Checking In With My Savings Plan: March 2018 Edition

Photo by Michał Grosicki on Unsplash.

In March I received $2,794.73 in freelance income and $24.95 in book royalties, or $2,819.68 total.

Here’s how I divided up the cash:

- $140.99 went to my HSA

- $140.99 went to my traditional IRA

- $182.39 went to federal taxes

- $39.65 went to state taxes

- $169.17 went to my individual brokerage account

- $169.17 went to savings

- That left $1,977.32 for overhead, business, and personal expenses

- I also put $1,611 of my tax refund into my savings account and $2,000 into my individual brokerage account

I knew March would be a low cashflow month, so I deliberately budgeted as few personal and business expenses as possible. April is looking like it will be a high cashflow month (though I won’t know for sure until I get the checks, since some of them could end up paying out in May) and I am gearing up to make a lot of travel-related purchases for this summer.

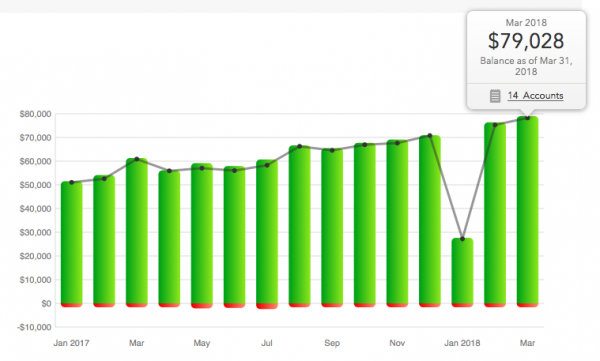

I also put $1,611 of my tax refund into my savings account and $2,000 into my individual brokerage account, so let’s look at how all of that reflected the other big metric for March: my net worth.

Looks like all of that saving is still paying off. Whether I hit that $100,000 end-of-year net worth goal that I kinda told Vicki Robin that I would totally do is an interesting question. I’d need to raise my net worth by $2,333 every month, which is theoretically (though not easily) achievable. We’ll see what happens.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments