Chatting About Real Estate Month, Money Management, and That Damn Dress

Ester: Hello! Happy End of Real Estate Month.

Nicole: Happy End of Real Estate Month to you! I feel like it should have a tagline/benediction, like “May your closings be swift?”

Ester: Sure, that works! “And may your lawyers be savvy.” Our real estate lawyer saved our hides more than once, and she worked out of her apartment in a robe and slippers.

Nicole: Well, all the best people work in their pajamas, so that’s cool. How did your lawyer save your hides?

Ester: For one thing, she realized before anyone else did that the bank we had gotten to pre-approve our application wasn’t actually going to be able to give us a loan, because of an obscure provision of co-op-related real estate law that basically only applies in places like New York City. (The bank itself didn’t realize til we called them and asked them to investigate. Then they were like, “Gee! Whaddayaknow. We guess you’re right.”) So thanks to her heads up, we were able to scramble and find another mortgage provider in time, one that could pre-approve us and also give us a loan. As it happened, they offered an even lower interest rate, so it was #winning all around. But it was also very stressful and anxiety-producing, as is everything related to buying your first apartment.

Nicole: Yeah, when I wrote earlier this month that I wasn’t ready to own property, that was a big part of it. I don’t know how to own property. I’m terrified of walking into someone’s office and saying “I would like to own that, please.”

Ester: It is surreal to hand over all your money, that is for sure. I had had an online savings account for nearly a decade — watched it, babied it, cooed over it — and I cashed out the entire thing for our down payment. Poof! Just like that, it was gone.

But even though the numbers are bigger, an apartment is still just another Thing that you’re buying, in a way. A Thing and an Experience: a Home. You realize by doing it than you can do it and then it’s like, hey cool, this was possible after all.

Nicole: Awww. You can’t see IRL, but I am totally smiling. This is brightening my day.

Ester: Oh good! Yay. We all need brightening, especially in this endless February. (Related: “Hey, Can You Not Invite February?”)

Nicole: But you can’t brighten too much, otherwise a bunch of people will think your dress is white and gold. BOOM! Had to make a reference.

Ester: My god. The dress IS white and gold, like a unicorn. But actually what I love about the whole stupid pseudo-drama is that it reminds me — everyone? — that we only think we see things the same way. We all believe so firmly in our own opinions. It’s like Climate Change, or Vaccinations, or something. People hold so fast to their own beliefs just because they believe them. The nice thing about the dress at least is that, if you ask yourself, “What if I’m wrong?,” the answer is “Who cares?” The stakes could not be lower. In most cases, if you ask yourself “What if I’m wrong?” — like, what if vaccines are a good public health idea, or what if we will all be dead from a global warming-induced flood in twenty years if we don’t do something — the stakes are a bit higher.

Nicole: That was the big takeaway from the Billfold Real Estate Survey, for me: I wrote a lot of questions that I thought were perfectly straightforward, and revealed my own logical gaps — as well as the dozens of ways people could interpret these questions. It was fantastic and fascinating.

Also, we won’t all be dead from a global warming-induced flood in twenty years, because John Cusack is going to close the Ark gate in time. I saw the movie.

Is he going to rescue Kate Winslet or what?

Ester: PHEW. But yeah, those Survey responses were intriguing to me too for the same reasons. It gave me a lot of sympathy for people who design questionnaires and standardized tests. It’s very, very difficult to cover all the bases and to please not everyone but a strong majority of people.

Nicole: Well, and it’s about clarity and looking outside of your own worldview. I think that the parts of the survey that worked the least well were the parts where I only approached the question from my own worldview — and that was while I was trying to include as many options as possible!

Ester: Interesting. We should have to take more classes in high school and college in seeing outside your own worldview. It’s an important skill. Not to mention we should have to take classes on budgeting and how the economy works. There’s so much I still don’t begin to understand.

Nicole: I was talking about that the other day with my hair stylist at Great Clips. (He is the best, seriously.) He was all “nobody taught me how to manage my money,” and I was all “me too,” and then I said “and it wasn’t like we could have been taught best practices because 401(k)s weren’t even invented until the 80s, so they couldn’t put them in school textbooks.” It’s hard to teach money in general, and it’s extra hard because the way we interact with money keeps evolving.

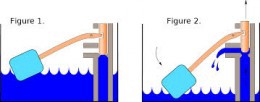

Ester: Oh yes. Anything they taught me in high school in the ’90s they would have had to augment or enhance in college in the ’00s. But at least it would have been a start. Would you rather have had to learn Money Maintenance or Household Maintenance? Like, how to balance a checkbook or how to bake a cake and fix a ballcock?

Nicole: I took Home Ec, so I did learn how to bake a cake from scratch and how to sew an apron to wear while baking the cake. We didn’t learn about ballcocks.

Ester: Too bad, because ballcock is one of the funniest words in the English language.

Via Wikimedia

Nicole: I think I would have liked to learn about Money Maintenance, and I feel like we covered it a little bit in school, but it’s also so personal. You can teach money maintenance to 100 people, and they’ll each say “Okay, but now I’m going to go spend my money how I want.”

Money maintenance is also variable. Give 10 people each $10,000, and one of them will get married and have children and another one will have health issues and a third will invest in a business and a fourth will travel the world and the fifth person will do all of these things, and the sixth person will try the stock market, and nobody’s money will follow the same growth and loss pattern.

Ester: I mean, sure, and no two cakes will taste the same. But it’s still useful to know what flour is and how to sift it, and how to separate egg yolks, right? And what tools to use to mix everything? We had neither Home Ec nor any class to do with money at any of my schools. We did have Sex Ed, though it was almost entirely useless. (“You will get chlamydia, and die.”) Money Ed would have at least given me some baseline info I couldn’t have learned from Judy Blume.

Nicole: I definitely think that, say, “how to avoid these common money mistakes” would have been super useful. My stylist and I were also talking about credit cards, and how it would be great if kids were taught how to use credit properly. (I love that I apparently talk money with my hair stylist.)

Ester: Hee! Yes. Sounds like better-than-average salon talk, actually. And yeah, I knew much more about sex — from YA novels, of course — than I did about credit cards going into college. Yet here I am, sitting in my own apartment. It worked out okay, and I thank my lucky stars.

Nicole: I feel like I went into college fearing credit cards the way they wanted us to fear sex: “If you use credit cards, you will get debt and die.” It took me until I was in my late 20s to get my first card. And here I am, also sitting in my own (rental) apartment, so I guess it worked out okay too!

Ester: [high five!]

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments