A Tool for Young People to Figure Out Their Post-College Debt Burden

I followed my head, rather than my heart, during my senior year of high school when I chose UC-Irvine as the college I would attend because it was the college that was offering me the most in scholarships and financial aid. I did not want to be the type of person who graduates from NYU with $100,000 in debt.

I should also mention that this was about 10 years ago when tuition and fees were about $4,600 a year, and going to college wasn’t as huge of a financial burden as it has grown into today.

And it’s a burden to think about! You gather your financial aid letters, and calculate what your debt burden might be after you graduate. You may also do that thing where you ask your school for more money.

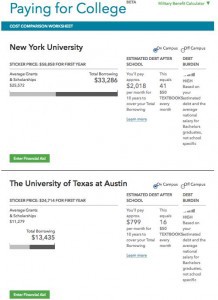

Here is a new tool from the Consumer Financial Protection Bureau that allows you to compare three colleges you are considering attending, and how much you might owe based on the amount of financial aid the school provides you. It looks like it’s actually useful!

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments