Happy New Year! Here Are Some Pointless Or Obvious Savings Tips!

So far, 2015 looks a lot like 2014, at least from the vantage point of the desk in my living room. It’s cloudy outside, and cold; the sun plans to set about two hours before dinnertime. If you had trouble saving in November, you will probably encounter the same obstacles in January. (December was holidays. Doesn’t count.) Still, in honor of the changing of the calendars and in case you want to seize the day and try to break out of old patterns, the Internet is ready with some vacuous savings advice!

Quit your gym if you’re not using it. Many of us are paying $20-$40 per month for gym privileges but aren’t going. That’s $240-$480 a year. You might save that money instead and just walk, run, or use weights at home. Think about other services you might be paying for and not using.

Stay healthy. Wash your hands frequently to reduce your chances of catching something, exercise regularly, and eat well. Staying healthy can keep you from having to pay for doctor visits and medications, and might keep you from missing work, too.

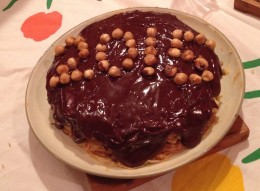

Cook more meals at home. Cooking at home can help you stay healthy as you control what goes into your food, including how much salt and fat — and veggies and whole grains. It can save you money, too. With a big crock-pot, you can easily make a big batch of something tasty that can serve as several meals.

“Stay healthy.” What a novel concept. And $20-$40 per month for gym privileges? What magical state-subsidized gym is this and where can I sign up?

I don’t mean to sound cynical. I had a lovely, low-cost New Year’s — married couples and babies at a friend’s house, cooking, reading, games, music, male tears — and I’m actually feeling a bit optimistic about this year. Maybe we’ll at last figure out how to do what we love and not lose money at the same time!

But why does the Internet persist in offering tips that are either brain-numbingly obvious (“Cook more meals at home”) or kinda dumb?

Buy a programmable thermostat. It can save you from heating or cooling your home when you’re not there and the Department of Energy estimates that it can shave 5% to 15% off your energy bill. That’s easily $200 for some folks. Each year.

Save $200 over the year! Awesome! Except the Nest programmable thermostat costs $250. So, you need to have $200 in disposable income; you need to be able to wait over 12 months to recoup your startup costs; and then you’ll be able to see some profit. In 2016. Assuming we even have houses and thermostats then.

We’ve already cut or severely reduced our consumption of “luxuries” like gym memberships, therapy, and travel. We cook. We dress Babygirl in hand-me-downs and stay out of toy stores; we don’t drink bottled water or lattes. (Not that there’s anything wrong with that.) The truth is, there’s only so much to give up. Ben and I have decided to change our strategic focus from spending less to earning more. What are you going to try, if anything — besides, you know, avoiding expensive ATMs?

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments