Making My Monday Mornings Feel More Like Saturday Nights

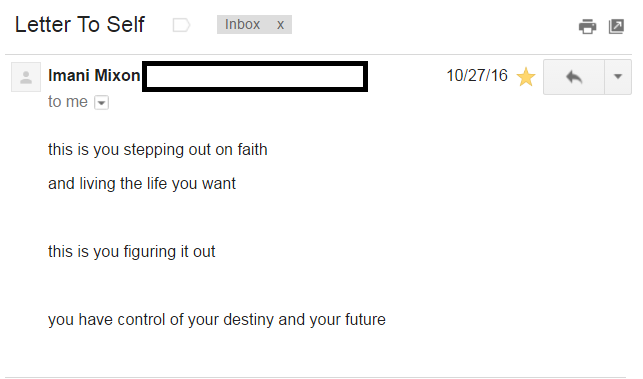

Photo credit: Imani Mixon

18 Mondays ago, I was rinsing rings of foreign coffee stains from the rim of my favorite “Passion Never Fails” mug. A record-keeping pattern had formed around the rim, marking how many of my coworkers reached for the same reminder from our communal coffee cup cabinet. When I sat down in the seat that would become my home for the next nine hours, I caught remnants of my Saturday night silhouette flirting with me from the computer monitor. The cautionary flash of red lip stain and chunky crescent-shaped gold hoops were still intact.

The previous Saturday night, I stood barefoot in a thrifted see-through dress performing love poems with III Sisters, a writing collective comprised of myself and two friends. Attendees shuffled rose petals beneath their feet as they orbited around our BYOB offerings and transformed a cozy little pop-up shop in Detroit’s West Village into a standing room only venue. We charged an $8 entry fee, served $3 scoops of vegan ice cream and ran out of spoons halfway through. Afterward, we split our earnings and I cupped the cold, crisp $30 that felt warm in my hand. It was the most money I had earned from poetry for the year.

I spent the better part of 2016 (approximately 206 days) wondering how to squeeze my Saturday-night self into my daily marketing startup surroundings. In this land of beanbag chairs, ping pong and motivational posters and mugs, money came a little more reliably in the form of a bi-weekly direct deposit. Each payment soared smoothly into my bank account, further solidifying my perfectly predictable post-grad path. It was the only way I knew how to afford to live my life as well as the student loans, car note, car insurance, monthly rent, groceries, girls trips, eyebrow threadings, and impulsive freakum dress purchases that came along with it.

13 days after my poetry performance, I was speaking to an even more intimate audience (of three) in an impromptu performance review where I was given the opportunity to leave my full-time job. Did I see myself working with the company a year from now? Was it a good culture fit?

This unexpected, albeit welcome, transition has catapulted me into the kind of reality I used to daydream about (minus the solid escape plan). For 2017, I resolved to retain my financial independence while prioritizing creative endeavors.

The last few days on the job were more awkward than any water cooler conversation I’d had over the year. No better time to start asking about how much money I should be expecting to cushion the blow of my jump from the full-time train, right? Even though it was weird and I was itching to frolic the streets as a free (freelance?) woman, I made sure to be vigilant and informed about the monetary promises made upon employment. I left voluntarily, so for me that meant about a week of severance pay. I was enrolled in the company’s 401(k) plan and I’ve started working with a representative to access and manage those funds.

When I was working the 9 am — 6 pm schedule, I envied people who were enjoying midday frolics to the cafes, restaurants and stores that surrounded my workplace. How could they afford to be laughing over shrimp salad with lettuce and tomato on housemade cheddar bread when it wasn’t even lunch time? I don’t know the answer to that. But I do know that the relative freedom (read: unpredictability) of my current schedule is all thanks to the two part-time jobs I’ve picked up since leaving. Each week, I oscillate between assisting with communications at a truly diverse Detroit-based media company and working my third stint at the retail store that got me through my first New York internship and the post-grad limbo of summer 2014. This may sound like a piecemeal plan to some, but something about not being bound to one schedule or company makes me feel much more free right now.

In a perfect world, I’d be able to slide seamlessly into a full-time creative life without missing a step. For right now, I’ve taken stock of persistent expenses that I can cut out. On a day-to-day basis, that means sticking to a careful $150 bi-weekly grocery store budget instead of shelling out $225 for on-the-run snacks and lunches that won’t make it to dinner time. On a bigger scale, I’ve started to let go of some of the typical trappings that accompanied my full-time salary. That new-ish car that’s neck-in-neck with my rent payments right now? My mom is taking over the lease when hers expires next month and my dad is helping find a smaller, cuter, older (CHEAPER) car. The past few months, I’ve been leaning on my family for more moral (and sometimes monetary) support than I’ve needed in years, so I’m thankful to have them.

The most useful thing that I’ve learned from my last job is that every word I type has value and power. While working on a strict schedule of 40+ hours a week, I took on projects and made partnerships with people who were more like me to fill a creative void. Although I continue to create, there’s no more space to do it for free. Now I’m channeling that energy toward freelance pieces, published poems, and guest blogs. I’ve begun to think about the tasks that I’ve gotten paid for before and the time it takes to complete them in order to develop a pay scale that honors my work and goals.

As much as I’d like to say that I can confidently log into my Chase app and know precisely how much money is in my bank account every time, I can’t. It’s scary as hell to see your lifestyle change expressed in numbers (or the lack thereof), but knowing what you’re working with is a crucial step in maintaining financial independence. Don’t believe me? Well, during my first week as a full-time free woman I accidentally bought $14 worth of apples for an apple pie recipe that only required three and that’s not a mistake I’d like to repeat on my new funemployed diet. No matter how much it hurts, no matter how weird it feels, it’s time to stop treating money like it will always be out of reach.

On the tough days, my mind wanders to the thought that if I’d been saving money throughout all of this, I’d have a hell of a backup built up by now. I’ve always been more of a hands-on learner. Of course I wish I would have saved more regularly and spent less generously and that will make a great cautionary chapter in my memoir, but right now we’re talking about resolutions. I’ve made a promise to save at least $100 each month (the same amount I allotted when I was working with a full-time, salaried budget) because I know there are things I want in the near future, plus unexpected expenses always seem to find me.

Want to know what my Monday mornings look like now? Chirping birds announce my wake up call around noon then flutter through the open window to deliver my computer from my desk to my lap. I awaken from my doe-eyed slumber and use my perfectly polished hands to tie my silk robe. Then I disappear behind the perfectly illuminated computer screen to freelance!

Just kidding, most nights I fall asleep with my laptop and I keep my windows closed. This is real life after all.

Imani Mixon is a Detroit-based and embraced writer whose work has been published at Complex.com, Conde Nast Traveler, Huffington Post and WeTheUrban. Follow her on Twitter or Instagram.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments