Welcome to 2018. We’re Broke!

Photo credit: Karolis Parfeniukas, CC BY 2.0.

We’re usually pretty good at this money stuff, or so we thought. I try to pay our bills on time and make sure we have enough to cover our emergencies. We give generously. Friends and family routinely ask me for help with things like taxes. (I love forms. In my next life, please pencil me in for a great secretarial job, circa 1955, like Mad Men.) We have relatively high incomes: my partner nets about $3K a month; I net about $6K a month after 401(k) deductions and everything else. We also will have income from our property, to the tune of about (hopefully) $3,100/month — $1,500 of which will start in February, and another $1,600 will kick in by April 1.

But we have a lot of debt, and no real savings. I didn’t know how much debt or nonsavings we had until some kind Billfolders suggested that I total my damages. And holy hell.

In our defense, my partner and I accumulated a lot of debt in the past couple of years, but it’s not entirely our fault. We remodeled a small apartment building near a mid-sized city. It cost, not surprisingly, more than we anticipated. Who knew that we would have needed new furnaces for the entire building? How could we have thought that we hired the Wrong Guy for electrical work, and would have to hire someone else to do the same work, to code, later?

The building was purchased from a bank, which meant we weren’t going to get anything back on closing costs (usually 5—10 percent of purchase price) and we definitely weren’t going to get anything back on our taxes (usually prorated, but not for us). It took months to close, and lots more time before we could finish the remodel and move in. One of our units remains unoccupied; the other one is occupied by friends who are living there for “free” because we borrowed money from them to finish the house. So that’s an issue too.

As part of our New Year’s Resolution to get out of debt, I’m going to need The Billfold to hold me accountable. Here’s what we’ve discovered so far:

- We are cashflowing negative. Yup, that’s right. Every month on this earth we cost more than we did in the previous month.

- My partner has finally taken me seriously on this whole Debt Emergency problem. I do occasionally listen to Dave Ramsey, and I agree with the whole “Debt is an emergency!” thing despite my misgivings about his Christian point of view, his lack of knowledge about index funds, and his general disregard for people with unusual situations (“Sell everything!” is usually the motto, but it’s not always that simple).

- Our debt is actually preventing us from doing stuff we want to do, like travel, enjoy our lives, spend time with family and friends, and other cool stuff.

- Our car costs too much (more on this in a second).

- Just because we are able to cover the minimum payment on something (even with 0 percent interest) does not mean we can afford it.

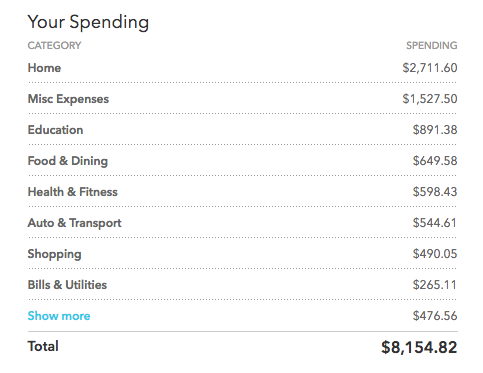

Our monthly costs are as follows, according to Mint:

Yeah. I said it was bad. We also have the additional expense of $3K in home improvement costs (something I don’t add to our normal budget, because it comes out of another budget, and also because it’s something that is tax deductible or depreciable, depending on the individual item — this is for our tenant’s apartment, not ours). That’s also where you get the negative cash flow problem.

Here’s the rundown:

- Home is our mortgage, including taxes and insurance.

- Education is entirely student loans (mine).

- Food and dining: well, we’re going to stop eating out. Ta-dah. I actually prefer to eat in, but my partner is another story.

- Health and fitness: I regularly buy a ten or twenty punch card that I use at the gym to work out with a group of coworkers, but I will be slowly eliminating this.

- Misc. expenses includes the costs of a legal matter that will be resolved soon, but unfortunately, that’s not something that I can minimize any further than it has been already.

So in 2018, starting this week, we’re doing the following:

- Selling the car. Seriously. We pay $433 a month for it. I should be taking public transit to work. We bought it used and pay almost 5 percent interest, and our car insurance is $1,400/year. We need the money more than we need this car.

- Finishing and renting the spare apartment for February 1.

- Eating in, forever (cash envelopes for everything), and more vegetarian dinners.

- Selling spare stuff (we don’t have a lot of this, but we could get rid of an extra computer, some athletic equipment we don’t use, extra building supplies, and more).

- Not buying anything (see shopping category, above).

- Taking on additional jobs/gigs (see “pitching the Billfold,” here).

It was terrifying to try and look at our income, and even scarier to detail our expenses in Mint. But we’re going to turn this sinking ship around, or something.

WearsPants usually freelances for glossies, but has a soft spot for The Billfold. They live with their partner in the Upper Midwest.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments