Are You Paying A Marriage Penalty Or Enjoying A Marriage Bonus?

In honor of the ides of April, the New York Times has put together an infographic explainer of something about which I’ve long been curious: what does getting married do to your taxes? I’ve heard the term “marriage penalty,” of course, but I’ve also heard discussion of a “marriage benefit.” Which is it? Well, it depends:

Married couples pay more or less in taxes than they would if they were allowed to file like single individuals. The penalty or bonus depends on how much couples make in total, and how evenly their income is divided. … The largest marriage penalties fall on couples on either end of the income spectrum — poor or affluent — as well as on couples in which the two people are making similar amounts of money. Childless couples in the broad middle of the income spectrum, making between $40,000 and $175,000, tend to receive a marriage bonus instead, paying less in taxes than they would if they were filing separately.

So the government rewards you if you, as a couple, don’t have a kid yet and make between $40,000 and $175,000. Excuse me while I daydream for a moment about the life Ben and I could have if we made $175,000 between the two of us, didn’t have to spend a sizable chunk of it on daycare, and got a tax break to boot. Okay. Wiping the drool off my chin. Let’s continue.

In marriages without children, the largest bonuses, in percentage terms, occur when couples have income just under $100,000 and only one earner. [←emphasis added with goggle eyes] These couples pay about 7 percent of their income, or $7,000, less in taxes than they would if they were forced to file as two single individuals. The largest marriage penalties are for those who earn around $17,000, split evenly. These couples pay about 4 percent of their income, or $700, more in taxes than they would if they were allowed to file as two single individuals.

So working class people are often right to choose cohabitation; getting hitched isn’t in their best interest, at least not at tax time. As a country, instead of giving lower earners an incentive to gain the benefits and protections of marriage, we reward wealthy folks for engaging in a traditional family structure where one person works and the other stays home, even if there’s no baby involved.

That means if a married couple brings in $750,000 a year, but all of that cash comes from one spouse while the other contributes nothing but ginger cookies and lemonade, that couple gets a 1% bonus of ~$7,400. If the couple brings in $750,000 a year but the amount is split between the earnings of two spouses, they have to pay a huge penalty for their perverse, egalitarian lifestyle: 4.4% or $33,400.

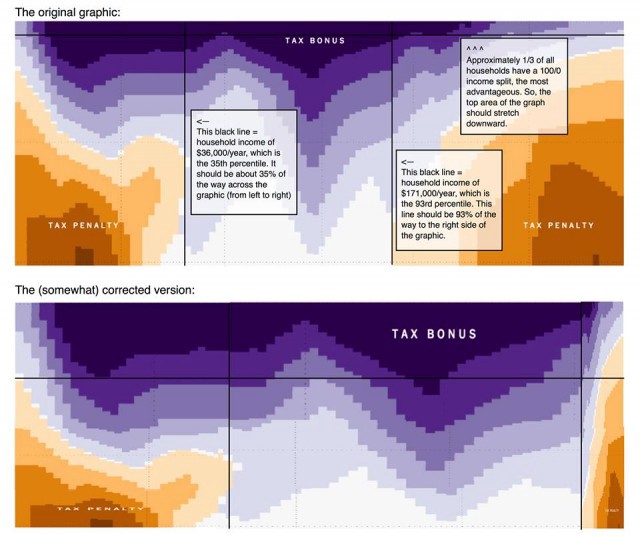

Though the NYT’s interactive graphic is fun to play around with, Assistant Professor Amelia Hoover Green of Drexel University in Philly points out that it has flaws.

This graphic is so misleading. If the axes represented percentiles — of income and income splits — we’d know that marriage tax penalties (a) are much MUCH more common among low-income people than rich people and (b) are much MUCH less common, overall, than this graph portrays.

She offers up a corrective that is more visually accurate, complete with explanations:

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments