Checking In With My Net Worth and Financial Runway: January 2019

It’s a new year, so I’m going to change up my usual “checking in with…” posts; instead of focusing on how much I put into my savings and investment accounts, I’m going to evaluate my income and savings based on total net worth and financial runway.

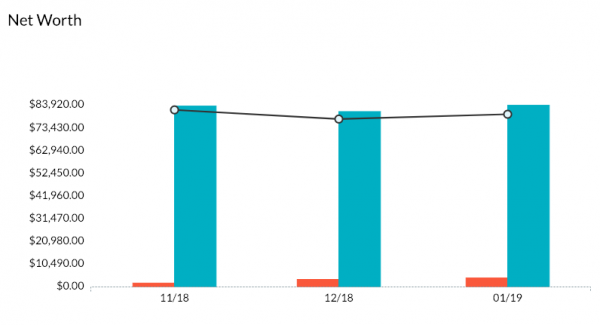

My current net worth is $79,708.80. (This only includes personal income/savings/investments/retirement, not the money in The Billfold’s business bank account.) As this YNAB screenshot illustrates, my net worth is $2,018.42 lower than it was when I began using YNAB:

Part of this is because I paid fourth-quarter estimated taxes in December; part of it is because I have a lot of money on my credit cards right now (I recently booked a business trip, for example). I’m not super-happy seeing my net worth drop, so I gotta start focusing on Project Earn More Money.

This is partially because only $12,469.56 of that net worth is in a checking or savings account (vs. a brokerage or retirement account), and when YNAB subtracts the current balance on my credit cards it leaves me with $8,321.98 pretax dollars that can go towards jobs.

That’s not a very long financial runway. Right now, if I earned no additional money, I would be funded through the end of February. Sure, I could adjust my YNAB budget and pull cash out of the “vacation” category or the “publish another novel” category and make the income last a little longer, but not much longer.

I received $5,067.59 in freelance checks in December and should receive another $5K or so this month, so the financial plane will keep inching down the runway, but I’d like it to soar, if you’ll forgive the terrible aeronautic metaphor.

So I could either cut back on my spending or earn more money — and I’m still thinking earning more money will be easier. Right now I only have $300 budgeted for clothing for the entire year, for example, which basically means one shopping trip when the weather gets warm and another when it gets cold again. I wanted to budget more, but when I tallied up all of my business trips and personal trips and Christmas and taxes and health insurance and HSA/IRA contributions and money I wanted to put in my brokerage account and etc., there just wasn’t much left.

I don’t mean to sound like I’m complaining, because I know that I’m still doing really well for myself, financially. But I do want to be as realistic as possible about what earning $5K/month (pretax) means — both for my own benefit and for yours. In my case, it looks like it means prioritizing my HSA/IRA and brokerage contributions, as well as at least one business trip, two personal trips, and one family holiday trip.

(It’s a good thing I like all of my current clothes.)

So that’s what I’m thinking about, this month. I did add a “stuff I didn’t know I wanted” category to YNAB, as per my 2019 resolutions and goals, and I’m funding it by pulling $50/month from my travel budget. This means I can purchase one big $600 thing, if I’m patient enough to wait until the end of the year for it. It also means I’ll need to cut my travel costs by $600, which I’m hoping I can do with my new travel credit card. (More on that later this week.)

But yeah, I need to start figuring out how to earn more money.

BTW, if you would like to try YNAB for yourself — and trust me, it will change the way you think about your finances — use this link to get your first two months free.

Photo credits: personal YNAB screenshots.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments