If You’re Doing Your Taxes at the Last Minute, You’re Not Alone

by Tori Finkle

I was walking home from work the other day when I realized that it had finally happened. I had reached the day where I couldn’t reasonably put off doing my taxes any longer. That got me thinking, how many other jerks are in the same boat? So, in an almost perverse fit of procrastination, I started digging around online for some data. Instead of, you know, firing up TurboTax.

It turns out that the IRS received 131 million tax returns by April 18, the Friday after Tax Day last year, and roughly 40 million of those were submitted that month. More than 18 million filers waited until the last week to send in their forms. The funny part is that I, like the vast majority of taxpayers, am expecting a refund. Nearly three out of four people get money back.

In my defense, there were some serious complications waiting for me that made the job seem extra menacing. I had to move my 2014 retirement contributions into an IRA — that’s several clicks of a button online — and I was pretty sure I’d need to call my bank to ask about a form I couldn’t find. The horror!

David Just, a behavioral economics professor at Cornell University, explained that this “hassle factor” is exactly why my brain seems so bent on avoiding this relatively mundane task, even when there are real upsides to getting it done.

“Essentially, we think about the benefits, but we weight this cost of current period hassle that we have to incur to file as being bigger than it actually is,” he said. “We weight it so big in our minds until we’re actually forced to do it by the government.”

Economists have even done the math to figure out how much money we leave on the table when we delay collecting our refund, as well as when we pay any taxes we owe before the money’s due.

One study found that taxpayers gave up more than a billion dollars in earned interest by either waiting to cash in on a refund or filing a payment too quickly. (Granted, the study looked at 1988 returns, and interest rates have plummeted to comically low levels since then. But the concept still holds.)

I enjoyed how the study summed up this instinct to put off the task: “In our model people do not leave $100 bills lying around on the sidewalk forever. However, they may leave them there for some time while they wait for a moment when bending over to get the bill is relatively painless.”

Ugh, if only that moment ever comes!

Joel Slemrod, a professor at the University of Michigan and one of the authors of that paper, seemed particularly concerned about the people who pay early.

“The one irrational thing that’s pretty clearly irrational — if you do your taxes and discover you owe money. If you owe, there’s no legal requirement to pay until it’s due,” he told me. “What, are they afraid they’re going to forget? That’s the best explanation I can come up with.”

That’s not to say those collecting a refund are the only ones procrastinating. Finding out that you’ve got an open tab with the IRS can be an unwelcome spring surprise. It may be more rational to hold onto the money you owe until it’s due, but there are certainly some among us who might be avoiding the inevitable up to the last minute because it’s a financial hit — sweating the government bill that’s finally come due.

Still, while it’s cold comfort to learn I’m not alone in my arguably illogical tendencies, I was surprised (and humbled) to realize that more than 58 million early birds filed their taxes last year by the end of February. I confess I’m more focused on the finish line than the starting gun.

“The IRS doesn’t send you a bill in February or March or even in April. But most everyone knows April 15is the deadline, so then we really have to engage and get it done,” said Elaine Maag, a senior research associate at the Tax Policy Center in Washington, D.C.

But to their credit, the early birds are getting some pretty fat worms. The average refund in the first few weeks of tax season last year was $3,300, and that figure fell to $2,700 by the middle of April as more people submitted their returns, meaning that the fast filers had bigger refunds to look forward to receiving. Maag added that those who file early often do so because they need the money and may be eligible for certain credits, like the Earned Income Tax Credit. It makes sense that the more you’re looking to get back and the more crucial the money is to you, the more likely you’ll file early.

The ability to file in late January and February is “fortuitous” for families struggling to make ends meet, Maag said. By early in the new year people are anxious to pay off any deferred heating bills they’ve accrued over the winter months as well as any holiday debt they might have racked up. Seasonal workers, like those in retail, may also be facing cuts in their hours or layoffs by the time the typical tax season kicks off.

Ultimately, this little trip down the taxes rabbit hole probably cost me a couple of extra days before I got around to finishing my own return, but hopefully it’ll pay motivational dividends in years to come. Picking up those $100 bills off the sidewalk isn’t that hard, after all.

Tori lives in D.C., where she writes about banks and Congress.

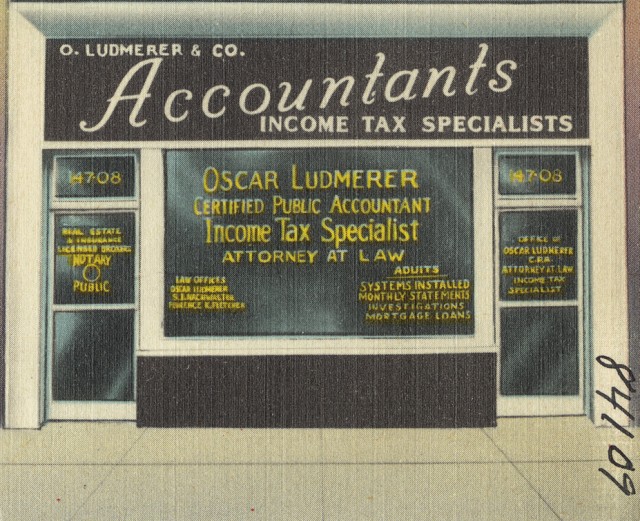

Photo: Boston Public Library

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments