Can I Afford to Help People?

by Liz Niemer

In the fall I’m going teach childhood literacy as an AmeriCorps member in Minneapolis.

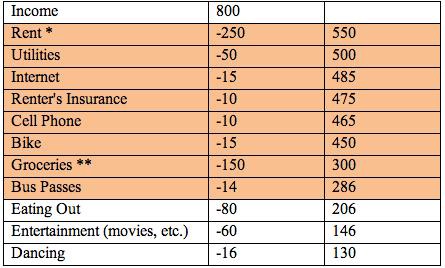

The job description says that the pay is approximately $900/mo., but other AmeriCorps members have told me that after-tax take-home pay is more like $800/mo. That’s $200/week, $9,600/year — a small number no matter how you phrase it. I’m passionate about childhood literacy — it’s why I applied for AmeriCorps in the first place — but before committing to the job I had to take a serious look at my finances. Could I afford to spend this year making such a small salary?

My first budget was a disaster — I kept forgetting things — utilities! renter’s insurance! — but after several revisions, it looks something like this. Expenses that are mandatory are highlighted in orange, with other “fun” expenses left in white.

* I’m moving in with my boyfriend in a shared house. Our rent is absurdly cheap.

** I’ve also spoken with several AmeriCorps members who have enrolled in MN’s food assistance program, which I will definitely qualify for. I decided not to include that in my budget because I don’t know how much assistance I’ll receive. It could be that this number will go down.

My leisure expenses are low, but that’s realistic to my lifestyle — college austerity mode developed my ability to find cheap or free entertainment. I like eating out maybe once a week, but I never order alcohol with dinner, and if I do get drinks somewhere, it’s exclusively during happy hour ($20/week).

So: The numbers say Americorps is going to work for me, but they might not have if it weren’t for the cheap rent I’m sharing with my boyfriend or the generosity of my parents. My parents have helped me graduate debt-free and are letting me stay on their phone plan — and thanks to Obama, also their health insurance plan. There’s no way I could afford to do this without the privileges I’ve had and continue to receive.

Even knowing I’ll have enough money to survive, I do wonder how good I’ll be at “surviving.” I’ve never had to live by a strict budget. Will counting up my daily spending be a reminder that helps me stay organized or a chore that makes me resent my job? I’ve never really used credit cards before — will my limited income make credit more appealing? I’m also worried about stalling my eventual career — will a year of AmeriCorps service make it look as though I didn’t have the motivation or skills to pursue “real” employment? I guess I’ll figure it out, and I’m excited to take this risk.

Liz Niemer lives in Minneapolis, Minn.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments