Fronting

by Joshua Michtom

At The Root, Demetria Lucas writes about a phenomenon that is happening among young adults: “fronting,” or running up deep debts to project the professional success they aim to achieve (“fake it till you make it,” “dress for the job you want,” etc. etc.). Lucas tells the story of a friend who wanted to launch himself as a nightlife entrepreneur:

He was convinced that in order to be taken seriously, he had to look like “the people” who already had what he wanted. It was a classic mistake of trying to have at the beginning what someone else had after years of hard work… [T]o my friend, “looking the part” meant designer T-shirts at $150 a pop, custom kicks and five-day weekends at every major music festival around the country.

My wake-up call came 18 months later when my friend called me in a panic, not knowing what to do next. He was around $30,000 in credit card debt and had student loans. That friend ended up moving back in with his parents for a year-plus so he could save money to pay off his credit cards. (More than 10 years later, he’s still paying off student loans.)

Lucas’s focus is on black twenty- and thirty-somethings in arts and entertainment, but she seems to have diagnosed a broader malaise. After all, Lucas points out that African Americans are more likely (94%) to have some kind of debt than the general population, but even 82% of the general population carries debt, and the average credit card debt among households that have such debt is around $15,000. In other words, this is a problem that, like so many economic problems, may hit the black community harder, but hits everyone.

Obviously, part of this is a symptom of long-term economic trends. It’s not surprising that young adults find it harder and harder to achieve the levels of economic stability and material comfort they got used to as children: real wages have been stagnant for over fifty years while college education costs have far outpaced not only wage growth but also inflation — that’s a recipe for long-term debt, even without the flashy spending that Lucas decries.

But how do our expectations play into the equation? Lucas’s examination of this question starts with the hyperbolic economic success of rappers and the unrealistic expectations they create. But what about the more modest expectations of the good old American dream? My own story of amassing debt in pursuit of an idealized middle class lifestyle — law degree, suburban house, car, children — doesn’t seem as absurd as the plight of Lucas’s would-be nightlife impresario, but it’s really no different: hard work and big dreams can’t necessarily overcome poor planning, deep debt, and a lousy economy.

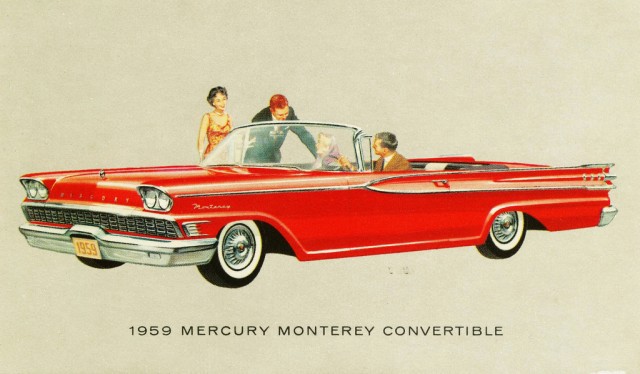

So my question for you, dear readers, is this: Are there financial or material attainments that you always reflexively assumed would figure in your future, but that honestly may be out of reach? Many millions of people are finding that home ownership isn’t the guarantee we once imagined it to be (I’m so over it). Others are already asking seriously whether college and its attendant debts are necessary. What else did you have as a child or reasonably expect to have as an adult that now seems unrealistic? Tell us in the comments, while listening to “Frontin’” by Pharell and Jay Z (and yes, this video depicts exactly the kind of unrealistic excess mentioned above, but it is a catchy song).

Josh Michtom is a public defender in Hartford, Connecticut. He spends way too much of his spare time decorating his children’s school lunch bags.

Photo: Alden Jewell

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments