Checking In With My Savings Plan: September 2018 Edition

Photo by Michał Grosicki on Unsplash.

In September I received $4,133.95 in freelance income and $121.98 in book royalties, or $4,255.93 total.

Here’s how I divided up the cash:

- $212.80 went to my HSA

- $212.80 went to my traditional IRA

- $469.28 went to federal taxes

- $117.32 went to state taxes

- $255.36 went to my individual brokerage account

- $255.36 went to savings

- That left $2,733.03 for overhead, business, and personal expenses

I ended the month about $500 short of my $3K checking account buffer, but that was because a few checks that I thought would arrive last month are actually going to hit my bank account this month (one of them already arrived). I currently have $4,012 in outstanding freelance invoices, all of which should pay out before October 15.

But yeah, I was anticipating that September would be a high cash-flow month and now it looks like October will be the high cash-flow month, which means that at the end of the month I’ll have to re-ask myself whether I should put any checking account money above $3K into savings, just to keep it a little out of reach.

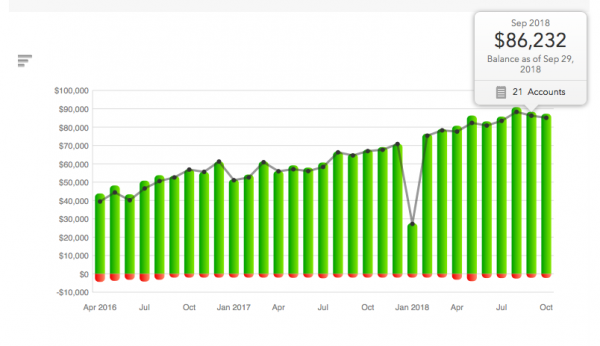

My net worth dropped by $2,008 between the end of August and the end of September, which makes sense because I paid both my own estimated taxes and The Billfold LLC’s estimated taxes in September — and the $1,278 I transferred from The Billfold LLC’s bank account to pay back Iowa’s estimated taxes didn’t hit my bank account until October 1.

I’m predicting a net worth jump of around $3K this month, given the estimated tax repayment, my current outstanding checks, and my anticipated freelance work. This should put me really close to $90,000 by the end of October, which gives me two months to increase my net worth by another $10K and hit my six-figure net worth goal by the end of the year, which… probably isn’t going to happen. (Especially because December is generally a really low earning month.)

But hey, the year isn’t over yet — so I’m not going to completely give up on this goal. On the other hand, even aggressive budgeting and saving won’t get me there. I’m guessing I’ll receive $6K in freelance checks in October, $4K in November, and $3K in December. That’s $13,000 total, but taxes will get about $2K and the cost of living will eat up another $6K, so my net worth will really only increase by $5K between now and the end of the year in a best-case, no-major-discretionary-or-unexpected-expenses scenario.

We’ll have to see what happens.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments