types. That’s interesting. Not sure that’s the proportion I would have guessed.

I also wonder about the 16% of folks who think the set-up is unfair but who don’t favor taxes as a remedy. Taxes are a blunt instrument, in some ways, to be sure; if there is a better corrective to ingrained and increasing injustice — the return of Robin Hood? — I would love to hear about it.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments